22 Sep, 25

Weekly Crypto Market Wrap: 22nd September 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- ASTER, a new DeFi token backed by Binance founder CZ, launched with a 1,650% price surge and $371 million in first-day trading volume.

- Binance Coin (BNB) hit a new all-time high above $1,080, outperforming other large-cap altcoins.

- MetaMask is integrating Hyperliquid’s perpetual trading into its wallet.

- The SEC streamlined crypto ETF approvals, reducing review times and enabling Grayscale’s Digital Large Cap Fund.

- Base network is “beginning to explore” launching a native token

Technicals & Macro

Markets

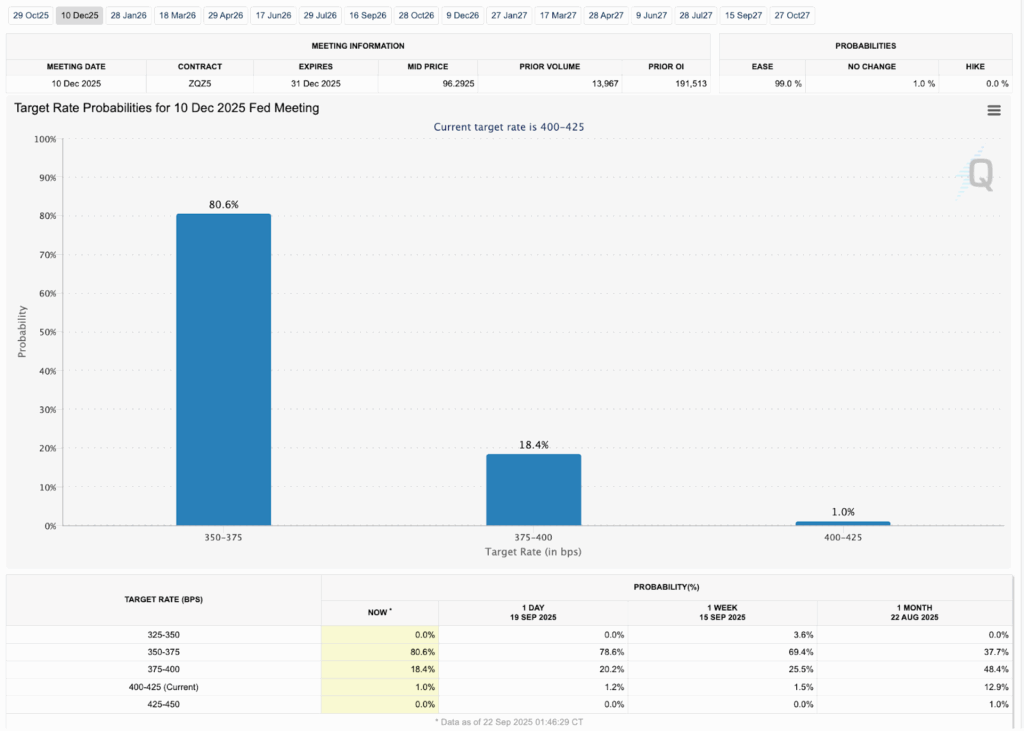

Last week’s FOMC reaction was mixed. The Fed delivered the expected 25bps cut, the first of the cycle, but markets were left grappling with the balance between dovish projections and Powell’s more cautious tone.

The mood shifted during Powell’s press conference. He dismissed the possibility of a 50bps “jumbo” cut outright, reiterated concerns that inflation remains elevated, and admitted uncertainty around the broader outlook – noting “no one knows where the economy will be in three years.” The market viewed this as hawkish, especially with positioning already skewed heavily toward a deeper easing path. Risk assets gave back gains into the close, leaving gold and Bitcoin still in strong trends but short-term momentum dented.

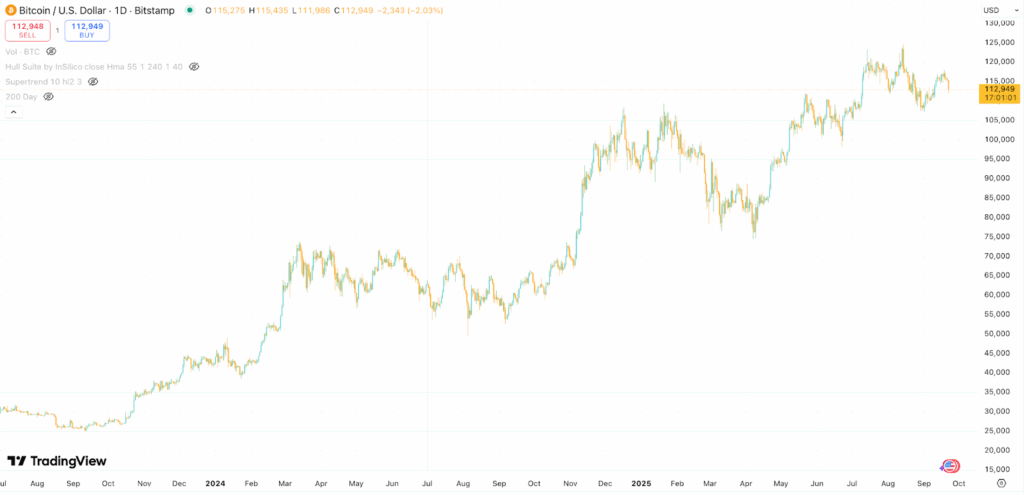

In digital assets, Bitcoin briefly dipped below USD $115k on volatility around the decision, but buyers quickly stepped in at the 200-day moving averages, a level closely watched across the desk. BTC now sits just below key resistance at USD $116.9k. A decisive break above this level would likely confirm momentum towards new highs into quarter-end.

Markets are now pricing an additional 50bps of cuts by year-end, whether through one larger step or two smaller moves. Combined with Q4’s historical tendency to be the strongest period for risk assets, the beginning of this easing cycle provides a constructive macro backdrop for Bitcoin.

The key question now is whether BTC can translate that tailwind into a sustained breakout.

Emir Ibrahim, Analyst

Spot Desk

Flows on the desk this week featured a mix of record volumes in mainstay names alongside increased appetite for higher-beta plays linked to leading base layer narratives.

Among the more familiar faces, Solana was the clear standout; with the desk recording its highest weekly SOL volumes to date. This comes as Nasdaq-listed Brera Holdings’ rebranding to Solmate – a SOL-based DAT (Digital Asset Treasury) secured a $300 million via private placement backed by Solana Foundation and Ark Invest and a slew of similar announcements across the space continue to bolster enthusiasm around the Solana trade as the next big DAT benefactor.

HyperLiquid (HYPE) also remained a favourite on the desk this week, further solidifying its status as one of the market’s emerging darlings. Altcoin excitement in the space was otherwise dominated by “BSC season,” as Binance-backed Aster (ASTER) launched Wednesday at approximately $0.07 before spectacularly surging to $1.98 by Sunday, as the new challenger in the on-chain perpetuals vertical surpassed HyperLiquid in daily DEX volumes. This rally coincided with BNB’s continued push into fresh new highs, sparking meaningful derivatives demand on the desk as clients looked to express mid-term upside views through various structured product offerings.

Global risk markets advanced as rate-cut relief lifted sentiment, with the S&P 500 hitting new highs led by Intel (INTC) and Alphabet (GOOG). Bitcoin (BTC) traded sideways for much of the week before a sharp selloff to start this week triggered $1.7 billion in liquidations. Still, DAT momentum remains strong – highlighted by Metaplanet’s largest purchase to date coming in last week at 5,419 BTC (~$630M). Despite its scale, the buy only lifted the firm to fifth among public corporate holders, underscoring the intensity of corporate accumulation.

On the FX side, AUD/USD marked new yearly highs at 0.6707 before cooling post-FOMC, with flows for the week skewing toward onramping. Stablecoin activity in USDT and USDC against AUD, USD, and EUR stayed robust, while NZD volumes picked up on both sides. After several weeks packed with market-moving data, this week’s quieter calendar leaves Powell’s Wednesday remarks and Friday’s U.S. Core PCE release as the key near-term drivers.

Further out the curve, Ondo Finance (ONDO) drew strong interest as did JOE (JOE), the native token of Avalanche’s leading DEX, which gained traction after news that the Avalanche Foundation is seeking to raise $1 billion across two U.S. treasury company deals. Rounding out altcoin flows were PEPE, TAO, XRP, FLUID, SYRUP, and NEAR all seeing significant activity. With BNB in price discovery, animal spirits stirring in altcoins, BTC consolidating at highs, and global risk surging post Fed rate cut, traders can’t help but recall Q4 2020 – remembering what happened next and wondering if history is ready to rhyme once again.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions, offering competitive pricing across majors, stablecoins, and altcoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Ben Mensah, OTC Trader

Derivatives Desk

WHOLESALE INVESTORS ONLY*

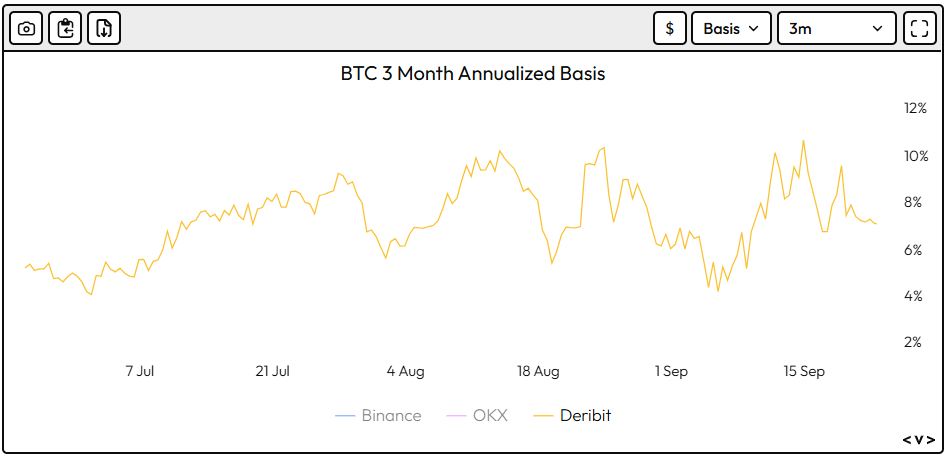

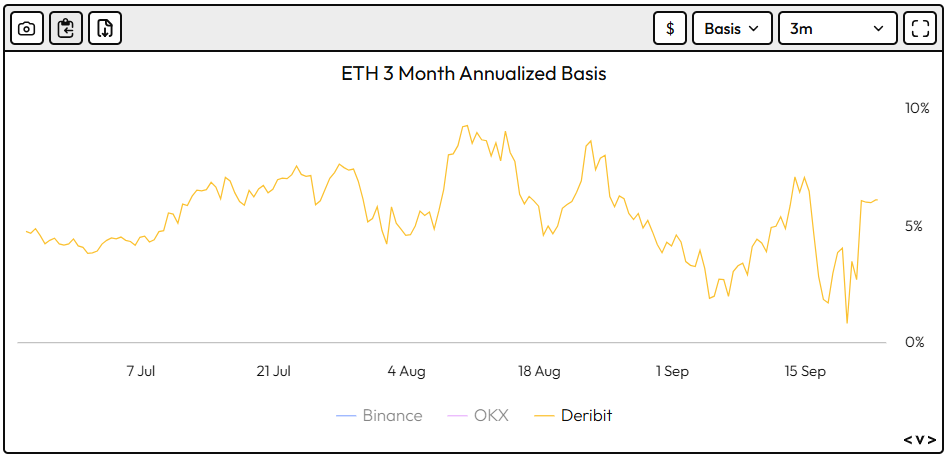

BTC’s basis rate has come off heavily over the week – down over 300bps to 7.06% annualised. ETH’s basis rate is also down over the week (6.08% p.a.).

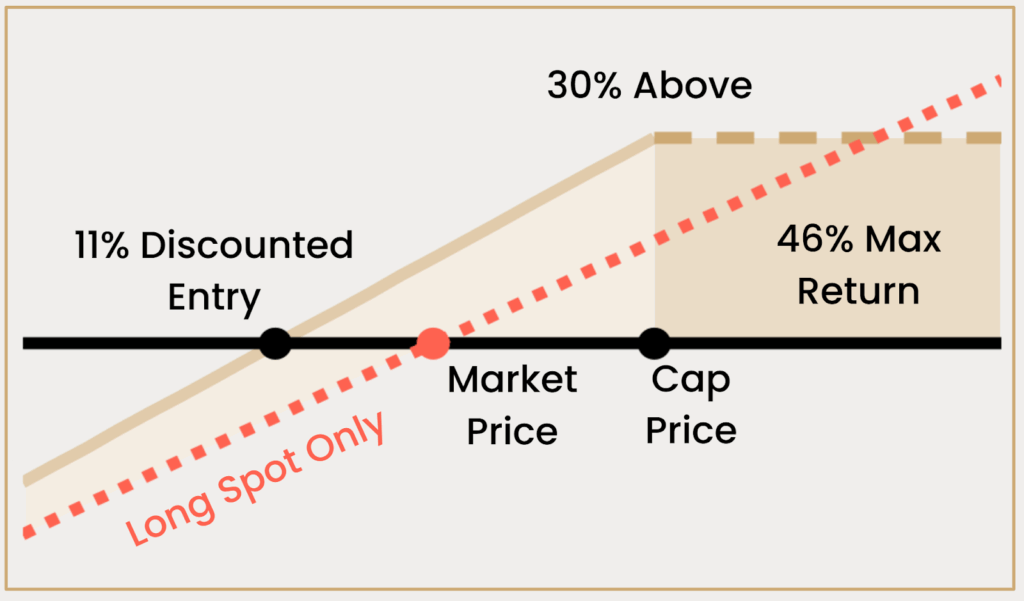

With the FOMC resuming its interest rate cutting cycle, the desk favors strategies that offer asymmetric entry points into high-beta assets like Solana (SOL). The SOL Discount Note provides investors with a defined-risk (favorable entry structure into SOL), by combining a discounted entry with capped upside participation.

Proposed Structure:

Instrument: SOL Discount Note

Discount to Spot: 11%

Cap Level: 30% above current spot

Max Return: 46.07% in USD

Expiry: 30 Jan 2026

Payoff at Maturity:

If SOL expires above the Cap Price, the investor earns 46.07% return in USD.

If SOL expires below the Cap Price, the investor acquires SOL at 11% below the current spot price.

Rationale:

Provides a strategic entry point into SOL at a material discount, well-suited for investors with a moderately bullish outlook.

Offers a defined upside of 46.07% in USD, attractive in an environment where SOL outperforms but does not experience a runaway rally.

Risk is limited to the initial investment, making this a measured approach to gain exposure to SOL’s long-term growth potential.

Risk Considerations:

- SOL Downside Risk: If SOL falls materially below spot, investors still purchase at an 11% discount but may face mark-to-market losses.

- Capped Upside: Returns are limited to 46.07% in USD, which means investors forego gains if SOL rallies significantly beyond the Cap Price.

- Market and Regulatory Shocks: Unexpected macro events, regulatory changes, or liquidity shocks could drive SOL below the discounted purchase level.

Why the Structure Makes Sense Now:

- Defined Risk/Reward: Provides a discounted entry into SOL while still offering attractive capped USD returns.

- Neutral-to-Bullish Alignment: Suited for investors expecting stability or moderate upside in SOL, without the need for an outright spot purchase.

- Favorable Macro Backdrop: The Fed’s rate-cutting cycle continues to provide tailwinds for risk assets, including crypto.

Institutional Interest: Growing institutional inflows into SOL highlight conviction in its ecosystem, reinforcing the structure’s appeal.

What to Watch

MON: PBoC LPR, EZ Consumer Confidence Flash (Sep)

TUE: Riksbank Announcement, EZ/UK/US Flash PMIs (Sep)

WED: CNB Announcement, Australian CPI (Aug), German Ifo Survey (Sep)

THU: SNB Announcement, Banxico Announcement, BoJ Minutes, PBoC MLF, German GfK Consumer Sentiment (Oct), US Durable Goods (Aug), US GDP (Q2), US PCE (Q2)

FRI: Japanese Tokyo CPI (Sep), US PCE (Aug), US University of Michigan Final (Sep)

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 16 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 9 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

The Bitcoin to IBIT Swap: A Structured Approach to Managing BTC Exposure

Zerocap’s Bitcoin to IBIT swap enables investors to transition BTC exposure into IBIT efficiently, supporting portfolio rebalancing strategies. The core objective is to exchange physical

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post