10 Nov, 25

Weekly Crypto Market Wrap: 10th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- ASIC said it now considers stablecoins, wrapped tokens, tokenized securities, and crypto wallets as financial products and companies will need a license to offer these

- DBS and Goldman Sachs said they completed the first OTC crypto asset options trade between banks in a trade involving cash-settled BTC and ETH options.

- Tether reported it has generated over $10b in profits for the year through Q3

- Mastercard in late stage talks to acquire crypto and stablecoin infrastructure company Zerohash for between $1.5b and $2b

- Consensys is reportedly planning to go public and has engaged Goldman Sachs and JPMorgan to advise

Technicals & Macro

Markets

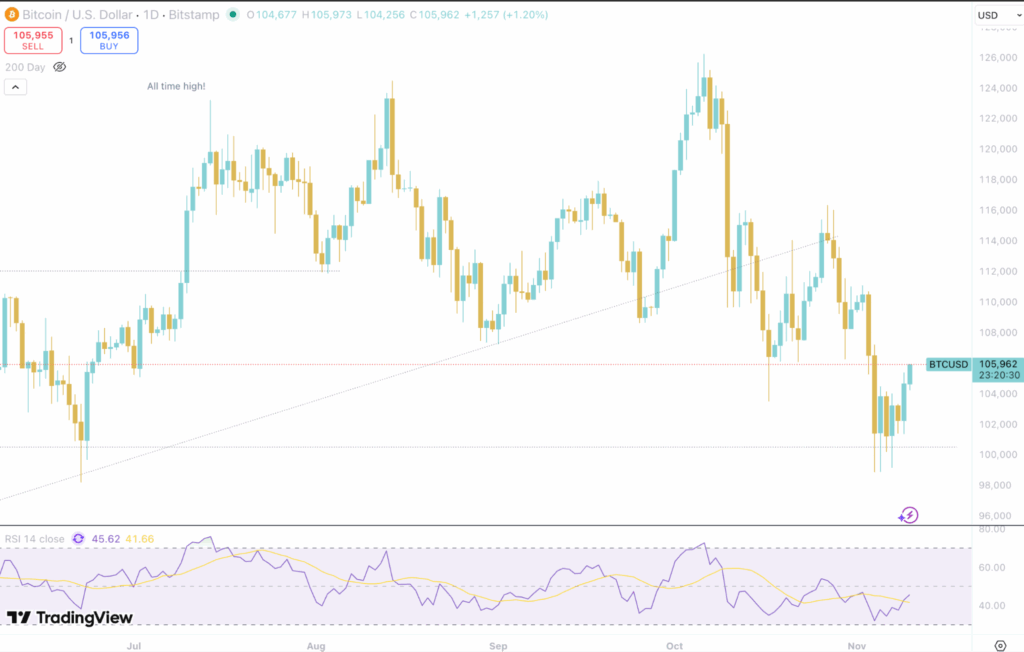

BTCUSD

It has been a wild ride the past few weeks. Aggressive sell-offs early in the week were driven by long-term holders and the continuing blow-off from the Oct 11 washout.

Today we are finally starting to see some short-term direction with improving macro conditions, a concluding government shutdown, and a helpful stimmy check from the Trump camp which is finding its way into altcoin flows. Some media are calling for an impending altcoin run – I’m not so sure.

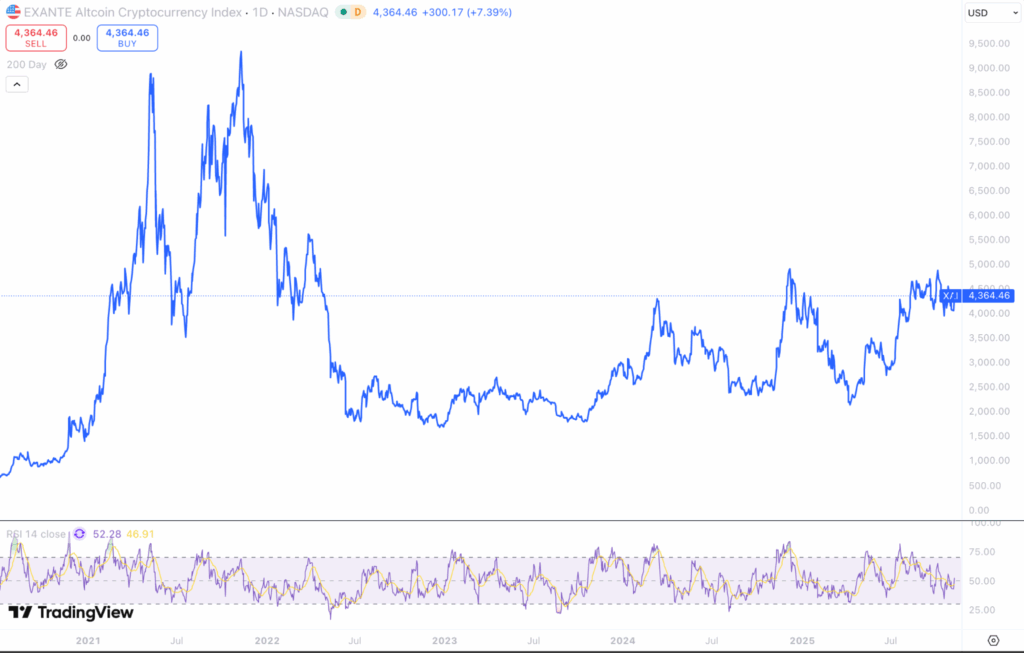

Exante Altcoin Index

Altcoins have moved – but historically, not close to where we were in 2021. Furthermore, AI has come off hard over the past week, and long-tail risk is still, well, risky.

Even so, Friday saw Trump responding to reporter concerns of an AI bubble with “No, I love AI”, “We’re leading China, we’re leading the world!” What could possibly go wrong when the President is behind it? Open AI is looking at a US $1T, yes that’s Trillion, IPO mid-2026. Insiders are saying that losses are mounting internally, but one has to give them the benefit of the doubt. The sheer penetration and network effect of Chat GPT has been astounding. And the lesson from the dot-com bubble was that many disappear, but the survivors become a part of everybody’s world.

Macro implications

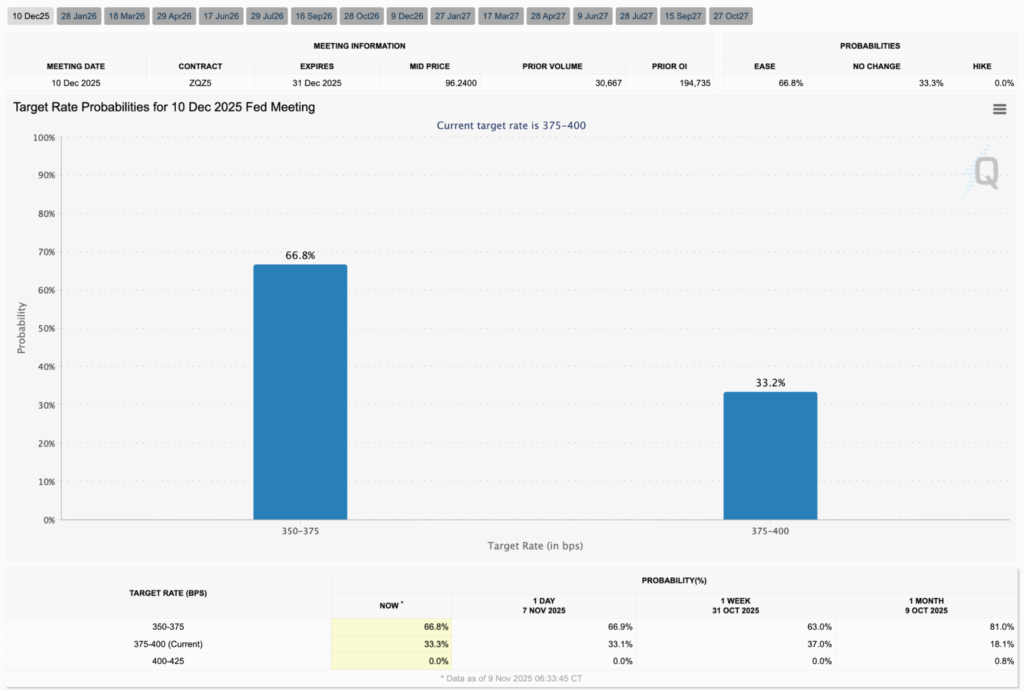

Source: FedWatch (CME)

Liquidity conditions in the short to medium-term however still point toward a further run of the debasement trade. FedWatch is now pricing in a 67% chance of a cut at the December meeting. Every time this meeting looked uncertain, the market had some kind of sell-off. Wall Street has a habit of sending non-verbal messages to the Fed, and this appears to be one.

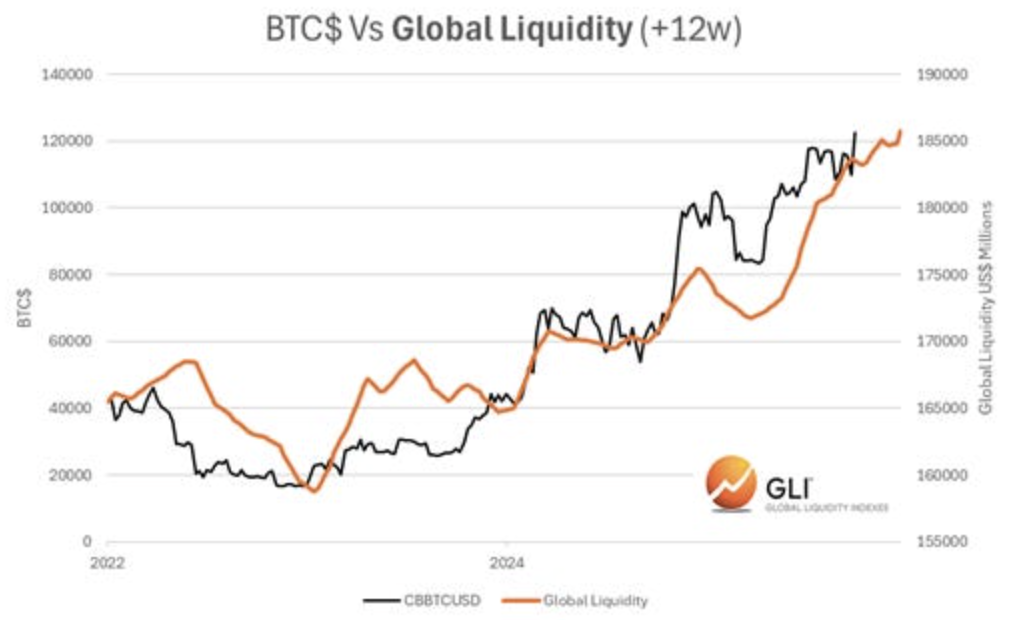

Source: Michael Howell, Capital Wars

Michael Howell from Capital Wars agrees – the above chart was taken just before the Oct 11 dump. Liquidity conditions have been easing, and are a few rate cuts away from increasing the rate of change further. That would indicate that we are below the mean (fair) value in BTCUSD, although it’s tough to know whether we get spillover in any AI risk across the cryptoverse.

All in all, the longer-term structural elements are positioned well, and even though the 4-year BTC cycle is in question – the scarcity factor is not.

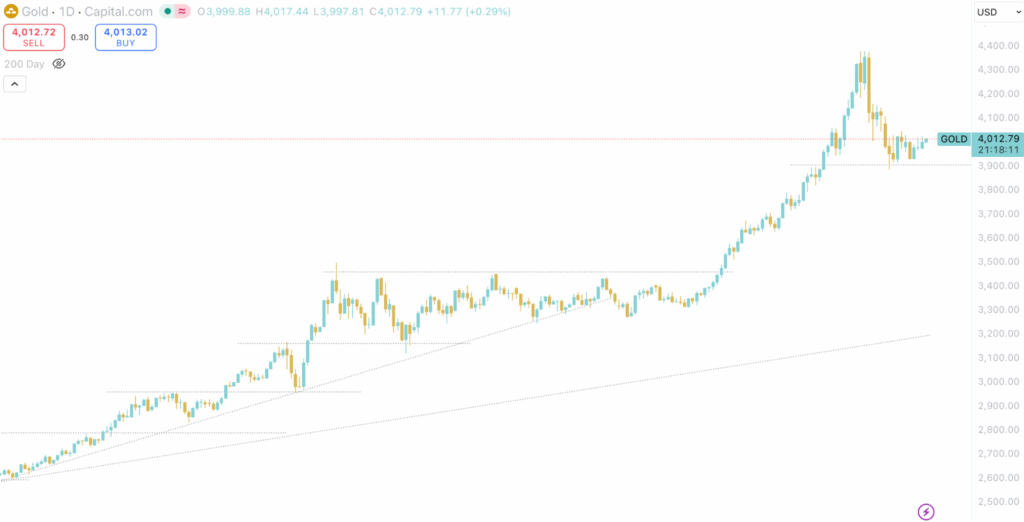

Gold

Gold for this reason should also maintain some buoyancy, even if risk assets move into positive regions.

ETHUSD

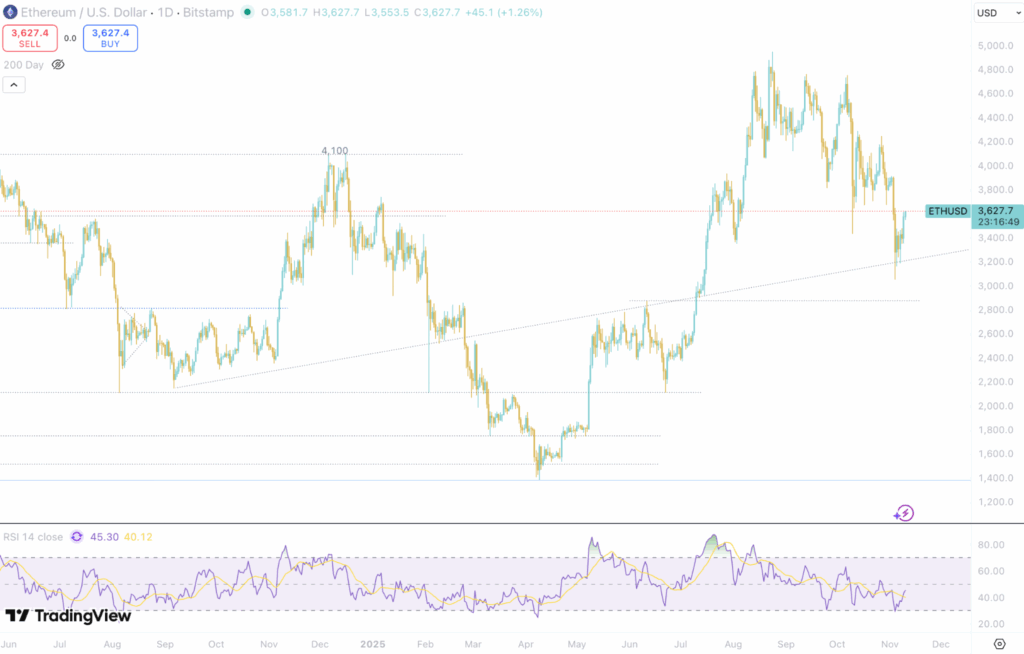

And Ethereum – well, what a run-up to the Oct 11 sell-off. We still see a wall of institutional interest in Ethereum. Yes, Solana is faster, and other chains outperform on various metrics, but remember – the institutions take risk on the safest bets.

I’ll leave you with that – stay safe out there!

Jon de Wet

CIO

Spot Desk

Crypto spot markets experienced sharp risk-off capitulation last week, marked by aggressive long-term holder distribution. Bitcoin briefly fell below $100k for the first time since June, with long-dated wallets and miner stress accelerating sell pressure across majors. As mentioned in the prior section, Monday is proving resilient.

Stablecoin activity was balanced overall, though USDT/USD flow remained skewed towards selling as clients rotated into fiat during heightened volatility. USDC activity softened this week, reflecting lighter institutional engagement, while AUDD flows were consistent with prior weeks.

BTC trading remained two-way but with a buy-side tilt, as clients stepped in selectively through the dip. ETH saw a similar tone, with more buyers than sellers positioning into weakness. SOL interest was subdued, with limited participation versus the majors.

Across alts, flows skewed defensive. NEAR, XRP, PEAQ and VIRTUAL attracted selective interest, while selling pressure emerged in S, WLFI, XPL, ASTER, ADA and HBAR, reflecting caution and capital rotation following the drawdown.

FX desk activity continued to centre on USD and AUD, with CAD, NZD and EUR flows steady. The RBA held rates at 3.6%, in line with expectations, keeping borrowing costs at their lowest since April 2023. AUD continued to soften against USD, trading below 0.65, as risk sentiment weakened and USD funding demand remained firm. Friday’s US CPI remains in focus as a potential volatility driver.

The OTC desk continues to provide institutional liquidity across majors, stablecoins and fiat pairs, with T+0 settlement ensuring efficient execution and repositioning throughout heightened market volatility.

Reshad Nahimzada, OTC Trader

Derivatives Desk

WHOLESALE INVESTORS ONLY*

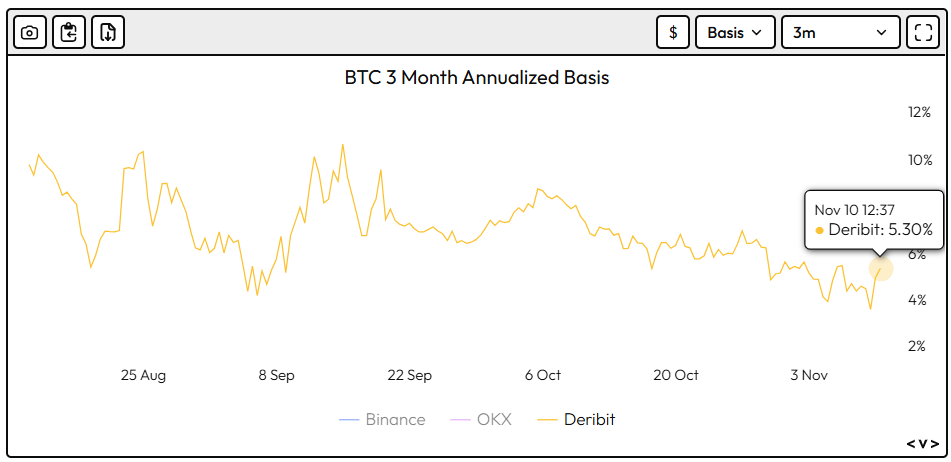

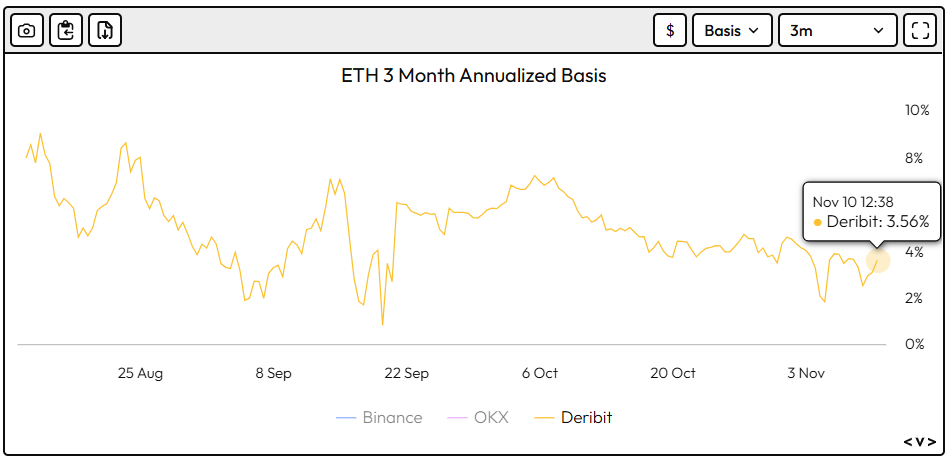

BTC and ETH basis rates have rebounded since the weekend on the back of Trump’s $2k tariff stimulus proposal, despite still being historically low. BTC’s basis rate is currently at 5.3% (annualised) while ETH’s sits at 3.56%.

Source: Velodata

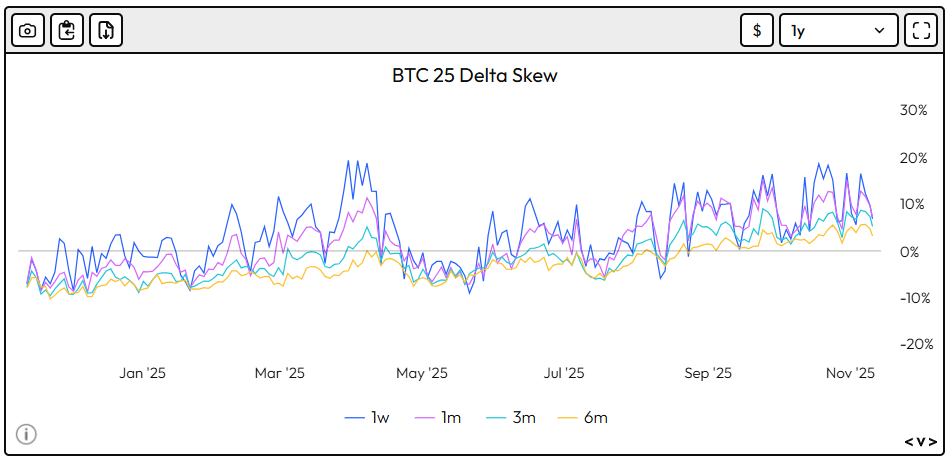

As investors look for downside protection, there has been a persistent bid of puts over calls over the last year, which can be seen in the options skew (puts over calls):

Source: Velodata

This Week’s Trade Idea – BTC Yield Entry Note

The desk continues to see value in Yield Entry Notes — a structured product that takes advantage of elevated put premiums in the current options market. With skew heavily favouring puts and basis rates remaining relatively low, this is an opportune time to generate attractive yields while maintaining a clear path to BTC accumulation at discounted levels.

Zerocap can offer this structured on BTC:

- Underlying: BTC

- Strike Price: 95,000

- Tenor: 2 months

- Indicative Yield: 2.5% (~15% annualised)

- Settlement: Cash or BTC (depending on expiry level)

Possible Outcomes at Expiry:

- BTC > 95,000: The investment is repaid in cash plus a 2.5% yield (paid in cash).

- BTC < 95,000: The investment is converted into BTC at 95,000, and the 2.5% yield is paid in BTC.

Why the Structure Makes Sense Now

- Favourable Skew: Put premiums remain elevated relative to calls, allowing investors to capture enhanced yields when selling downside risk.

- Attractive Entry Level: With BTC consolidating after recent highs, a 95k strike provides a discounted potential entry point for long-term holders.

- Low Basis Rates: Current funding and basis levels make premiums on put selling more attractive relative to calls.

- Yield Enhancement: The 2.5% two-month yield (~15% annualised) offers strong short-term return potential with defined outcomes.

Risk Considerations

- Downside Risk: If BTC falls below 95k at expiry, investors will take BTC exposure at that level, effectively buying into a market decline.

- Limited Upside: Returns are capped at the fixed yield — investors do not benefit from further BTC appreciation above the strike.

- Volatility and Macro Factors: Unexpected macro shifts, regulatory changes, or large market moves could impact both BTC price and volatility levels.

Summary

Yield Entry Notes provide yield-enhancing ways to take advantage of elevated put pricing while positioning for potential BTC accumulation at favourable levels. For investors comfortable owning BTC below 95k, this structure offers an attractive blend of income and strategic market entry.

Reach out to the derivs desk for live pricing and custom strike/yield combinations.

What to Watch

TUE: Westpac Consumer Confidence Change, NAB Business Confidence, Unemployment Rate (GB)

THU: Unemployment Rate (AU), GDP Growth Rate QoQ, YoY, MoM (GB)

FRI: Industrial Production YoY (CN), Retail Sales YoY (CN), CPI (US), Inflation Rate (US), Core Inflation Rate (US)

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 19 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 12 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post