14 Oct, 24

Weekly Crypto Market Wrap: 14th October 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- China’s highly-anticipated fiscal stimulus announcement fell short of expectations, deterring capital flows into Chinese equities.

- The Hong Kong Securities and Futures Commission (SFC) plans to approve more cryptocurrency licences in Hong Kong by the end of the year.

- The FBI creates a crypto token to catch market manipulators, charging18 individuals firms in first-ever prosecution for crypto market manipulation.

- World Liberty Financial, the nascent decentralised finance (DeFi) protocol supported by Donald Trump announced plans to start selling tokens on Tuesday.

- MicroStrategy plans to turn the company into a Bitcoin bank, now holding over US $15B in BTC reserves.

- MicroStrategy’s net asset value premium hit 2.5 times its bitcoin holdings, which is the highest since February 2021.

- The SEC charges Cumberland DRW for acting as unregistered dealer in crypto markets

Technicals & Macro

BTCUSD

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

We’ve seen a textbook break of trendline resistance, and the bounce this week from trendline support. Despite the US rate cutting cycle moderating and now pricing in a 25bp cut, with a 13% chance of no cut, equities, crypto and risk are on a bit of a tear. The VIX volatility index (fear gauge) is above 20, which is showing that broader markets are a little heightened to upcoming risk factors- namely increasing chances of the middle east tensions growing, the China stimulus program wobble, and perhaps a touch skeptical to a market that is a little over-exuberant in the current context.

Bitcoin has some notable catalysts. Michael Saylor has announced that MicroStrategy (MTSR) will pursue being a “Bitcoin bank”, offering the ability to leverage BTC into other securities. This is big news- and they have an edge: a Bitcoin inventory that is topping USD $15B. MicroStrategy is trading at 2.5x the value of its crypto holdings, which is punchy- but the vision and clever capital structure has created some real value to shareholders.

The upcoming election is also a critical event, and the polls have swung from Trump to Harris, and now look to be a deadlocked draw. The upside convexity on a Trump win is worth being long, and we are seeing market participants building positions in the lead up. In the absence of an escalating crisis, we see BTCUSD at 70,000 in the coming weeks, continuing off current downside support, with equities breaking further highs.

ETHUSD

Source: TradingView

Key levels

2,100 / 2,800 / 3,600 / 4,000

ETH has found its base and rallying alongside other risk assets, and is overtaking BTC’s return on a 7-day and 1-day basis, which is seeing a little respite in the short ETHBTC proxy trade. We still see BTC as outgunning ETH on a relative basis longer-term given BTC structural factors outlined above.

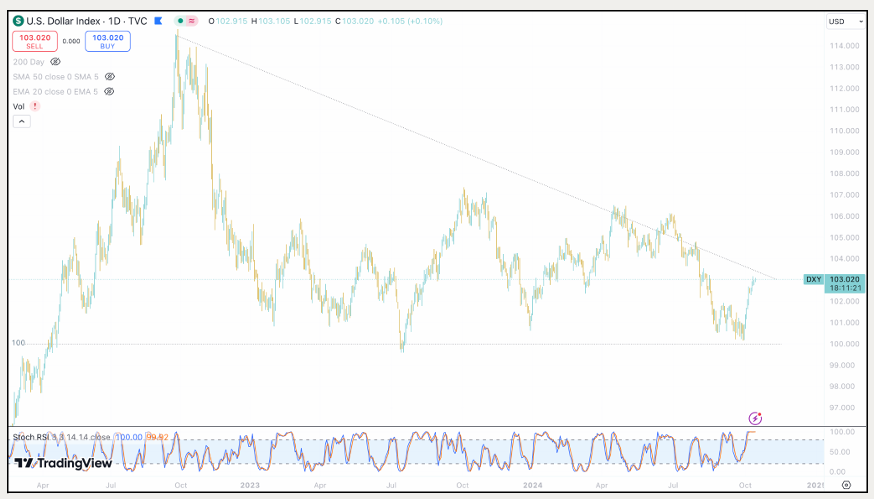

DXY rebound continues

Source: TradingView

DXY bouncing off the critical 100 level and firing back into the range. Despite this, equities and crypto are still moving higher- suggesting other FX currencies weakening against USD and risk. Keep an eye on the middle-east as this crisis could see USD breaking above the descending trendline and gold building on its momentum.

Jon de Wet, CIO

Spot Desk

The Australian dollar continued to decline for the second consecutive week against the US dollar, driven by a strong US payroll report and geopolitical tensions that increased demand for USD. Additionally, the much-anticipated fiscal stimulus from China fell short of expectations, disappointing participants and contributing to the sell-off.

The desk was heavily skewed towards off-ramping, as clients saw value in bidding on AUD during the sell-off. Major cryptocurrencies—Bitcoin, Ether, and Solana—continue to be bid up by clients, following last week’s trend, as market sentiment remains positive.

Altcoin activity is ramping up in anticipation of a potential Bitcoin breakout from its 7-month range leading up to the US election. We saw clients bidding on Layer 1s such as SUI, FTM, and STX. The desk also noticed some clients rebalancing their altcoin portfolios from majors like BTC and ETH into smaller caps, including HNT, JTO, EIGEN, GEOD, and SAFE.

The spot desk is well-positioned to offer attractive rates for major currencies, altcoins, and stablecoin pairs against major fiat currencies, with T+0 settlement available.

Oliver Davis, Operations Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

Basis rates on BTC and ETH continue to edge higher again (both up 70 bps

from last week):

- BTC’s 90-dayannualised basis rate is up to 9.4%

- ETH’s is up at 7.7%

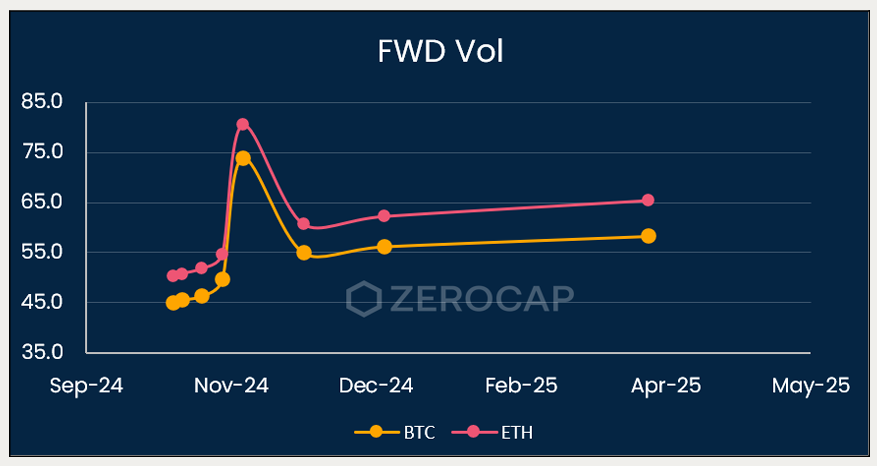

Forward Vol priced into the election has moved higher than last week. Comparing to last week’s chart, the FWD Vol into the Nov 8 expiry is up roughly 5 vol points on both BTC and ETH:

We have been writing about calendar spreads as an election trade idea for a couple weeks now by “selling the event” through trading volatility.

We still think a calendar spread involving short options around the election could be a play if one wants to cheapen up any bullish bets on price action towards the end of the year. Now might be an attractive time to put this trade on considering the FWD vol has moved higher over the week.

Berkeley Cox, Derivatives Analyst

What to Watch

- UK Claimant Count data on Tuesday. Forecast of claimant counts could signal weakening labor market conditions, influencing the strength of the British pound.

- Canadian CPI data on Tuesday. Forecast suggests inflation is relatively controlled, with moderate price changes over the year and a slight month-on-month decline.

- UK CPI data on Wednesday.

- Australia Employment Change and Unemployment Rate figures released on Thursday.

- European Central Bank to issue Monetary Policy Statement and Main Refinancing rate, and hold an ECB Press Conference on Thursday.

- US Retail Sales Data on Thursday.

- UK Retail Sales Data on Friday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post