22 Dec, 25

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Hong Kong proposed new rules to allow insurance capital to invest in cryptocurrencies.

- The U.S. Senate confirmed Michael Selig as CFTC Chair, reinforcing expectations of an expanded regulatory role for the agency in crypto.

- The Federal Reserve withdrew restrictive 2023 guidance limiting bank engagement with crypto-related activities.

- Hyperliquid saw over $430m in weekly outflows as competition from Lighter and Aster intensified across perp DEX markets.

- SoFi launched SoFiUSD, a fully reserved dollar stablecoin aimed at enterprise settlement and banking infrastructure.

Technicals & Macro

Please note that this will be our final weekly report for 2025. Our team will be having a well deserved break from the action, with our analysis back on Mon 12th January. We want to all thank you for your continued support, and wish you all the best for 2026.

Markets

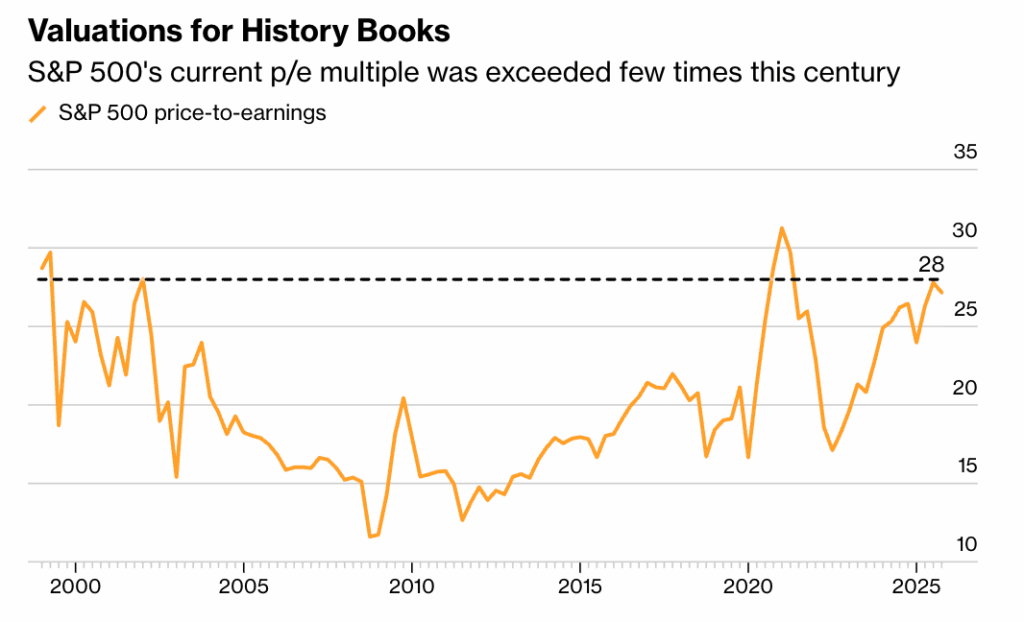

Global risk finished the final full week of 2025 mixed, with markets balancing AI-valuation concerns against a clearer disinflation signal. U.S. equities were largely range-bound: small caps lagged while the Nasdaq edged higher, consistent with ongoing late-cycle dispersion.

U.S. data remained two-sided. Payrolls rebounded in November, but the unemployment rate rose to 4.6%, reinforcing a gradual labour-market cooling trend. Inflation was the key support: core CPI eased to 2.6% YoY, the lowest since early 2021, and shelter inflation continued to roll over.

Even allowing for shutdown-related data issues, the market read-through was that the Fed retains flexibility to continue easing if growth moderates further. Forward-looking activity indicators softened as well, with PMIs slipping to a six-month low and hiring intentions cooling.

BOJ hike lifts JGB, yen weakens as path stays opaque

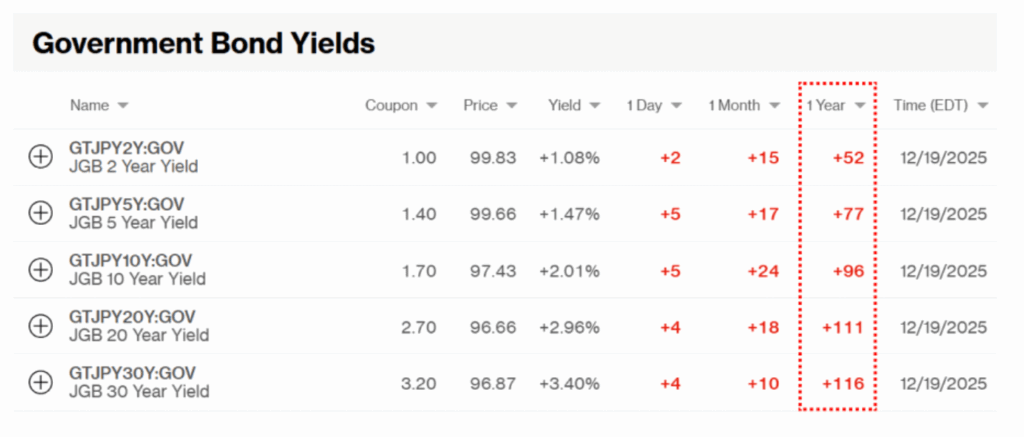

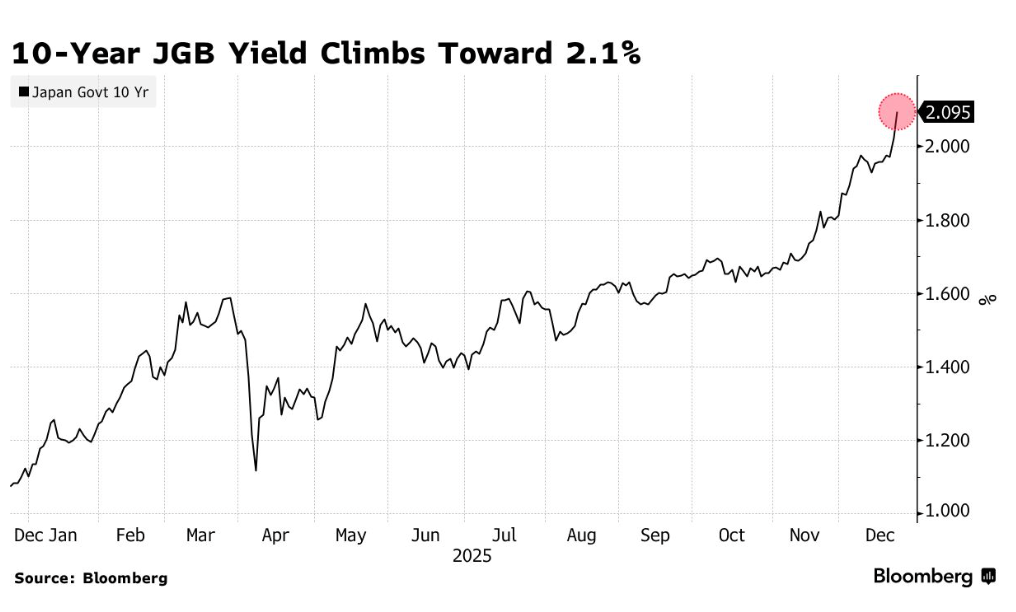

In Asia, the Bank of Japan’s hike to 0.75% (highest policy rate since the mid-1990s) pushed 10-year JGB yields through 2% for the first time since 1999, a meaningful milestone given the BOJ’s long-running yield suppression regime. The reaction was slightly counterintuitive: yields rose while the yen weakened, with USDJPY extending toward the mid-157.00’s as markets focused on the lack of clear guidance on the timing/trajectory of the next hikes.

The takeaway is that Japan is now a live input into global macro again: if the BOJ is forced to hike “more rather than less” to avoid falling behind the curve, the risk is higher JGB term premia and FX volatility transmitting into global rates (particularly in thin year-end liquidity).

Haven flows re-emerge into year-end as policy easing expectations firm

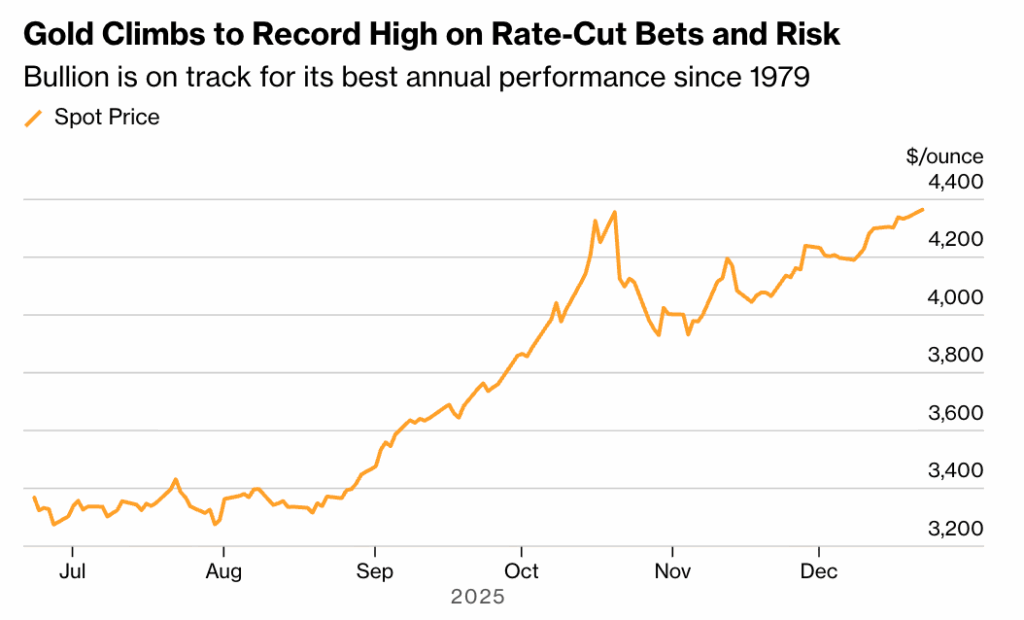

Commodities reflected a higher hedging premium: gold and silver hit record highs on lower real-rate expectations and geopolitical tension, while oil firmed on renewed Venezuela supply concerns.

Crypto – dispersion, cash-flow focus, institutionalisation

Crypto’s 2025 performance was defined by dispersion and concentration rather than a broad-based cycle. BTC reached new highs above $126k in October before settling back into the low $90’s, broadly flat on the year, while most tokens finished negative. Capital gravitated toward a small set of winners: assets with institutional access (ETF adjacency), clearer U.S. regulatory tailwinds, and niches that retained strong demand.

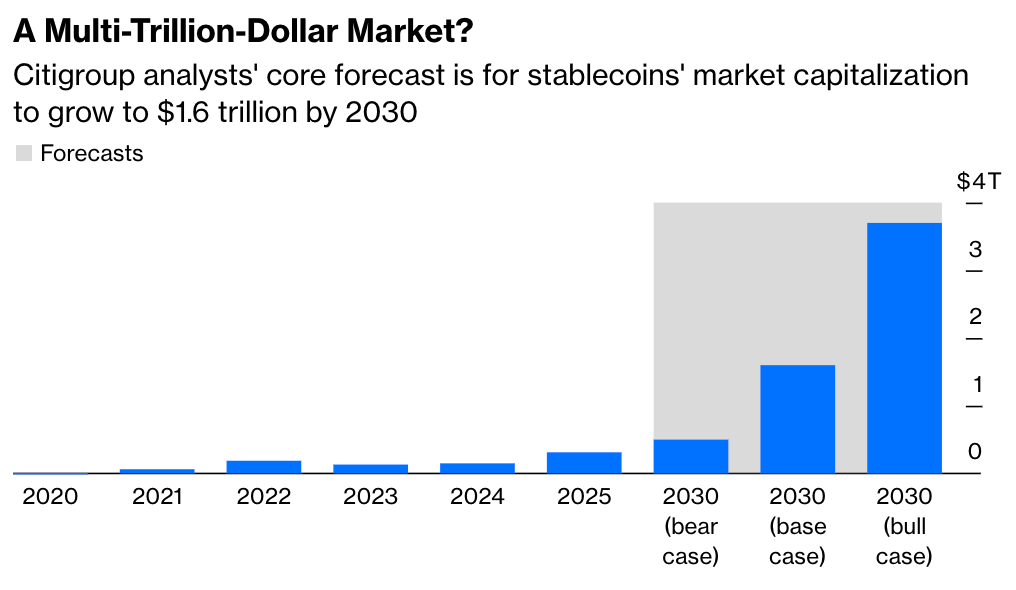

The more durable themes were structural. Stablecoins continued to scale in volume and importance, supported by improving regulatory clarity and strong issuer economics. In DeFi, a subset of protocols demonstrated repeatable revenue generation, particularly in perps and lending, shifting investor focus from “use cases” to unit economics.

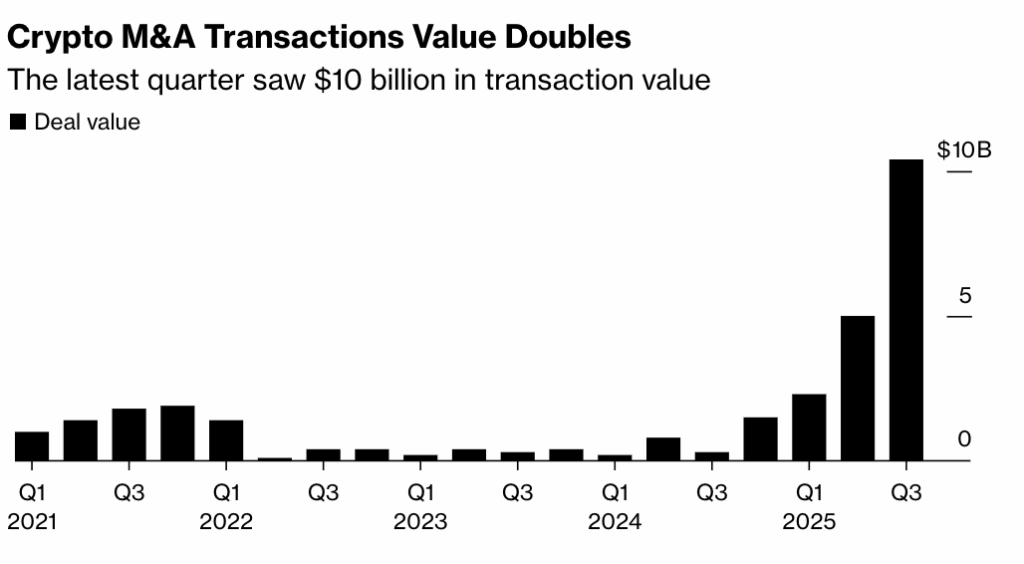

Record M&A activity reinforced where value is accruing – market structure, distribution, derivatives, and payments rails, rather than speculative infrastructure.

At the same time, several prior cycle drivers faded. New L1s struggled to justify differentiation, NFTs remained subdued, and the long tail continued to underperform as token supply expanded faster than the available capital base.

The market also proved more resilient through large deleveraging events, reflecting deeper liquidity, improved infrastructure, and a more institutional investor mix.

Looking into 2026, the market increasingly resembles traditional risk underwriting: emphasis on regulatory durability, distribution, and cash flows, with BTC’s volatility gradually compressing as the asset matures and incremental growth opportunities concentrating in revenue-generating applications and rails.

See ya next year!

Emir Ibrahim, Analyst

Spot Desk

The digital asset market remained in a cautious consolidation phase as 2025 drew to a close, with recent desk activity reflecting a market still finding its footing after a turbulent fourth quarter. Flows this week were largely balanced with a heavy concentration in majors; however, a skew toward purchasing in Solana (SOL) and some pockets of Ethereum (ETH) accumulation provided flashes of optimism, as traders looked to position in potential benefactors of a risk-on rotation in the new year. This was further balanced by the continued accumulation of Paxos Gold (PAXG) as a defensive hedge, suggesting that while participants are eyeing a 2026 recovery, they continue to remain wary of near-term price action.

Bitcoin (BTC) endured another week of range-bound “chop,” oscillating between highs of $90,356 and lows of $84,450. Desk flows mirrored a market optimistically weathering local headwinds, with BTC ultimately closing slightly green despite US$497 million in net outflows from U.S. spot ETFs. Ethereum (ETH) fared similarly, staying in its tight range between $2,775 and $3,177 to close near flat at $3,002, while the ETH/BTC pair finished slightly red as it reconsolidated following prior strength. In the decentralised sector, the “Perp DEX wars” continued as Hyperliquid (HYPE) recorded over $430 million in weekly AUM outflows, while rival Lighter rapidly closed the gap amid speculation surrounding a year-end token generation event.

Macroeconomic data triggered intra-week volatility as December’s US annual inflation rate came in at 2.7%, well below the 3.1% forecast. Annual core inflation also cooled to 2.6%, its lowest level since early 2021. Despite the “soft” print, the AUD/USD posted its first red week in four, closing lower at 0.6593 after opening at 0.6661. Desk activity for the pair was strongly skewed toward AUD onramping, consistent with broader trends seen over recent months. Looking ahead, the global calendar remains light into year-end, with Tuesday’s U.S. GDP numbers and Wednesday’s Jobless Claims serving as the primary critical data points for the final trading week of the year.

The week also brought significant progress on the regulatory front with the Senate’s confirmation of Michael Selig as CFTC Chair, a move widely viewed as a catalyst for structured oversight. This momentum was punctuated by White House Crypto Czar David Sacks, who confirmed that a Senate markup for the Clarity Act is locked in for January. These legislative milestones were met by major institutional strides, including the introduction of the Digital Asset PARITY Act – proposing tax exemptions for small stablecoin payments – and SoFi’s launch of SoFiUSD for bank-led settlement. As 2025 concludes, the convergence of clearer “rules of the road” and expanding platform capabilities from the likes of Coinbase suggests an exciting and maturing landscape for the year ahead, further compounding the leaps and bounds made this past year!

The OTC desk continues to offer tailored cryptocurrency liquidity solutions and competitive pricing across majors, stablecoins, and altcoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Ben Mensah, OTC Trader

Derivatives Desk

WHOLESALE INVESTORS ONLY*

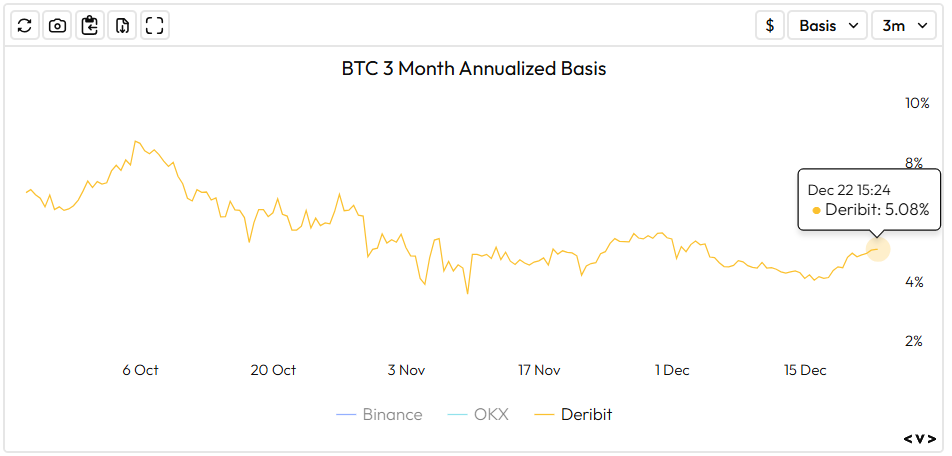

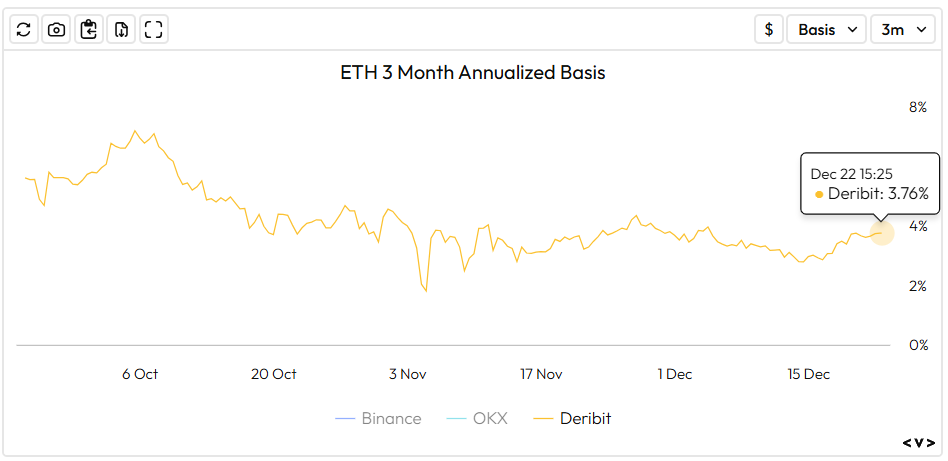

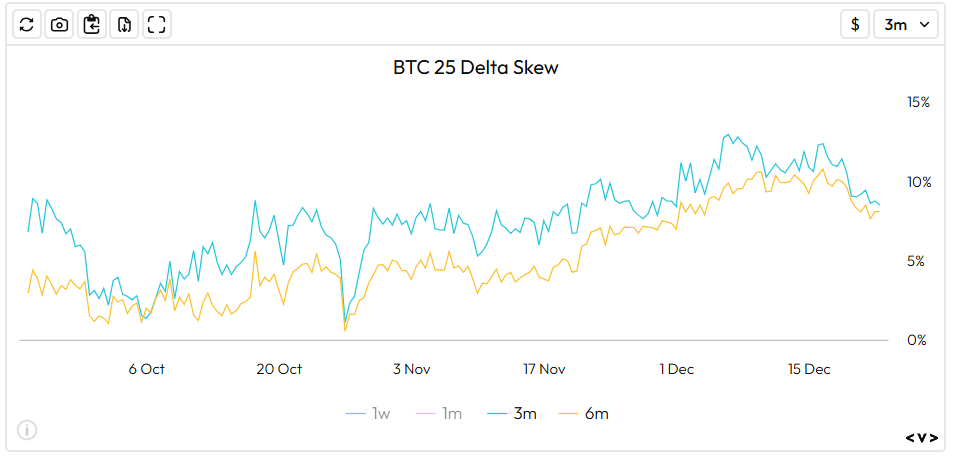

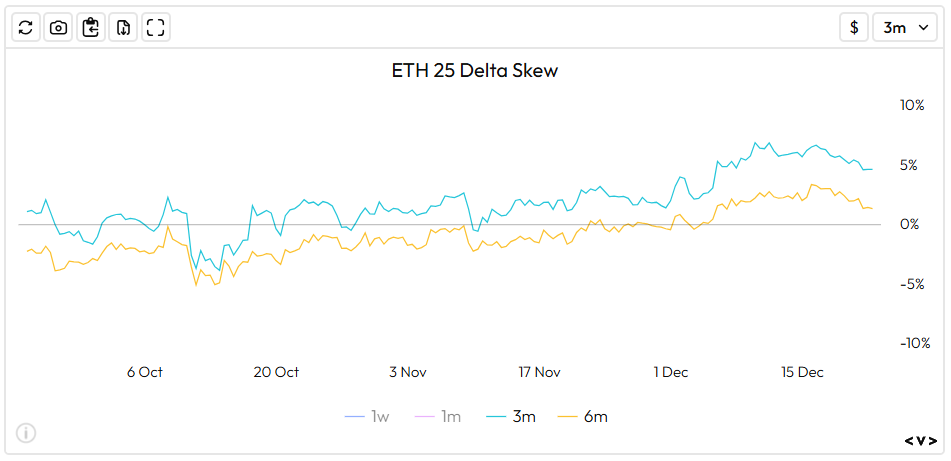

Basis rates have bounced this week with BTC’s 90-day rate up 80bps – 5.08%. ETH’s is up roughly 70 bps – 3.76%.

Source: Velodata

Source: Velodata

Long-dated skew on BTC and ETH has been towards puts, signaling a market that is seeking downside protection. With the skew finally starting to soften, we may be seeing a ‘peak fear’ inflection point. For those looking to capitalise, the current compression in put premiums offers a tactical window to position for a sentiment shift before the broader market catches up. For this reason, we like Yield Entry Notes which take advantage of heightened put premiums.

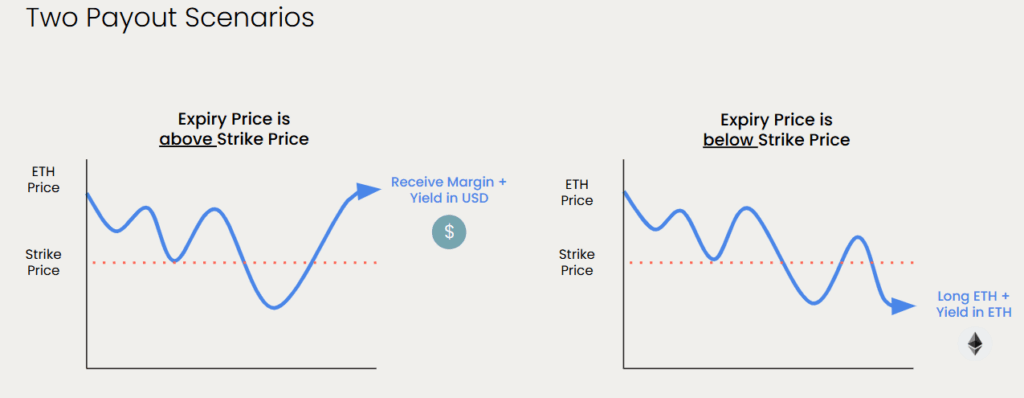

Trade Idea: ETH Yield Entry Notes

ETH Yield Entry Note:

- Scenario B (ETH < $2,800): Enter a long ETH position at 2,800 while still keeping the 5.00% yield.

- Earn yield from selling options on ETH by agreeing to purchase the asset if it expires below 2,800 on 30 Jan 2026.

- Mechanics of the Yield Entry Note (Scenarios at Expiry):

- Scenario A (ETH ≥ $2,800): Retain initial investment plus earn 5.00% yield.

- Risk Considerations (including but not limited to):

- Uncapped Downside: The primary risk is the short put leg. If the ETH price moves below the $2,800 strike, losses accrue toward zero. The investor must be prepared to buy and hold the underlying asset at that price.

- Opportunity Cost: Profit is capped at the 5.00% yield. If ETH rallies aggressively toward new highs before January 30, the investor forgoes full participation in the upside.

- Macro Volatility: A significant hawkish surprise from the BoJ or a further deterioration in global growth could cause a sharp spike in IV and a breach of the strike level.

What to Watch

TUE: RBA Meeting Minutes, US GDP QoQ

WED: US Jobless Claims

FRI: JP Unemployment Rate

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 2 March 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap Launches Institutional OTC Desk for Tokenized Gold Trading

Zerocap’s institutional OTC desk enables investors to access tokenized gold efficiently, supporting portfolio diversification and inflation hedging strategies. The core objective is to provide seamless

Weekly Crypto Market Wrap: 23 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post