17 Nov, 25

Weekly Crypto Market Wrap: 17th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Trump signs a deal to end the longest Government shutdown in history.

- Australian labour data comes in particularly strong, with the unemployment rate falling below expectations backed up by strong new full time jobs creation.

- 21Shares launches two new ETFs offering broad exposure to the top 10 crypto assets by market cap and to a basket of diversified crypto assets, excluding Bitcoin.

- Brazil’s central bank introduced updated regulations for virtual asset service providers, expanding anti money laundering and counter terrorism financing requirements, with rules that will take effect in February 2026.

- Strategies NAV to its Bitcoin holdings falls below 1 for the first time, sparking valuation concerns amid marketwide speculation.

Technicals & Macro

Markets

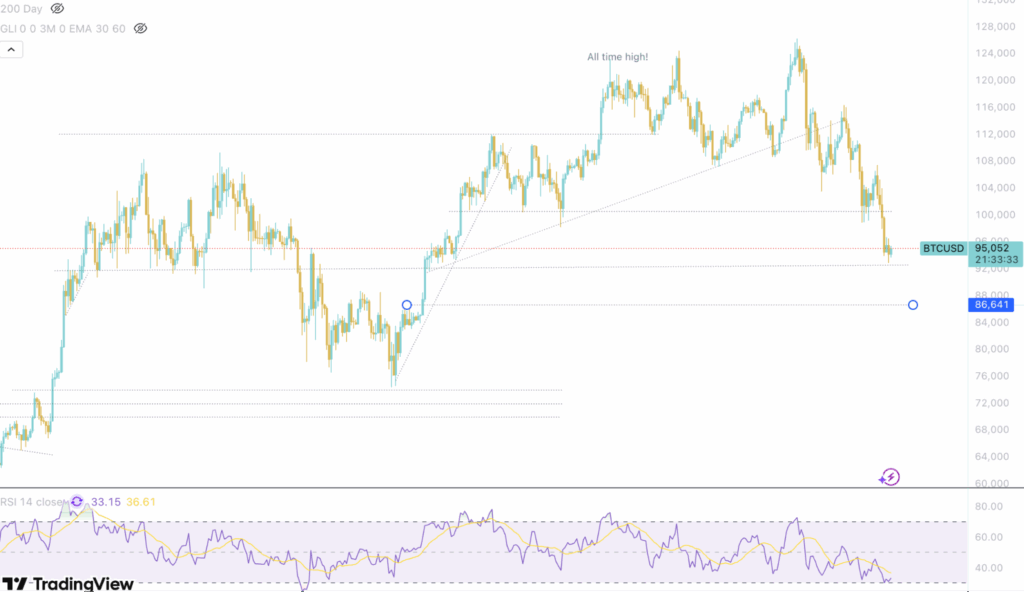

BTCUSD

Downtown – my favourite part of New York. East Village rocks. When crypto markets are heading downtown, I’m (much) less excited.

Our team was questioning whether BTCUSD could ever head below US$100K again only 3-months ago. We are currently sitting at the 95,000 level, and as Asia gets going here on Monday 17 Nov, 2025, price has based after the drop below 100,000.

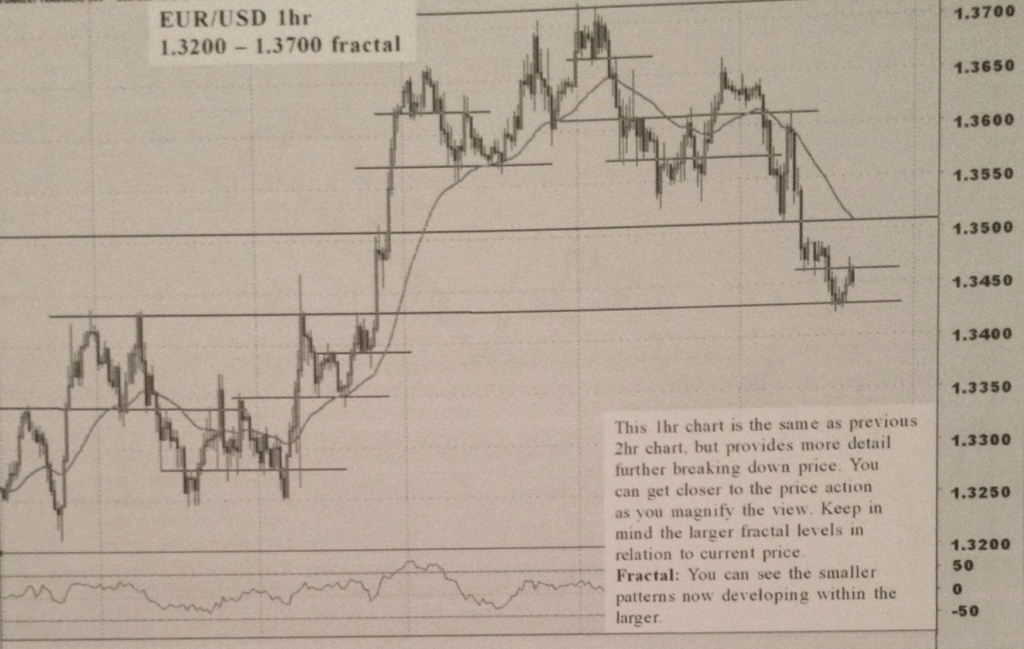

It’s important to zoom out of the noise during sentiment driven market events – as it is easy to get caught up in the hype. We’ve had one helluva run this year – after opening at ~92,000, we saw a yearly low touch below 75,000, then the run beyond 126,000. Taking a step back from intraday volatility in the daily chart above, it actually looks like a fairly orderly market. Price moves in fractals – Chris Lori is one of my favourite market technicians, a lesson well taught by him.

Chris Lori: EURUSD orderflow

Source: Chris Lori

As markets become extended, they tend to trade back into the range and form fractals at different price levels. These are not magic predictors of short-term direction, but rather pockets of latent, passive and active liquidity that tends to form price levels. These levels are then reinforced by other market participants as price trades either side on the back of broader sentiment and macro factors. The above EURUSD chart doesn’t look all that different to the BTCUSD move we are seeing, albeit on different timeframes.

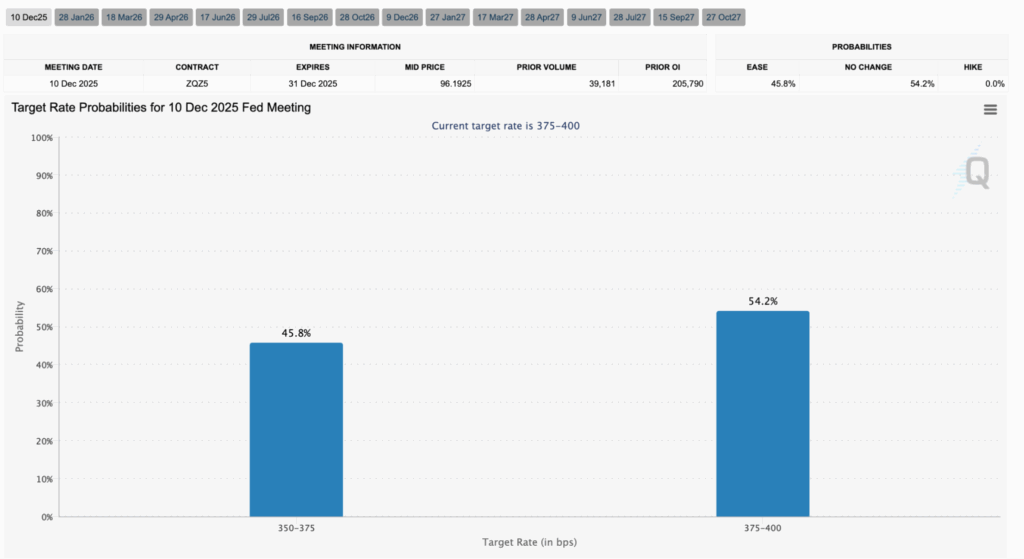

So what is exactly driving the BTCUSD fractal back to its origination point from late April? As mentioned last week, every time the Dec 2025 Fed meeting looked uncertain, the equity markets had some kind of sell-off. Wall Street has a habit of sending non-verbal messages to the Fed, and was one. We are almost 50/50 on the meeting now.

Macro implications

Source: FedWatch (CME)

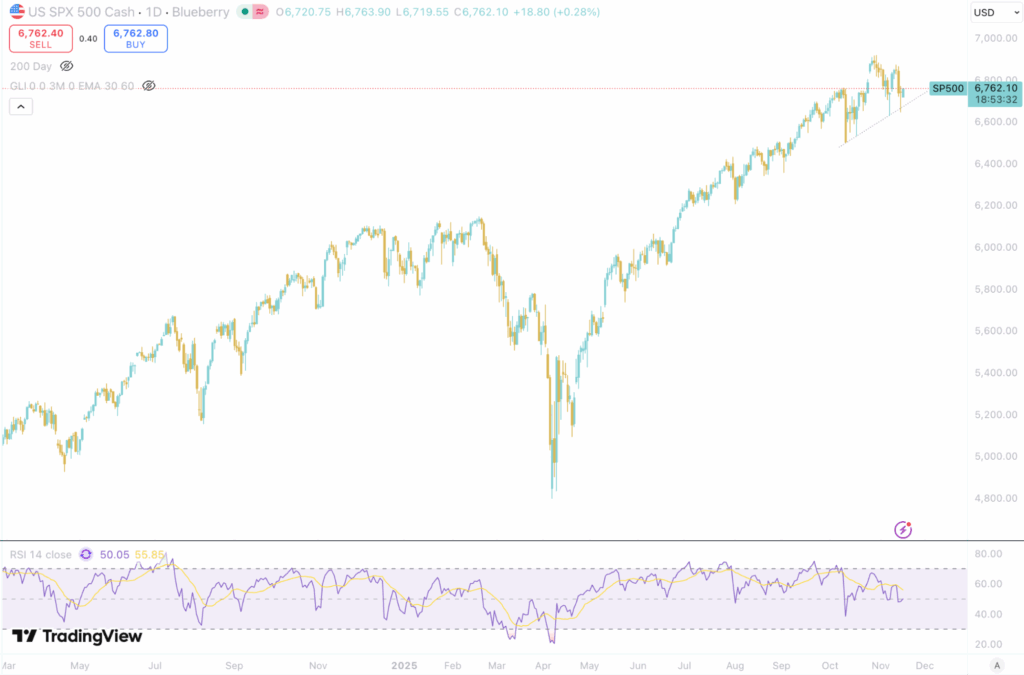

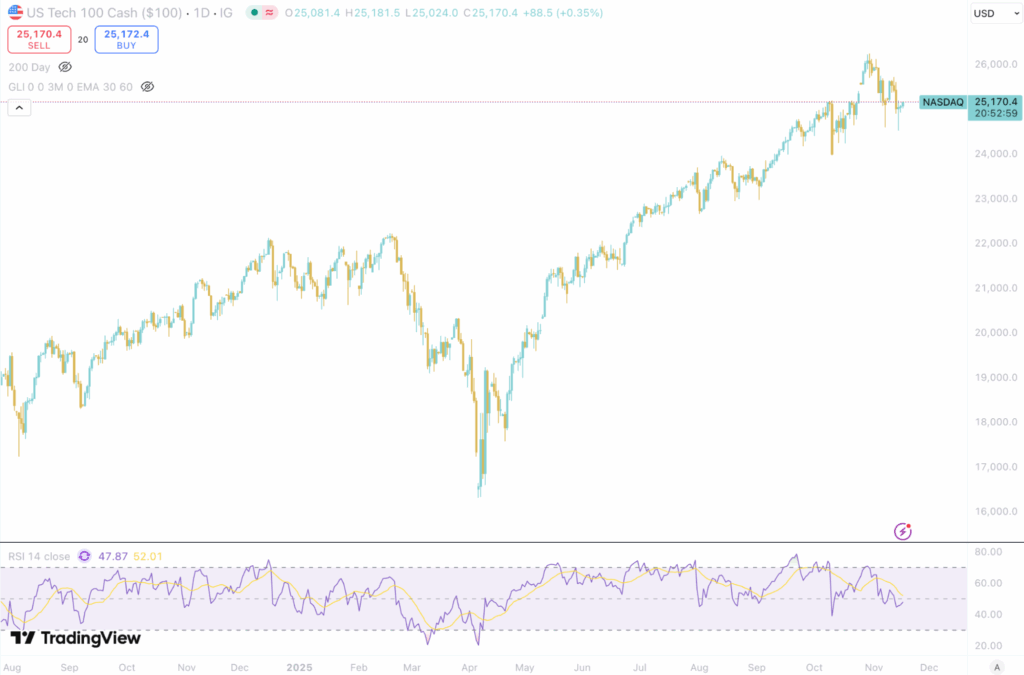

Crypto took a deeper dive than equities. The S&P and Nasdaq are still forming higher lows.

S&P500

Nasdaq 100

Crypto has always been heavily sentiment driven, and as a maturing asset class, tends to be more influenced by this theme during risk moves. The media has been running stories around the 4-year BTC cycle being dead, ETF outflows, and Bloomberg today has graced us with with this gem:

I wouldn’t call this a bear market just yet Bloomberg, but many of your readers are potentially trading off that headline alone. The gut feel check is that institutions are moving to the sidelines into Christmas, the Oct 11, 2025 leverage wipeout has hurt some of the market makers, which has in turn left us with less than ideal liquidity at some venues, and in the spirit of moderating excess, markets are teaching us all that price doesn’t always go up. Structurally, I’d bet that we are still pretty sound going into 2026.

If you’re looking for price levels – keep an eye on 86,500 to the downside which would actually complete the fractal to its original breaking point. To the topside, 100,000 is the number everyone will be watching.

There’s some funky stuff that you can do using our derivs desk (wholesale only) to take advantage of the basis, volatility and pricing at these levels – but I’d be equally happy holding the right assets, unleveraged, with a view that 2026 is a brighter market than now. The elephant in the room is the impending debt crisis, but this is a tough one to market time and even tougher to understand its effect on scarce assets like Bitcoin. So position size safely, be prepared to take some volatility along the way, and hold the long-view.

Jon de Wet

CIO

Spot Desk

On Thursday in Australia, labour market data for October came out particularly strong, with the unemployment rate falling from 4.5% to 4.3% (4.4% expected). Looking at the details, the employment created during October was all full time workers (55.4k), adding to the strength of this data. In the US, the House has voted to end the longest Government shutdown on record with 222 votes yea and 209 votes nay, removing a major political overhang and reducing near term fiscal uncertainty. Stronger Australia macro data and easing US political risk support a broader risk on tone: however price action in the crypto markets over the weekend tells a different story.

US equities also sold off on Thursday quite steeply and had mixed results post the Government shutdown ending – broadly closing the week in the red. Precious metals Gold (2.10%) and Silver (+4.57%) both recorded positive weeks despite weak price action in the crypto and US stock market. The divergence in price action between rising precious metal prices vs declining crypto and US equities prices is an indication that the market is perceiving current conditions as uncertain. All eyes are on FOMC minutes this Thursday 6am AEDT to gauge the FED’s tolerance for sticky inflation and any hints on the timing of future rate cuts.

On the spot desk, BTC saw consistent two way flow with balanced trading interest across the week. ETH volumes were softer and skewed heavily towards the offer, with very minimal buyside interest. SOL trading frequency decreases, however all client trades last week were on the buyside, opposite to ETH activity. Across the broader alts, flows were concentrated to ICP, ZK and LDO.

USDC activity remained consistent with previous weeks – driven mostly by interest in USDC/USD pairs. Flows leaned heavily to the sell side, consistent with a market still pricing in a structural discount on buy side executions. AUDD remained firmly one direction, with clients continuing to offload AUDD in favour of same day fiat and crypto settlement. USDT dominance rose 10.69% last week in line with the broader sell off as Crypto/USDT pairs are typically the most liquid markets. USDT/USD activity across the desk mirrored this dynamic as flows stayed bid-skewed as rising USDT dominance points to a growing supply of USDT circulating in the market.

FX flows were concentrated in USD and AUD pairings, while activity in CAD, NZD and EUR remained consistent with prior weekly trends. USDT/AUD trading was largely even, though a slight lean towards the sell side emerged midweek. AUDUSD opened the week at USD 0.6494 and was bid to 0.6536 by week’s close on Friday.

Given the current volatility in the crypto market, placing a limit order can help you secure a favourable execution automatically if price reaches your target level. It’s a useful way to express a directional view while ensuring that you don’t miss potential opportunities when the market moves quickly. Feel free to hit us up in the live chat in the Zerocap portal to discuss any enquiries surrounding limit orders!

The OTC desk continues to offer tailored cryptocurrency liquidity solutions, offering competitive pricing across majors, stablecoins, and altcoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Oliver Davis, OTC Trader

Derivatives Desk

WHOLESALE INVESTORS ONLY*

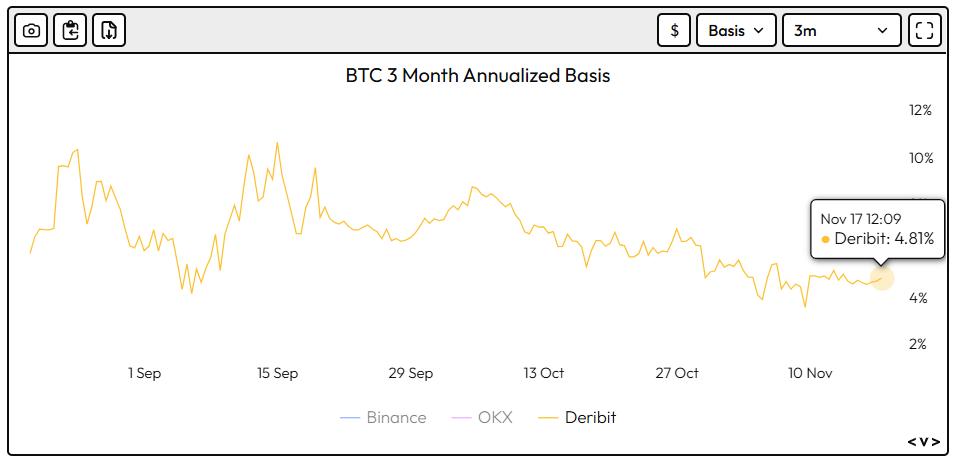

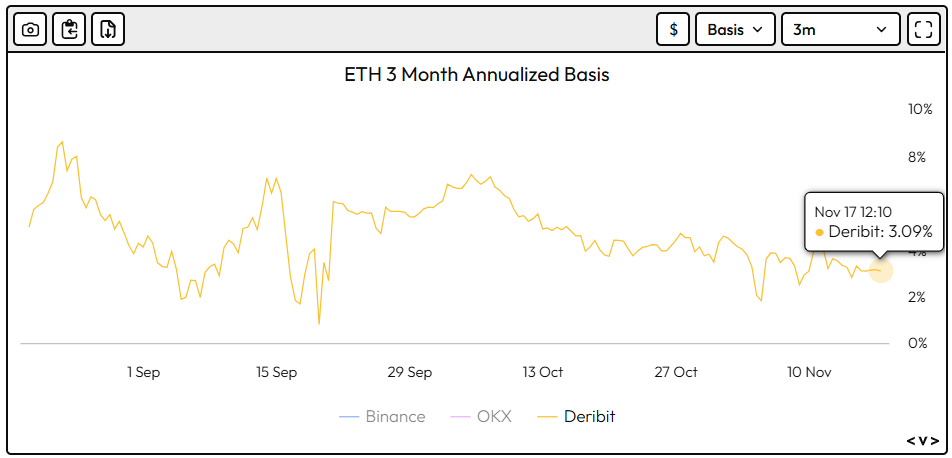

BTC and ETH basis softened slightly over the week, with BTC now trading at an annualised 4.81% and ETH at 3.09%. With risk-free yields sitting in a similar range, there isn’t much room for basis to compress further without creating outright dislocations.

The upside of these subdued levels is that collateralised borrowing is relatively cheap at the moment. Feel free to reach out to the desk for live pricing and structuring ideas.

Source: Velodata

Source: Velodata

Crypto markets are in a transition phase, with majors consolidating and altcoin momentum fading. Institutional and regulatory developments highlight continued mainstream integration, even as speculative flows cool.

Against this backdrop, strategies that capture upside while managing downside risk such as wide, low-delta collars (e.g., for ETH: USD 2.1K / USD 5K) remain well-positioned for investors navigating a volatile but structurally constructive market.

This Week’s Trade Idea – Zero Cost Collar

Implement a Zero-Cost Collar on ETH – a simple options strategy to simultaneously limit downside and cap upside at zero net cost.

Mechanics of the Collar

- Protective Put at USD $2,100 – this ensures a minimum floor: regardless of how far ETH might drop, the investor retains the right to sell at USD $2,100 at expiry.

- Covered Call at USD $5,000 – this caps the upside. The premium from writing the call offsets the cost of the put.

Payoff Profile:

- If ETH ≤ USD $2,100 at expiry → downside is fully hedged; the investor sells at USD $2,100.

- If USD $2,100 < ETH < USD $5,000 → they capture spot market gains (ETH trade value minus option costs = zero upfront cost).

- If ETH ≥ USD $5,000 → maximum payoff is capped at USD $5,000.

Risk Considerations:

- Opportunity cost: Upside beyond $5,000 is foregone for downside protection.

- Regulatory shifts: New laws (GENIUS Act, Project Crypto) may drive sudden shifts in ETH price or volatility.

- Alternative altcoin moves: Unexpected narratives (e.g., revenue meta/Ai hype) could redirect capital away from ETH, increasing relative risk towards downside.

Why the Collar Makes Sense Now:

- Secures present gains while retaining material upside.

- Neutral capital deployment: No immediate net premium means the investor doesn’t deploy additional funds while locking a favorable risk profile.

What to Watch

TUE: AU RBA Meeting minutes

WED: Nvidia quarterly earnings post government shutdown data backlog, US existing home sales

THU: US FOMC minutes, US Building Permits Prel, US Housing Starts, AU RBA Connolly Speech

FRI: US Existing home sales, US Consumer sentiment

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 8th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 1st December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 24th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post