Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Insights

- FAQs

- Why are market makers vital in the cryptocurrency domain?

- How does Zerocap set itself apart in the market-making sector?

- What challenges do tokens encounter regarding liquidity?

- What are the benefits of collaborating with a professional market maker?

- What potential risks are associated with certain market makers?

- DISCLAIMER

16 Oct, 23

Weekly Crypto Market Wrap, 16th October 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Insights

- FAQs

- Why are market makers vital in the cryptocurrency domain?

- How does Zerocap set itself apart in the market-making sector?

- What challenges do tokens encounter regarding liquidity?

- What are the benefits of collaborating with a professional market maker?

- What potential risks are associated with certain market makers?

- DISCLAIMER

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Bitcoin Lightning Network grows by 1,200% over past two years.

- Crypto investment products see largest inflows since July.

- JPMorgan debuts tokenisation platform.

- Australian crypto exchanges set to become subject to the same existing financial services laws of traditional exchanges – licence could be mandatory.

- Binance freezes accounts linked to Hamas following Israeli request.

- Blockchain gaming saw $2.3 billion in investments this year.

- SEC does not plan to appeal court decision on Grayscale Bitcoin ETF.

- Ferrari to accept crypto as payment for cars in the US.

- CFTC and FTC file lawsuit against Voyager Digital CEO, claiming fraud.

- Alameda former CEO Caroline Ellison blames Sam Bankman-Fried for misuse of user funds at trial, claims Binance’s CEO tweets contributed to collapse.

- Uniswap launches mobile Ethereum wallet on Android.

- FED sees “restrictive” policy still in place for the foreseeable future, until inflation eases.

- Slow UK economy faces partial bounceback in latest GDP data – BoE governor states future rate decisions will be “tight.”

- US consumer prices rise more than expected; September CPI data.

Winners & Losers

Data source: TradingView

Market Highlights

- Bitcoin’s consolidation phase hinges on opposing market drivers: apprehensions over the Federal Reserve’s potential extended high-interest rates and shifting sentiment on a Bitcoin ETF approval. While September’s CPI data met expectations, the PPI MoM for the same month surpassed forecasts at 0.5%. PPI is commonly viewed as a leading CPI indicator. The S&P 500 had its second straight week of modest gains at 0.45%, but gold’s impressive 5% surge suggests market participants may be reevaluating the potential for a core CPI rebound, favouring safer assets. Conversely, Bitcoin bulls faced a less fortunate fate, with Bitcoin set to conclude the week with a decline of over 3%.

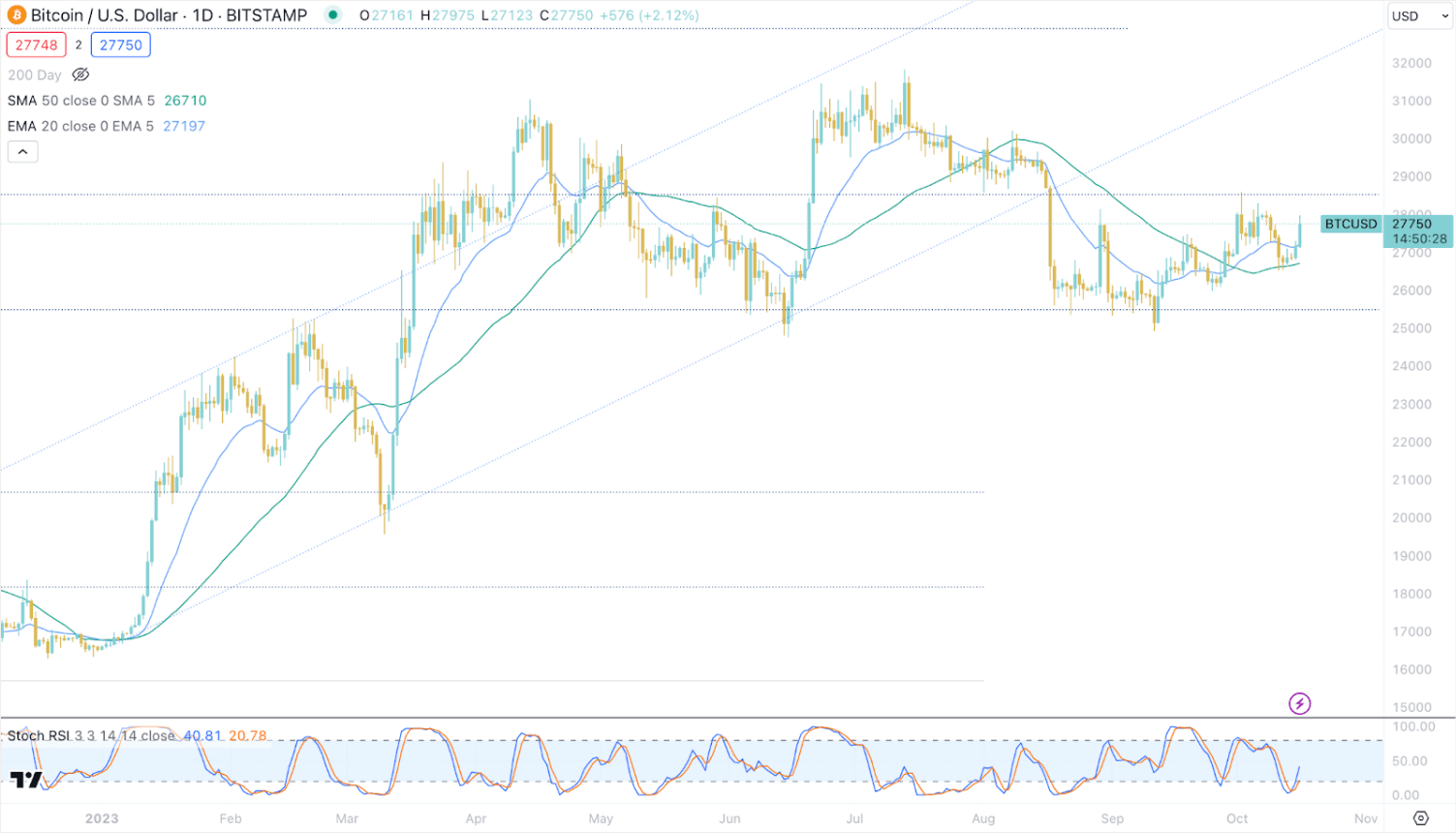

- According to Bloomberg’s ETF experts, there’s a 90% likelihood of a Bitcoin spot ETF gaining approval within the next three months. This positive sentiment is bolstered by ongoing buying interest around the 50-day Simple Moving Average (SMA) at 26,600. Looking ahead to the upcoming week in technicals, if buyers push the price above the 20-day Exponential Moving Average (EMA) at 27,100, it could propel the BTC/USD pair beyond the 28,000-resistance level. Conversely, a downturn below the 50-day SMA may lead to a decline to 26,000, with the potential to test pivotal support at 24,800. As I write this, BTCUSD is breaking higher – with stops clearing above 27,000. The pressing concern is whether the Fed can strike a balance between combatting persistent inflation with rate hikes while also addressing significant apprehensions from the credit and housing markets, which may warrant lower rates. Simultaneously, the escalating Middle East conflict poses a risk of oil price increases. Investors should remain watchful.

Data Source: TradingView

- The low volatility in Bitcoin and the recent regulatory uncertainties have deterred crypto investors from altcoins. Nevertheless, BTC’s relative strength in the ongoing ETH/BTC pair downtrend is noteworthy. Significantly, we are currently observing a re-test of the 200-week Exponential Moving Average (EMA) support, a historically robust level. Keep an eye on risk assets for an indication of where ETH goes from here.

Data Source: TradingView

- In a noteworthy move, the SEC has chosen not to contest an August court ruling that criticised its denial of Grayscale’s proposal to convert its Bitcoin Trust (GBTC) into an ETF. This could set the stage for the debut of the U.S.’ first Bitcoin ETF. Grayscale’s GBTC, the largest cryptocurrency fund globally, has witnessed its discount to net asset value (NAV) reduce from a staggering 48% earlier this year to the present 16.5%. Against this backdrop, Grayscale, supported by the DCG, is advocating for the transformation of GBTC into a Bitcoin ETF. The persistent discount has been a focal point of scrutiny over the years. While the SEC retains the right to reject the proposal on different grounds, the eventual transition of the trust into an ETF would be a welcome development for the industry.

Data Source: VeloData

- In local news, there’s a noticeable momentum in the Australian government’s efforts to regulate cryptocurrency, with the Australian Treasury recently unveiling new plans. The initial proposal states that platforms holding assets exceeding specified thresholds — AU$1,500 individually or AU$5 million collectively — must obtain an Australian Financial Services Licence. This initiative also includes directives concerning custody software standards and particular token transaction stipulations, spanning activities such as trading and tokenisation. The legislation, once it becomes law, will allow providers 12 months to transition to the new regime.

What to Watch

- Australia monetary policy minutes and US manufacturing index, on Monday.

- US retail sales report, on Tuesday.

- UK CPI, on Wednesday.

- FED Chair Jerome Powell speaks, on Thursday.

- UK retail sales report, on Friday.

Insights

Through meticulously fine-tuning bid/ask spreads and ensuring robust liquidity solutions, we bridge the liquidity gap in crypto markets – fostering long-term growth and stability in the volatile crypto space. Learn more about market making and Zerocap’s edge.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

Why are market makers vital in the cryptocurrency domain?

Market makers are indispensable in the cryptocurrency realm as they enhance liquidity by actively buying and selling digital assets. This activity bridges the gap between buyers and sellers, mitigates volatility, ensures consistent price availability, and fosters overall market stability.

How does Zerocap set itself apart in the market-making sector?

Zerocap stands out by meticulously fine-tuning bid/ask spreads, offering deep liquidity across a multitude of platforms, and utilizing proprietary technology for informed trading decisions. Their expertise ensures a seamless trading experience for users.

What challenges do tokens encounter regarding liquidity?

Many tokens grapple with liquidity challenges, often resulting in wide bid-ask spreads due to low trading volume. This can deter trading activity and potential investors. Market makers can help initiate the required liquidity, attracting more investors and facilitating further trading.

What are the benefits of collaborating with a professional market maker?

Collaborating with a professional market maker can lead to exchanges being more inclined to list new tokens, attract a diverse investor base, pave the way for organic growth, and potentially boost the token price due to increased trading volumes and investor confidence.

What potential risks are associated with certain market makers?

Some market makers might engage in questionable practices, such as manipulating token prices for short-term gains. While these tactics might benefit the market makers temporarily, they can damage the token’s reputation and lead to long-term adverse effects.

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 1st December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 24th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 17th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post