18 Nov, 24

Weekly Crypto Market Wrap: 18th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- The US spot Bitcoin ETFs surpass $500 billion in cumulative trading volume within their first year of launch.

- Bitcoin surpassed silver, becoming the 8th largest asset in the world.

- Crypto.com acquires licensed Australian brokerage Fintek Securities, expanding its regulated services in Australia.

- Coinbase just launched Coin50, a crypto index similar to the S&P 500, tracking the top 50 crypto assets by market cap.

- Canary Capital filed a form for (ETF) tied to HBAR, the native asset of the Hedera blockchain.

- Kraken, Tether-Backed Dutch firm rolls out MiCA-Compliant Euro, U.S. Dollar Stablecoins

- Metaplanet follows MSTR’s lead, announces $11.3M debt sale for additional Bitcoin purchase.

Technicals & Macro

BTCUSD

Source: TradingView

Key levels

66,000 / 73,000 / 77,000 / 93,500

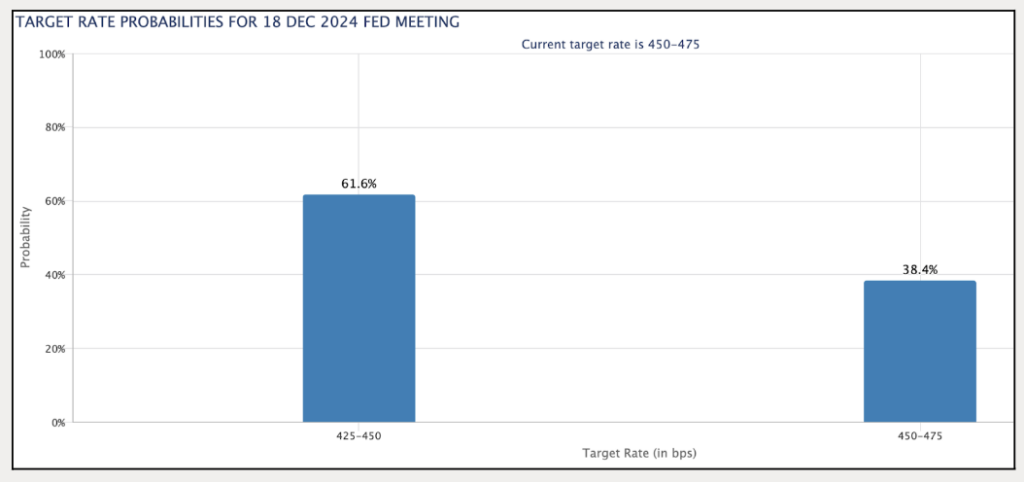

Well the week that was, brought a reshaping of the final expected interest rate cut into the end of the year, with some hotter than expected retail sales and a lingering concern that Trump’s policies may bring inflation. China stocks are taking a hit on additional concerns on large tariffs slated for the Trump Presidency in an effort to bring manufacturing back home to the US.

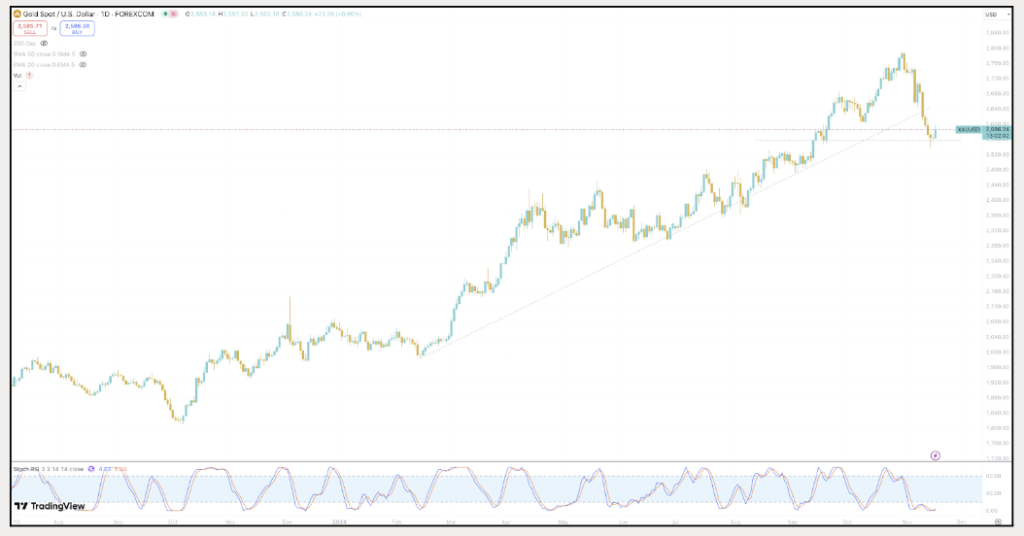

The wiggle in equities has barely touched the crypto space, with full-hype beginning to take hold. Solana, memes and real world assets plays are on the move, and of course, BTC the king continues to hold its ground at elevated levels leading to monumental inflows into the Blackrock ETF. The ETF is in the top 1% of assets held of any ETF ever launched, and we are moving further into record territory with bitcoin surpassing the market cap of silver. I keep banging on about the relative value trade with gold – the market cap differential is ripe to close, with bitcoin representing a $1.8T market cap and gold repping around $18T. This represents a 10x trade if BTC decides to close the gap higher (it was 17x a few months ago).

Technically price has an angry head on it – higher lows, and 100,000 in sight. We had a bet internally at the start of the year, and 100K seemed a long way off – but this year, the team may owe me beer for once.

Broader market downside risks are still centered around any policy hiccups in Trump’s unscripted speeches and further escalation in the Israel / Iran conflict. The VIX is still historically less elevated given the conflict risk, and the crisis does have the potential to escalate, and fast.

Gold taking a breather on USD strength

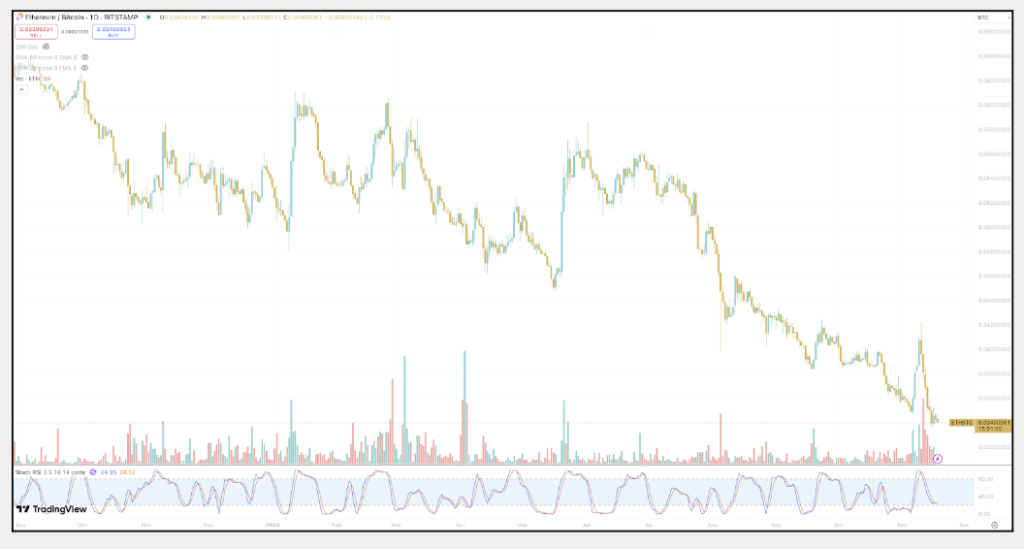

ETHBTC getting a little love

ETHBTC continues downtown – still a proxy trade on political shifts in the US, and corporate moves from Microstrategy

Be careful out there, and enjoy the fireworks.

Jon de Wet, CIO

Spot Desk

The Australian Dollar (AUD) continued its decline against the US Dollar (USD) this week, reaching its lowest point since early August. Australia’s unemployment rate met expectations at 4.1% and therefore provided no significant surprise to alter market sentiment. Robust US economic data and hawkish signals from the Federal Reserve further reinforced the USD’s dominance.

On the trading desk, activity remained skewed towards off-ramping as the AUD’s decline persisted. Major cryptocurrencies such as Bitcoin, Ether, and Solana continued to draw significant attention. However, we observed a mixed trading pattern, with clients selling BTC and ETH while increasing their buying activity in Solana. This shift reflects a rotation of capital into assets with perceived growth potential and aligns with the ongoing diversification of trading strategies in the market.

Memecoins were a highlight this week, driven by strong performance in the segment. Coins like BRETT and PEPE saw increased buying as traders speculated on further upside momentum. This marks another strong week for memecoins, reflecting a trend of heightened market interest in niche assets.

Our desk continues to provide tailored solutions for cryptocurrency liquidity, with competitive rates across major coins, altcoins, and memecoins, paired with key fiat currencies. We also support T+0 settlement for seamless trading experiences. For any inquiries or specific requirements, please don’t hesitate to contact us.

Reshad Nahimzada, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

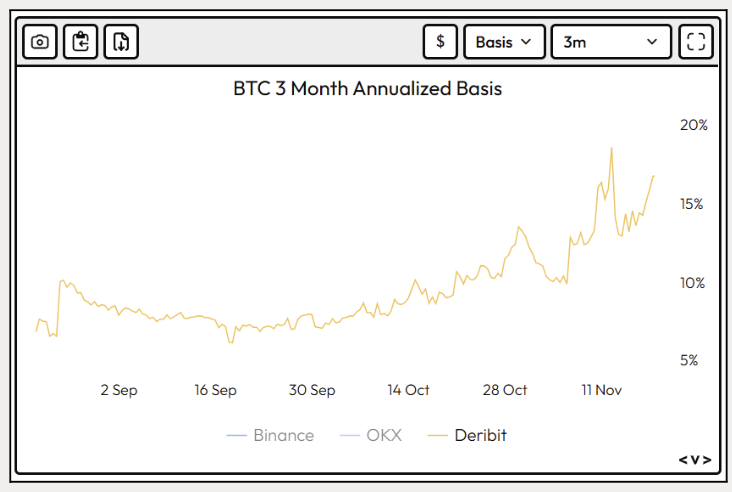

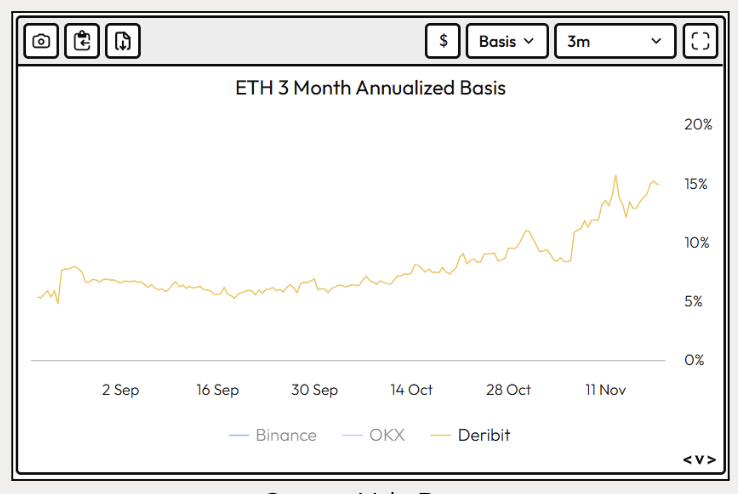

Basis rates on BTC and ETH are both lower on the week but the trend is higher!:

- BTC’s 90-day annualised basis rate is at 16.74%.

- ETH’s is at 14.88%.

Shorting the Basis becomes a very attractive trade at these levels – historically BTC’s basis rate doesn’t stay above 15% for very long periods.We like this trade because:

- It’s a high conviction trade with 100% principal protection (in terms of projected payout).

- High payout % – it’s rare to provide a trade with such limited downside that offers 15% + p.a. Yield.

- The Basis rate typically reverts once it gets too elevated so we see now as a solid entry level.

Berkeley Cox, Derivatives Analyst

What to Watch

- RBA MINUTES (TUE): The minutes as usual will be dissected for any commentary regarding potential policy steps ahead, whilst it was already telegraphed that the Board did not actively consider a rate hike or cut – just as in September.

- UK CPI (WED): Expectations are for the Y/Y to tick up to 2.2% from 1.7% while the core figure is seen moderating slightly to 3.1% from 3.2%.

- JAPANESE CPI (THU): There are currently no expectations for the Japanese CPI data, whilst the preceding Tokyo CPI release saw Core CPI above consensus but still down from the prior month.

- UK RETAIL SALES (FRI): Expectations are for October’s M/M figure to come in at -0.2% (prev. 0.3%) though the consensus is subject to a wide forecast range of -0.6% to 0.2%

- UK FLASH PMI (FRI): PMIs are seen printing in-line with October’s figures after several months of pressure, though there are numerous factors in play.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post