16 Sep, 24

Weekly Crypto Market Wrap: 16th September 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- MicroStrategy stock jumps 8% after purchasing 18.3K more BTC for $1.1B USD, their largest purchase since 2021.

- US spot bitcoin ETFs record highest daily inflows in nearly two months as BTC taps $60,000.

- US Commodity Futures Trading Commission prepares for a huge spike in election speculation.

- FTX’s Sam Bankman Fried appeals his fraud conviction appealing for a new trial.

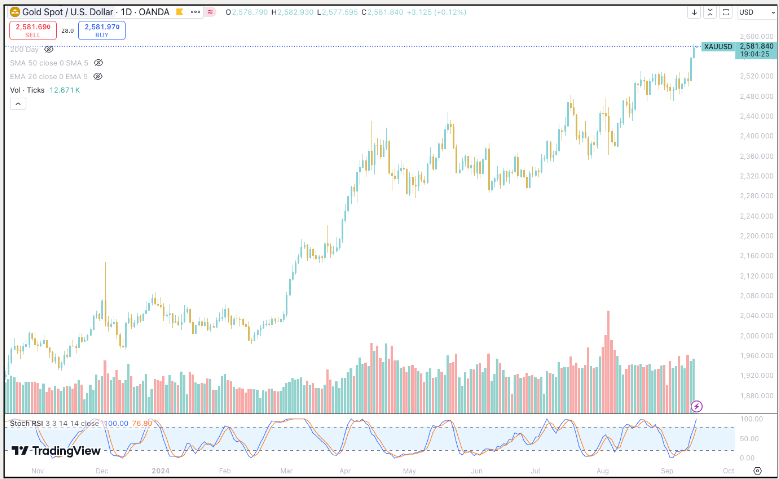

- Monetary easing saw Stocks, Bonds and Gold rally with gold hitting ATH while BTC still around 20% below ATH.

- Tether onboarded former head of government affairs from PayPal.

- Hong Kong considers a new licensing regime for OTC crypto trading.

- English court rules that Tether is personal property.

Technicals & Macro

BTCUSD

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

BTC got the rally to 60,000 last week off the back of within expectation inflation data (CPI and PPI), and an interesting shift in Fed Funds Futures – now pricing in a 59% chance that we see a 50 bps cut. This will be a closely watched, and volatile event – and is very close to call. Given the Fed has waited this long for the initial cut, we are in the 50 bps (vs 25 bps) camp. The Fed’s dot plot is looking more and more like the start of a rate cutting cycle, which should support risk assets into the end of the year.

The S&P and Nasdaq had great weeks, getting close to all time highs. BTC, and to an extent ETH, followed – but we are now seeing reversion back into the range in the early Asian session (Mon 16 Sep). Gold was the star performer though, breaking all time highs and rallying into early Asia today.

BTCUSD is forming an imperfect descending wedge on the daily chart, with a lot of chop (indecision) inbetween. Michael Saylor’s $1.1B of additional BTC purchases over the past month have helped to somewhat buoy the spot price, but we are definitely seeing underperformance when compared to equities. We follow that the upcoming election is playing into this – we are still not certain on how a Kamala Harris presidency would look for the crypto space. Harris leads in the polls, and had a convincing win over Trump in the recent debate. If these odds begin to shift, watch out for the long banks, energy and bitcoin trade with a Trump win.

We’re seeing a BTC downside target of 53,000 after the recent range lows, with an upside target of 65,000 after breaking the loose descending wedge. Tough to call on direction until we get closer to the election, but risk on conditions should lead to short-term positive sentiment.

Gold on the move

Source: TradingView

ETHUSD

Key levels

2,100 / 2,800 / 3,600 / 4,000

We mentioned last week that we are still short biased on ETHBTC, despite it hitting multi-year lows. It has indeed dropped further, breaking recent lows and seeing levels not touched since 2021. Are we still short biased? Price has come a long way, but fundamentals are still in BTC’s camp – and we expect this ratio to decline further. Would we get short here? Probably not – tough to make a case for a momentum trade when it’s already come this far on a short-term basis, however longer-term, happy to sell into ETHBTC as a long BTC proxy trade.

Jon de Wet, CIO

Source: Tradingview

Spot Desk

The Australian Dollar (AUD) took a dive, and then a rally – moving moderately against the US Dollar (USD) week on week, with a close at 0.6705. This sustained demand for AUD offramping for the desk. The late week recovery in the AUD was supported by a recovery in global stock markets and a decline in the US Dollar, as investors looked ahead to the Federal Open Market Committee (FOMC) meeting this week.

The week didn’t see substantial demand towards majors, with some bidding towards BTC and SOL. Alts haven’t been a preferred choice lately among investors as BTC remains the preferred asset on a relative basis.

Looking ahead, there is volatility anticipated as the Fed prepares to make its first rate cut decision this week. The desk remains strategically positioned to offer competitively priced stablecoin/AUD and USD pairs and T+0 settlement. Corporates, exchanges and other desks are encouraged to reach out with any interest.

Arpit Berit, Operations Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

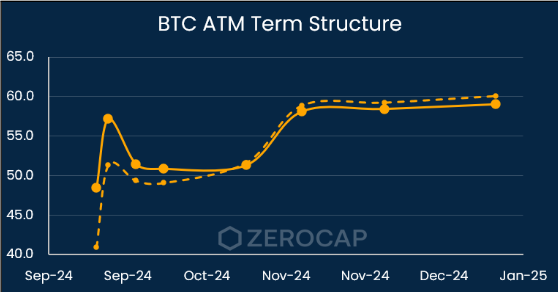

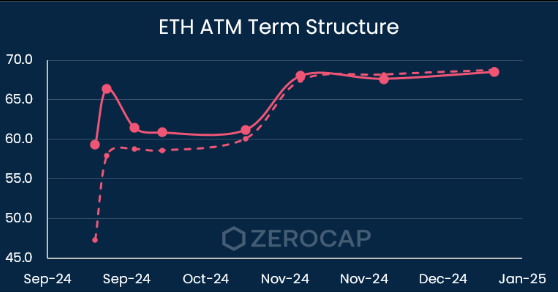

The Basis Rates rates are relatively unchanged for the week, with BTC’s 90-day annualised rate sitting at 7.25% and ETH’s sitting at 5.29%. While IV has been dropping off over the last few months on BTC and ETH, there is a slight kink in the front-end of the term structure ahead of the FOMC interest rate decision on Tuesday.

If you believe that the IV downtrend will continue, you could look at trades that involve selling volatility, to capture the Yield Premiums. For those holding BTC and ETH, Yield Exit Notes are a good way to capture some of this premium, by selling some upside volatility on their spot holdings.

Hit the derivs desk for pricing!

Berkeley Cox, Derivatives Analyst

What to Watch

- Canadian CPI and Retail figures, on Tuesday.

- UK CPI and PPI figures, on Wednesday.

- US Fed Fund Rates, Unemployment Rates, FOMC Economic Projections and Press Conference, on Thursday.

- AU Unemployment Rate and Employment change rates, on Thursday.

- UK Monetary Policy Summary and Interest Rates released, on Thursday.

- Japanese Interest Rates, on Thursday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post