14 Apr, 25

Weekly Crypto Market Wrap: 14th April 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Hong Kong’s Securities and Futures Commission (SFC) has issued guidance allowing licensed virtual asset trading platforms to offer staking services, aiming to position the city as a crypto hub in the Asia-Pacific region.

- Mantra’s OM token crashes 90% due to alleged reckless and forced liquidations, with one exchange possibly causing the collapse

- Ripple acquires Hidden Road for $1.25B to enhance stablecoin offerings, marking a significant industry move.

- Mastercard and Kraken partner to enable EU users to spend Bitcoin at 150 million merchants globally.

- BlackRock taps Anchorage Digital for Bitcoin and Ethereum ETF custody.

- ARK Invest buys $34.8M of Coinbase shares ahead of Trump’s new tariffs.

- OKX launches tokenized MMF collateral program with SCB, Brevan, Franklin Templeton under Dubai VARA; SCB custodian

Technicals & Macro

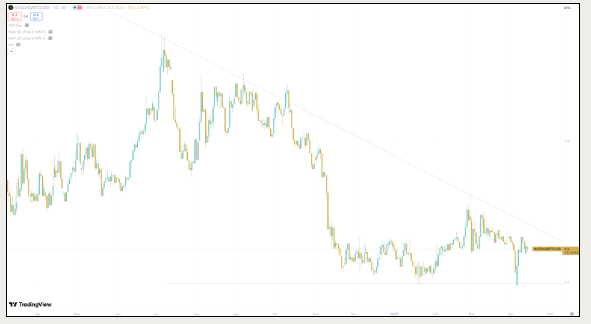

BTCUSD

Key levels

66,000 / 72,000 / 92,000 / ~110,000 (just north of the all-time high)

Dead cat bounce?

The past week has been defined by seismic shifts in global trade policy and their cascading effects on cryptocurrency markets, traditional equities, and macroeconomic stability. Preliminary calculations suggest the average effective U.S. tariff rate could reach approximately 25%, levels not seen since the 1880s. Despite the ‘stay’ of 90-days on higher bank tariffs, notably maintaining China’s at 125%, this did little to stem volatility. Our friends on the Goldman Sachs fixed income desk called last week one of the biggest they had personally had. With USD volatility, concerns of stagflation, and general uncertainty – we’ve seen rates going a little bananas. The 30-year treasury yield rose by 48.2bps – the largest weekly rise since 1987. Who said bond trading was dead back in 2020??!

We keep re-iterating the uncertainty card in these weekly reports. This is geopolitical uncertainty playing out and the markets are sending a warning sign to the administration – if you continue to play games with growth, we will sell everything. Trump’s response? “The bond market right now is beautiful”. There are rumours swirling that China is selling their US treasuries in response to the trade war – and this could certainly be true, but given the size of the bond market (being the world’s biggest market at $130T), and the US portion accounting for ~40% of debt worldwide, there would be a plethora of other players jumping on the train to produce these kinds of moves. As the world’s risk-free asset, this has far reaching implications – a pricing benchmark across everything from stocks to structured derivatives to sovereign bonds to mortgage rates. Treasuries and the US dollar find strength in the world’s perception of American competence – and right now, the world seems to be reconsidering.

The week was wild, but Wednesday’s reversion was a particular outlier. The S&P 500 rallied 9.5% – the most since the GFC days. Bitcoin followed and has been moving higher since. Technically we’ve closed the fractal gap from Nov, 2024, and are moving higher in a fairly orderly fashion compared to other markets. Of course Gold is the real winner amongst this chaos, but BTC’s resilience against other assets should be duly noted. Are we winding up for something bigger? We think so – the Strategic Reserve, significant corporate buying, and a host of M&A/IPO activity worth mentioning. The M&A action is telling – a record quarter with 62 deals, almost doubling Q3 2024’s deal count. Ripple acquired Hidden Road for $1.25B, Kraken took Ninjatrader for $1.5B, Robinhood & Bitstamp – the list continues. Furthermore, we’ve got Circle and Kraken gunning for an IPO, and Galaxy looking to list on the Nasdaq mid-May. These are healthy signs of a maturing market, looking to provide public access to the world’s greatest crypto firms. The geo/macro environment may provide short term volatility, but in the end fundamentals tend to win out.

So strap in – have a long-term view, and take smart positions with the right fundamentals. Easy right?

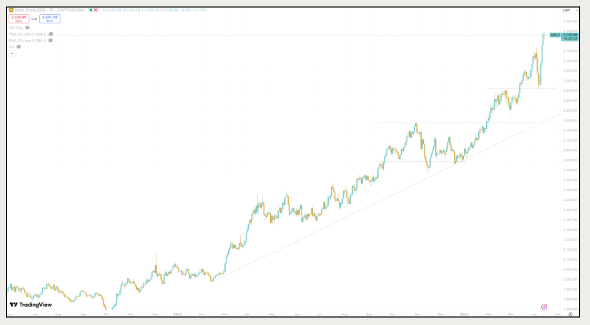

NASDAQ/BTC

Nasdaq winning on the bounce, but still way off BTC’s performance over the past year.

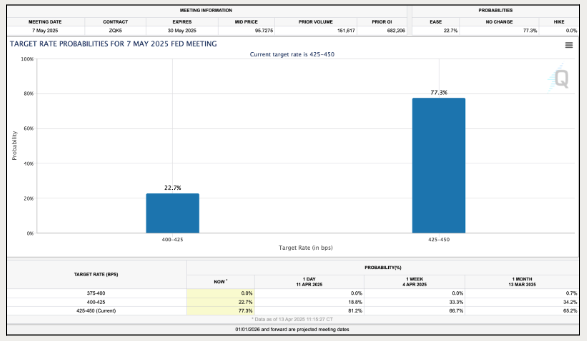

The next Fed meeting is no longer hanging on a wire – an 80/20 hold bet.

Dollar index tanks

DXY chart telling the story here. Lowest point since Aug 2023.

Gold trading like a leveraged meme coin

Unstoppable right now – with treasuries dumping, and traditional flights to safety being questioned. Gold is it. One day I think BTC will consistently rally on geopolitical fear, but not just yet.

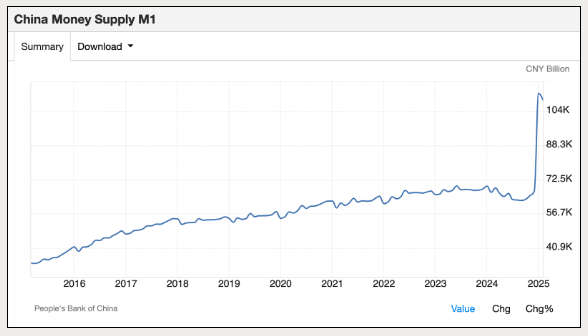

Chart from last week unchanged – liquidity is entering the system, and will need to find a home. One of my buddies sent me the following chart. It’s not direct causation, but it’s pretty close.

ETHUSD

Despite the successful implementation of Ethereum’s “Sharding” upgrade, designed to dramatically increase network transaction throughput and address scalability concerns, we are still in struggle-town here.

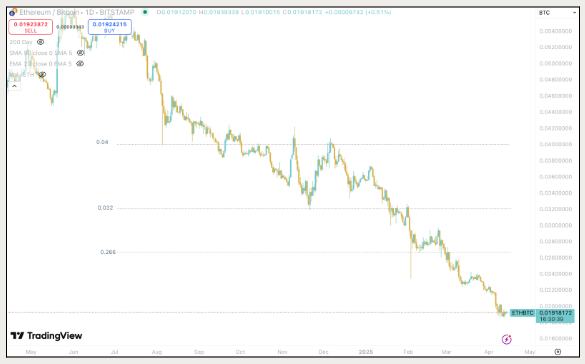

ETHBTC

ETHBTC – The pain trade continues.

Safe trading out there!

Jon de Wet, CIO

Spot Desk

Last week was marked by extreme volatility across the crypto, stock and FX markets driven primarily by rising global trade tensions and erratic US policy shifts.

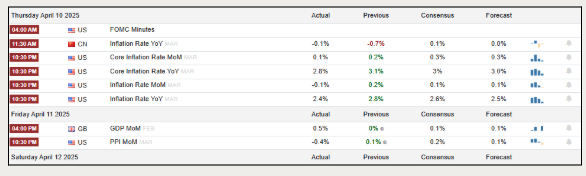

Are you sick of hearing about the Tariffs yet? President Trump’s “Liberation Day” announcement of a 10% minimum universal Tariff on April 2 sparked global market instability, and just 1-week later on Wednesday April 9 he announced a 90-day pause on reciprocal tariffs above the baseline 10% rate for 57 nations, including the European Union, Japan, and South Korea. China was excluded from this pause; instead tariffs on Chinese imports were increased to the current 145%. Contributing to the volatility, high impact economic events Core Inflation Rate MoM, Core Inflation Rate YoY, Inflation Rate MoM, Inflation Rate YoY, PPI MoM all came in lower than forecasted.

In an unusual development, treasury yields surged amid the market chaos as the 10-year Treasury yield rose by 50bps and the 30-year Treasury yield rose by 48.2bps (as mentioned, the largest weekly rise since 1987!)

As a result of the market uncertainty, US equities saw a sharp decline early in the week, before rebounding following the 90-day pause announcement on April 9. Mirroring US equities, Bitcoin dropped to a 2025 low 74.5k, reflecting a 5.5% decrease on Monday before surging above 82k in the midweek recovery. Unsurprisingly, altcoins behaved similarly with noticeably increased volatility. Notably, crypto related stocks benefited as well, with MicroStrategy rising nearly 25% and Coinbase Global increasing by 17% during the midweek recovery. USDT traded below parity all of last week with the exception of 2 hours on Thursday.

The cryptocurrency market remains sensitive to macroeconomic developments. Future movements may hinge on the Federal Reserve’s policy decisions, with the next meeting scheduled for May 6/7 – potential interest rate cuts could influence investor sentiment and market dynamics.

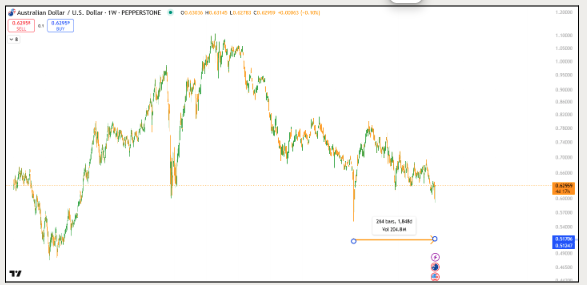

Needless to say amongst all the market uncertainty and chaos; the desk was extremely busy last week. Off-ramping demand was notably high as clients saw exceptionally high value in bidding up AUD, taking advantage of the 5 year lows against USD (reaching lows of 0.5955 USD).

The desk noticed 2-way crypto flows with a skew towards the offer. Clients were taking advantage of the dip, buying assets such as L3, BERA, SOL, and of course, BTC. We noticed a large pick up in clients placing limit orders on their mid-large cap crypto holdings far away from current mids in an attempt to exploit the volatility and try to capture a favourable result.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions, offering competitive pricing across major coins, altcoins, and memecoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Oliver Davis, OTC Trader

Derivatives Desk

WHOLESALE INVESTORS ONLY*

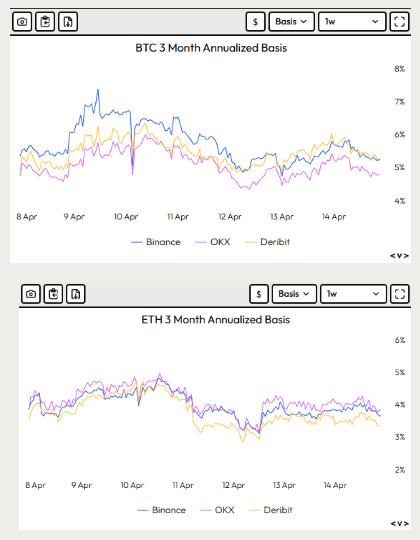

The basis remains in a consistent range for both BTC and ETH, and we expect it to stay within the 4–6% band until there is greater clarity around trade policies, bond market dynamics, and the U.S. monetary policy response to these developments.

FTrade Idea: Selling upside volatility

Global macro uncertainty surrounding U.S. trade policy, the U.S. bond market, and the Fed’s potential actions have led to increased volatility. We expect the global money supply to be a significant price driver for BTC over the next 6 months. The Fed will likely hold off on rate cuts to assess how the economy reacts to U.S. trade policies. Given the expected slow pace of these developments, we don’t anticipate a sharp rally in the near term. As such, selling upside volatility could offer attractive yields in the interim.

Yield Exit Note sample terms:

For a 27th June BTC Yield Exit Note with 95k Strike Price one can generate 4.3% absolute Yield (~23% annualised).

There are two possible outcomes at expiry

- BTC expires above 95k: Receive 95k USD per BTC invested + 4.3% yield paid in USD

- BTC expires below 95k: Receive back BTC margin + 4.3% yield paid in BTC

Get in front of the derivatives desk for info!

Austin Sacks, Derivatives Trader

What to Watch

Monday, 15 April – China Trade Balance (Mar):

- Trade data may show front-loading of exports ahead of steep US tariffs. Previous figures highlighted weakening trade momentum. Markets will assess implications for global demand and regional growth sensitivity.

Tuesday, 16 April – RBA Minutes (April Meeting):

- Expected to reaffirm a cautious stance with no strong guidance. Any dovish tilt could influence expectations for a May rate move. Markets remain alert to downside risks amid external trade uncertainty.

Wednesday, 17 April – China GDP & Activity Data (Q1/Mar):

- While headline growth may show stability, the data likely predates the latest tariff impacts. Retail sales and industrial output will offer a more current snapshot of momentum. Relevance tied to commodity demand and risk sentiment.

Wednesday, 17 April – US Retail Sales (Mar):

- Anticipated rebound driven by autos and durables. Will offer insight into consumer resilience amid tariff and inflation headwinds. Strong print could reinforce expectations of economic strength.

Thursday, 18 April – Australian Jobs Report (Mar):

- Rebound expected after February’s anomaly. Markets will focus on participation and unemployment trends. A soft print may raise expectations of near-term easing.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 15th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 8th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post