21 Oct, 24

Weekly Crypto Market Wrap: 21st October 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- Over 94% of the bitcoin circulating supply is now sitting in profit, historical data tell us profit-taking should start to build up.

- Since Oct. 14, bitcoin ETFs have seen approximately $1.9 billion (21,450 BTC) in net inflows, indicating significant positive market sentiment.

- Open interest on CME bitcoin futures reaches all-time high, driven by active and direct participants signalling bullishness.

- The total amount of crypto-collateralized loans within 5% of their liquidation price is at its two-year high on Avalanche’s leading decentralised lending platform Benq

- Singapore-based DBS Bank has announced a new suite of tokenized banking services and smart contract-enabled capabilities for institutional clients.

- Harris leads the polls by a tight margin against Trump, but betting odds are showing a different story – pricing in a Trump win.

Technicals & Macro

BTCUSD

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

BTCUSD is looking incredibly strong right now on the technical front. We’ve broken the descending trendline from June, and are heading up towards the key 70 & 72K zone that was previously rejected as a double top from earlier this year. In many ways we are in a different market dynamic right now – easing interest rates from the Fed, a very tight US election that is too close to call, and a gold market that is on an absolute tear. In addition to the geo and macro environment, we have Microstrategy making plans to become a Bitcoin Bank, enormous BTC ETF inflows which have now topped US $20B, an SEC approval allowing the listing and trading of options against Blackrock’s ETF, and a market that is seeing an increasing appetite for scarce assets. We believe that institutionalisation is the short-term catalyst that gets us above all-time highs – combined with easing monetary policy into 2025 for follow through.

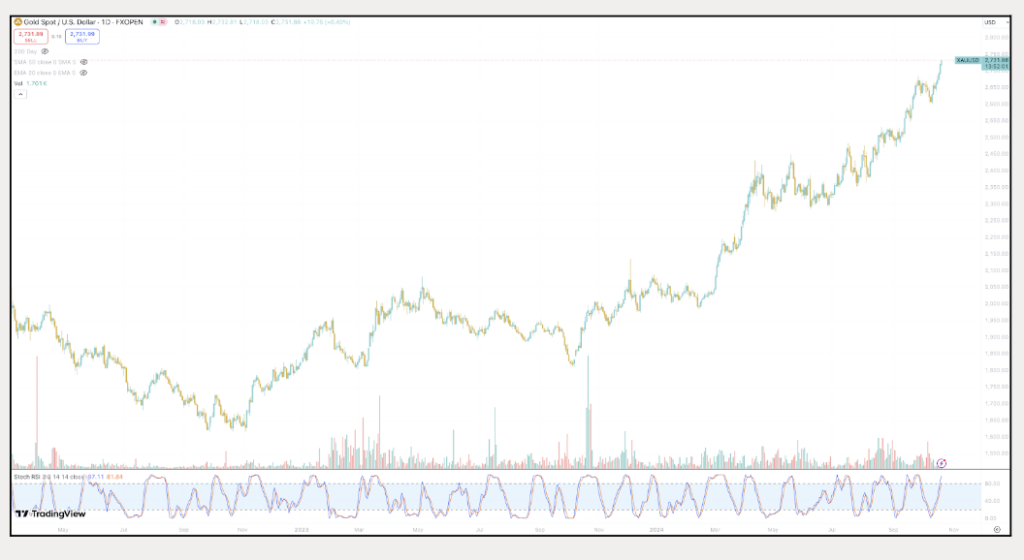

Do we get above highs prior to the end of the year? We think so – the trade is really a relative value trade against gold. Gold sits at an ~$18T market cap, while Bitcoin is currently sitting at ~$1.4T. The question should be – will BTC overtake gold’s market cap at some point? We are (speculatively) a resounding yes. Clearing 70,000 should see 72,000 fairly quickly, with some chop to get through prior to the highs.

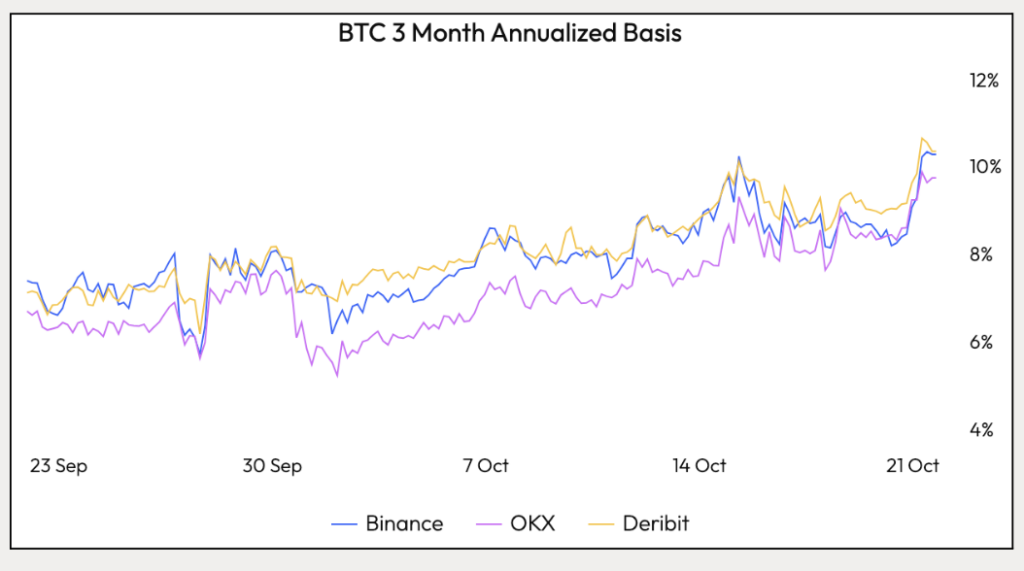

The futures basis curve floating higher is indicative of a growing bullish sentiment, looking for some leverage.

Basis looking strong

Source: VelocData

Downside risks are centred around any wild stuff prior to the election, such as assassination attempts, or the crisis in the middle-east growing and spilling further into US political dialogue. An outlier risk is also the JPY carry trade unwind which seems to have softened based on recent Japanese data.

Despite this, gold is trading like a meme coin..

Source: TradingView

ETHUSD

Source: TradingView

Key levels

2,100 / 2,800 / 3,600 / 4,000

ETH has found its base and rallying alongside other risk assets, and continues to overtake BTC’s return profile on a 7-day and 1-day basis.

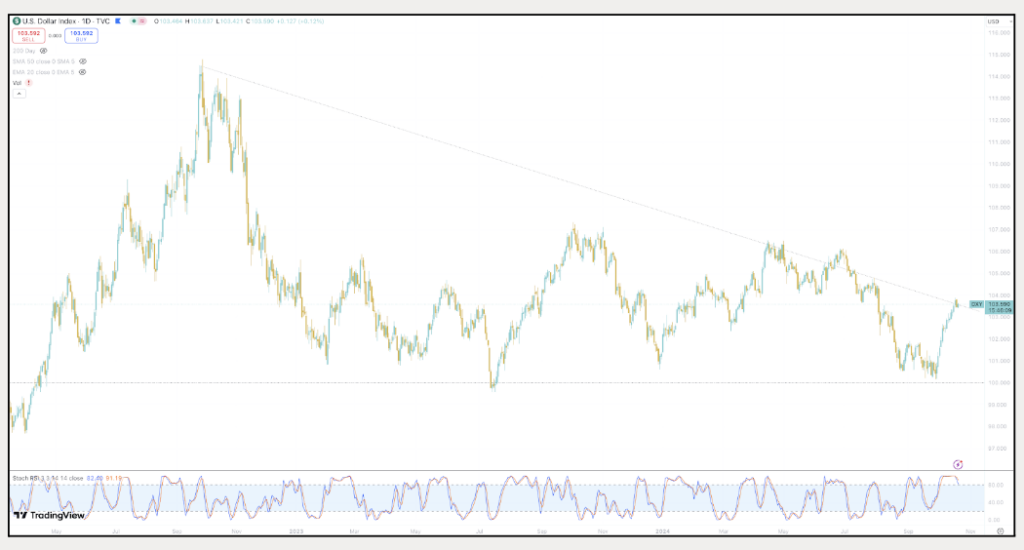

DXY rebound starts to find some resistance

Source: TradingView

All in all – going to be a big week on the crypto front! Keep a keen eye on moves, and watch the leverage!

Jon de Wet, CIO

Spot Desk

The Australian Dollar strengthened after the People’s Bank of China (PBoC) announced rate cuts, reducing the 1- and 5-year Loan Prime Rates to 3.10% and 3.60%, respectively. This appreciation was further supported by positive domestic labour data, which lowered expectations for a rate cut by the Reserve Bank of Australia (RBA) this year. The PBoC’s lower borrowing costs are expected to boost China’s domestic economic activity, potentially increasing demand for Australian exports.

Meanwhile, client sentiment on the desk leaned heavily toward off-ramping, with many seeing value in purchasing AUD during the recent sell-off. Major assets like Bitcoin, Ether, and Solana continued to be in demand, maintaining positive momentum from last week, while altcoin trading was minimal, though AERO attracted some interest.

GOAT, an AI-designed meme coin, made a significant buzz over the weekend, quickly surpassing a market cap of $300 million. SPX6900, a US stock market inspired meme also gained attention, while APE saw a rally following the launch of bridges to the APE chain, introducing features that enable native yield earning.

The spot desk is well-equipped to provide competitive rates for major currencies, altcoins, and stablecoin pairs against key fiat currencies, with T+0 settlement options available.

Arpit Beri, Operations Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

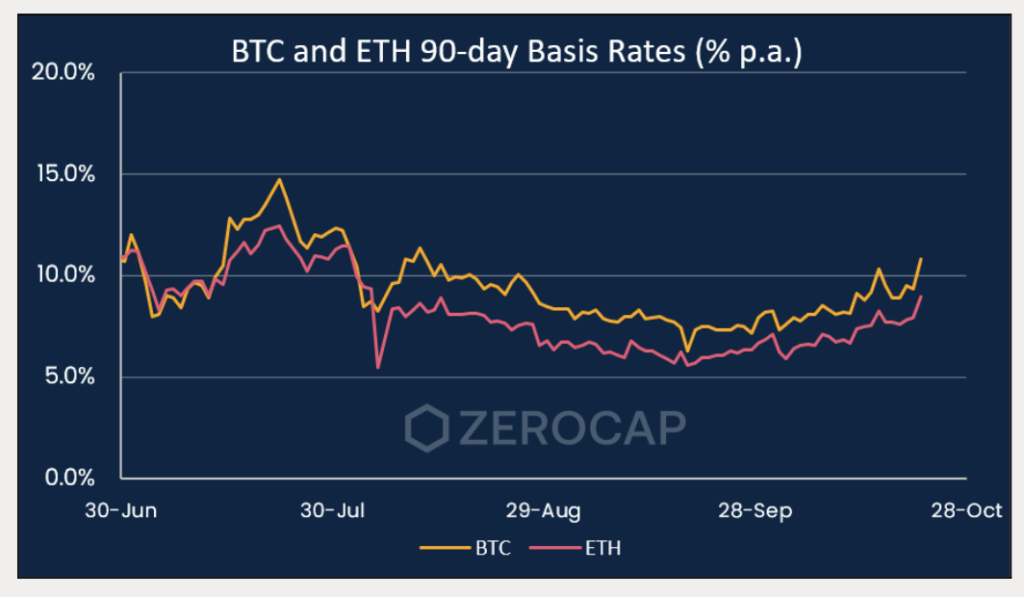

Basis rates on BTC and ETH are both at 2-month highs:

- BTC’s 90-day annualised basis rate is up 140 bps to (10.8%).

- ETH’s is up 120 bps (8.9%).

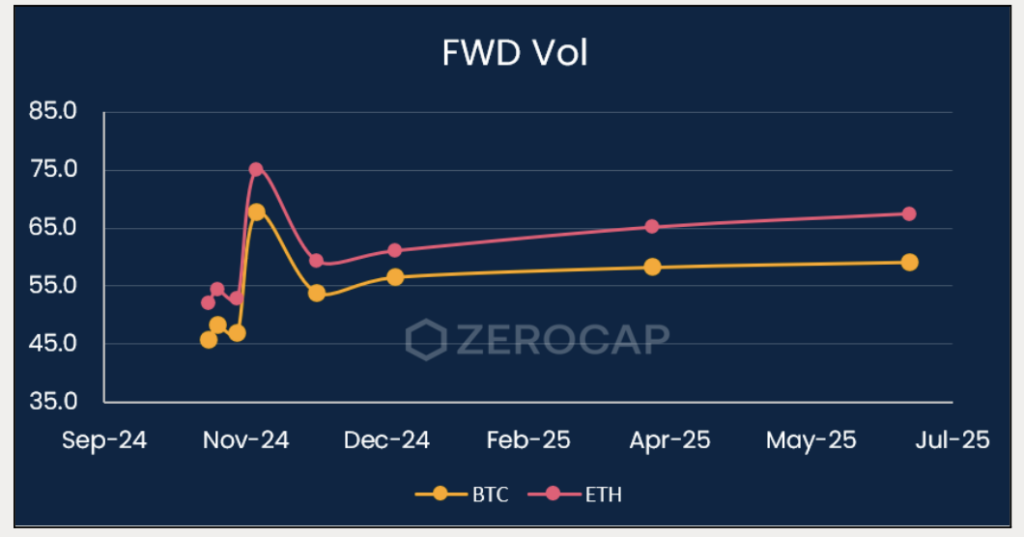

Over the past month, we’ve been tracking the forward volatility embedded in the U.S. election options expiring on November 8th (see chart):

The spike in forward volatility for this expiry is down roughly 7 vol points since last week, while the rest of the curve has remained relatively flat. This means that traders who bought the calendar spread last week would have performed well.

We still see more juice in this trade, considering the magnitude of the forward volatility spike and the tailwinds surrounding BTC and ETH as we approach year-end.

Berkeley Cox, Derivatives Analyst

What to Watch

- Bank of England Governor Andrew Bailey to speak at Bloomberg Regulatory Forum in New York on Wednesday; volatility is often experienced during his speeches as traders attempt to decipher interest rate clues.

- Bank of Canada releases Monetary Policy Report, Rate Statement and Overnight Rate data on Thursday.

- Bank of Canada to hold a press conference on Thursday.

- US Flash Manufacturing and Services PMI figures released on Friday.

- CAD Core Retail Sales m/m and Retail Sales m/m figures reported on Friday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post