10 Feb, 25

Weekly Crypto Market Wrap: 10th February 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- Bitcoin dominance (BTC.D) has reached a new cycle high of 61.6%, the highest level since March 2021, following a recent spike in altcoin liquidations.

- Blackrock plans on listing a bitcoin exchange traded product (ETP) in Europe with marketing to begin as soon as this month.

- Trump Media and Technology Group plans to launch three ETFs under the Truth.Fi brand, including one tracking Bitcoin, later this year.

- MicroStrategy, rebranded as “Strategy,” reaffirmed its Bitcoin commitment, holding 471,107 BTC, unveiling a “21-21 plan” to raise $42B by 2027.

- Crypto.com plans to file for a Cronos (CRO) ETF in Q4 2025, part of its push to institutionalize digital assets. The exchange will expand into stocks, options, and ETFs by Q1 2025 and launch a stablecoin by Q3.

- Bitcoin’s hash rate hit 852 EH/s, a new record, with mining difficulty expected to rise 6.38%. 19 pools control 97.7% of the network.

Technicals & Macro

BTCUSD

Key levels

66,000 / 72,000 / 92,000 / ~110,000 (just north of the all-time high)

A week of compressing prices alongside geo and macro uncertainty.

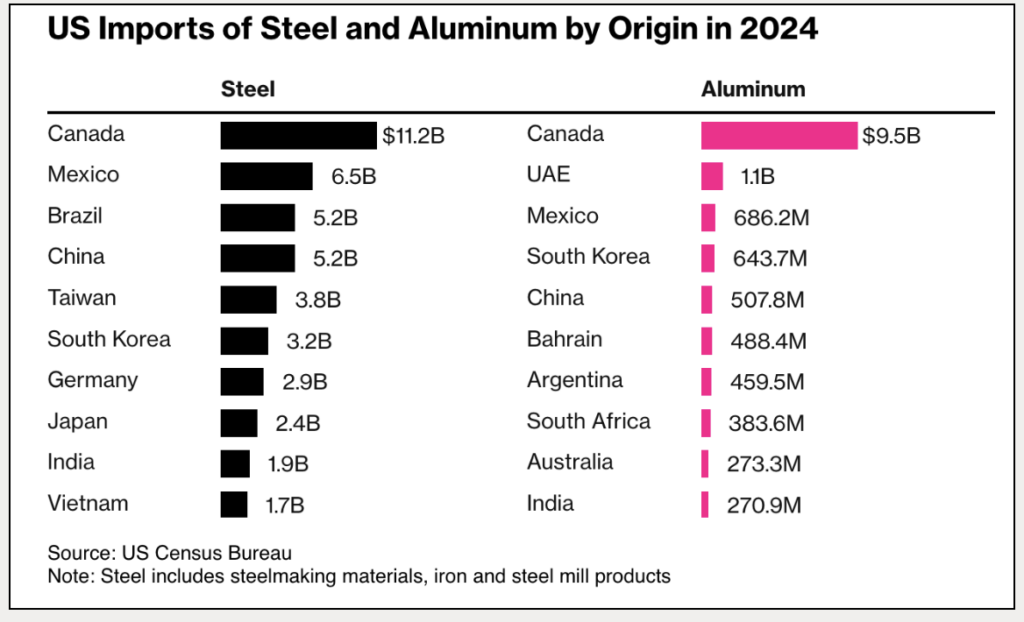

BTC continued its post-ATH consolidation within the 92,000 to 110,000 range,, and even though we are seeing compression in pricing now, earlier in the week was volatile with swings between 92,000 to above 100,000. Strong buy walls have formed around 92,000, with deeper support near 87,000 if selling pressure continues. Tariffs continue to weigh on the broader market – and it’s not necessarily the tariffs themselves as opposed to the geopolitical and macroeconomic uncertainty they create. Just today Trump announced that imported steel and aluminium to the US would be hit with a 25% tariff. Implicit in tariffs are implications for global growth and stability, and the first 100-days of presidency are becoming less clear.

On-chain data is showing that Bitcoin exchange reserves have continued to decline, reaching approximately 2.4 million BTC as of February 6, 2025 – showing that long-term holders are increasingly shifting to self custody. Further to this, real money buyers are still sweeping up at key levels – with moves from U.S. foundations and university endowments (notably the University of Austin, Emory University, and the Rockefeller Foundation). This trend is expected to increase, driven by Trump’s goal to position the U.S. as a “bitcoin superpower”. Of course leading the mix in real money buys is Strategy Inc., formerly known as MicroStrategy, who raised an additional $584 million through preferred stock sales to further its $42 billion cryptocurrency acquisition plan. The company now holds a record 218,887 bitcoins.

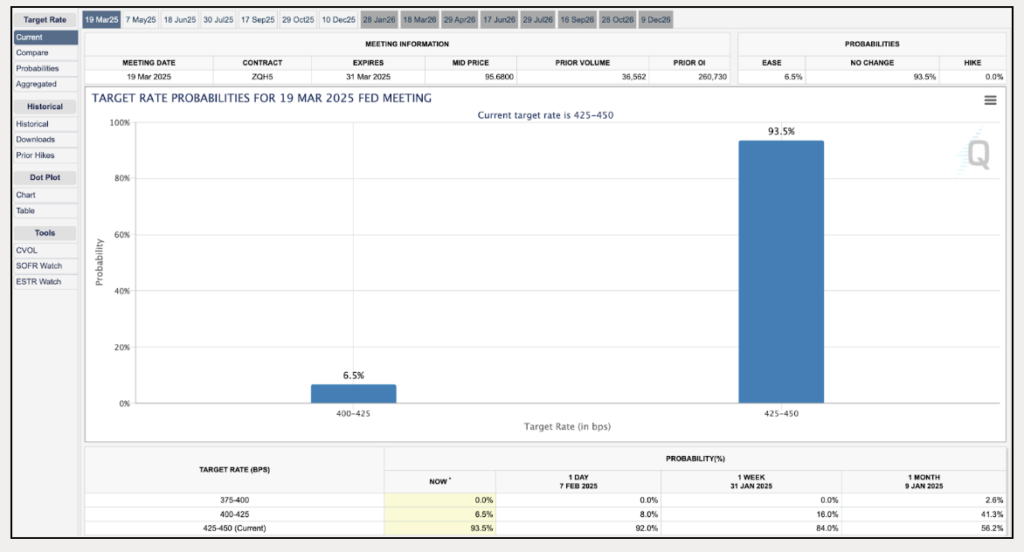

Upcoming U.S. CPI data could inject further volatility – March is looking like another hold from the Fed, and the market will be watching data closely for price drivers. This said, current sentiment is hanging on the Trump effect – if he sneezes, the markets could get a cold so watch the leverage over this period!

Dollar index heading skyward

The greenback is holding above its multi-year range. A little bit of everything here – interest rate expectations, flight to safety, and the potential to bring in a manufacturing growth mecca locally to the US (although the market seems dubious on global growth implications).

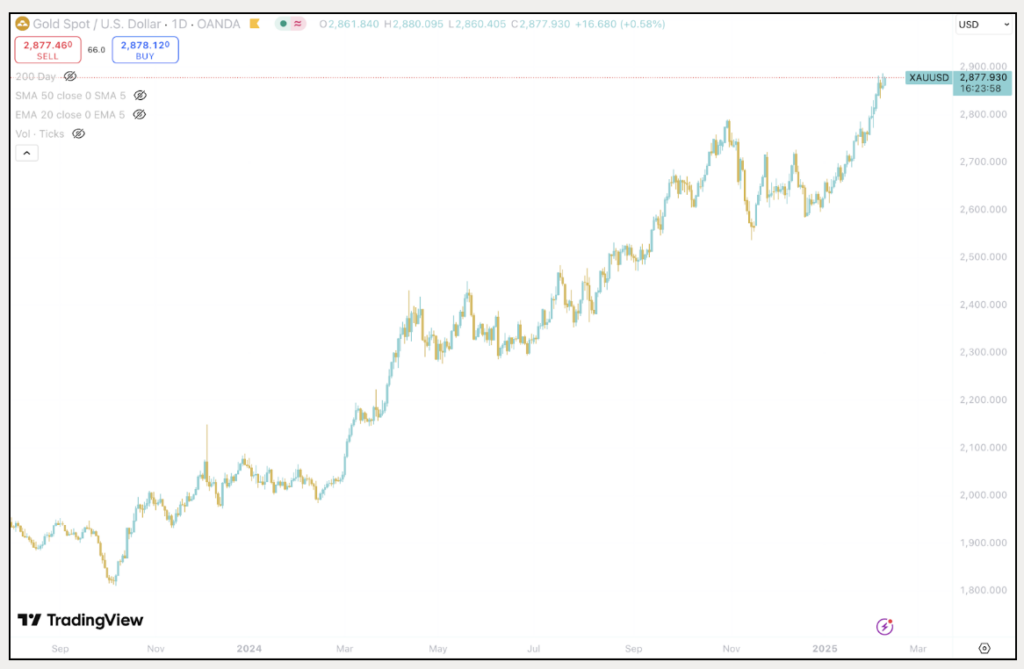

Right now we are seeing sell madly during Asia, and ask questions later. Gold is rallying on safe haven/scarcity bidding, but given bitcoin’s run, the relative value trade in market capitalisation is still a rational bet if you believe that BTC will take on more of the properties of gold over time. With real money corporate, sovereign and mutual fund buyers – the hedge narrative is increasing, and the media’s portrayal of BTC’s likeness to gold is getting stronger. A leveraged version of gold? Either way – dynamics are very important as the institutional crypto adoption increases.

Gold poking above highs (again)

Given comments on DXY, gold is a natural benefactor. We think it goes higher, although not without some two-sided volatility on the back of risk sentiment swings.

ETHUSD

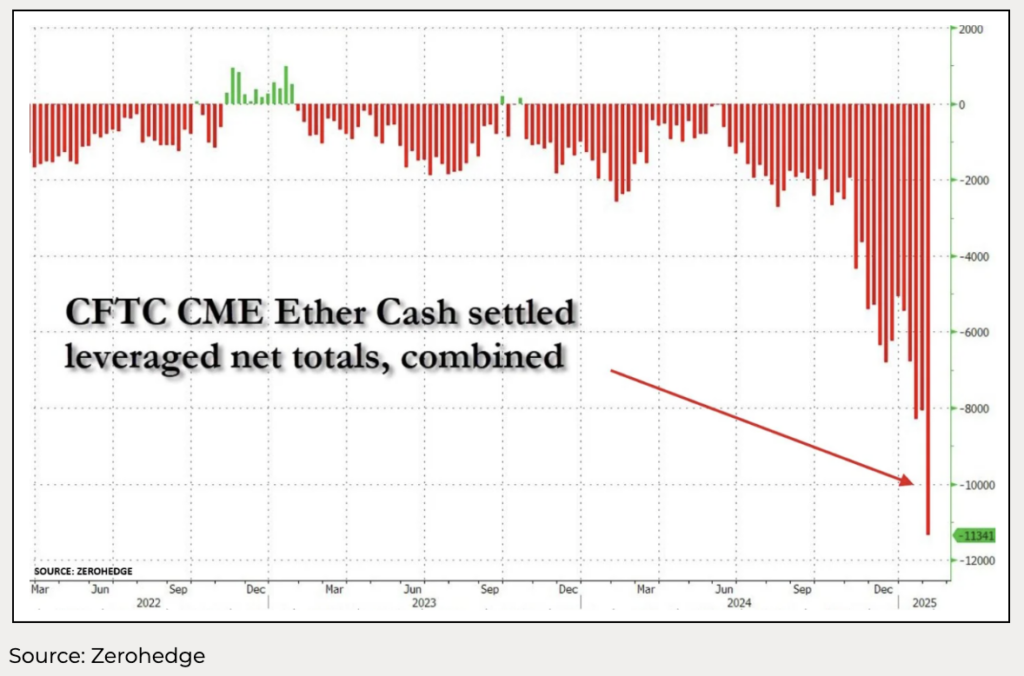

Over 31% of circulating ETH is now locked in staking contracts, reducing available supply, although this is not helping ETH’s decline. Its circulating supply has recently risen past pre-Merge levels. Notable orderflow drivers are putting a ceiling on rallies – ETH short positions have increased by 500% since November 2024, reaching new highs. Notably, short positions on the CME have increased drastically, adding to leverage.

If I was a betting man, I’d be looking for a wild reversion at some point. Timing is the tough one here – but positive risk sentiment could be the trigger to short-covering.

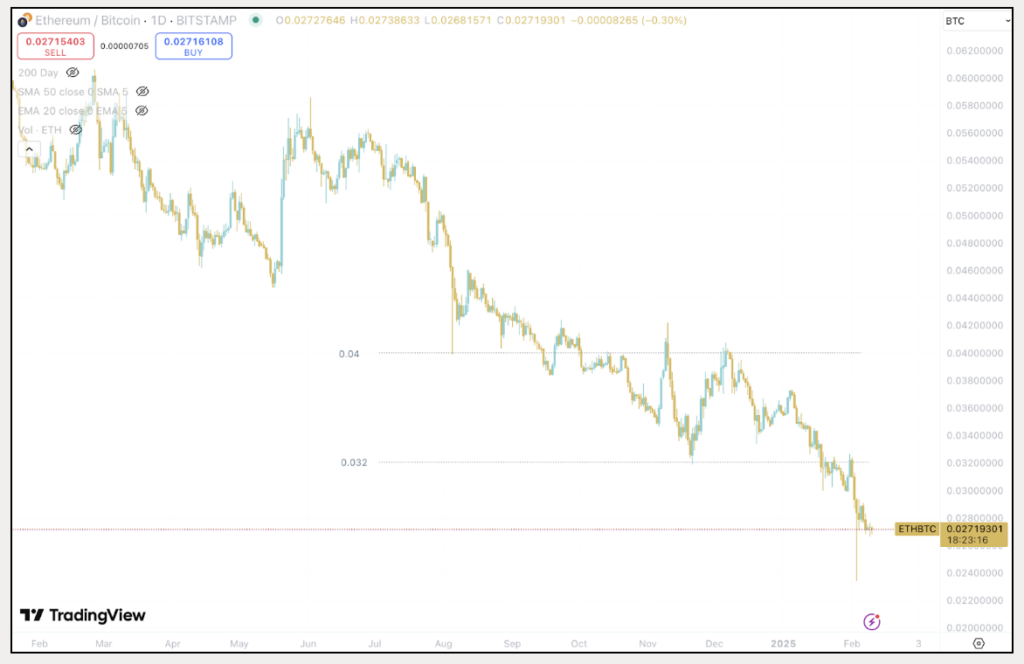

ETHBTC

And of course, ETHBTC continues to bleed.

Safe trading out there!

Jon de Wet, CIO

Spot Desk

The Australian Dollar (AUD) tumbled to a low of 0.6087 against the US Dollar (USD) as USD strengthened following Donald Trump’s announcement of new tariffs on Mexico and Canada. Meanwhile, USDT maintained its stability, trading mostly at parity. Looking ahead, several key economic events are set to drive market sentiment, including US inflation data, US Producer Price Index (PPI) month-over-month, and US Retail Sales month-over-month figures—all of which could have significant implications for the AUD’s trajectory.

Market activity was relatively subdued this week as the Chinese New Year holiday led to a slowdown in trading across Asian markets. Despite the quieter market conditions, we observed a mix of both off-ramping and on-ramping activity. Notably, on-ramping demand has increased, with clients likely looking to capitalise on recent market movements and position themselves ahead of key economic events in the coming weeks.

The crypto market remained highly volatile, with Bitcoin (BTC) leading the price swings. BTC dropped to a low of $91,695.8 on Monday, triggering a broad market sell-off. However, the dip was quickly absorbed, with BTC surging to $101,692.9 the following day before falling back below $100K, where it has since consolidated. This trend was reflected on the spot desk, as clients took advantage of the price drop, driving strong buying interest in BTC, ETH, and SOL. Altcoin and memecoin activity declined significantly, with investors appearing more risk-averse amid heightened market uncertainty.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions, offering competitive pricing across major coins, altcoins, and memecoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Reshad Nahimzada, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY*

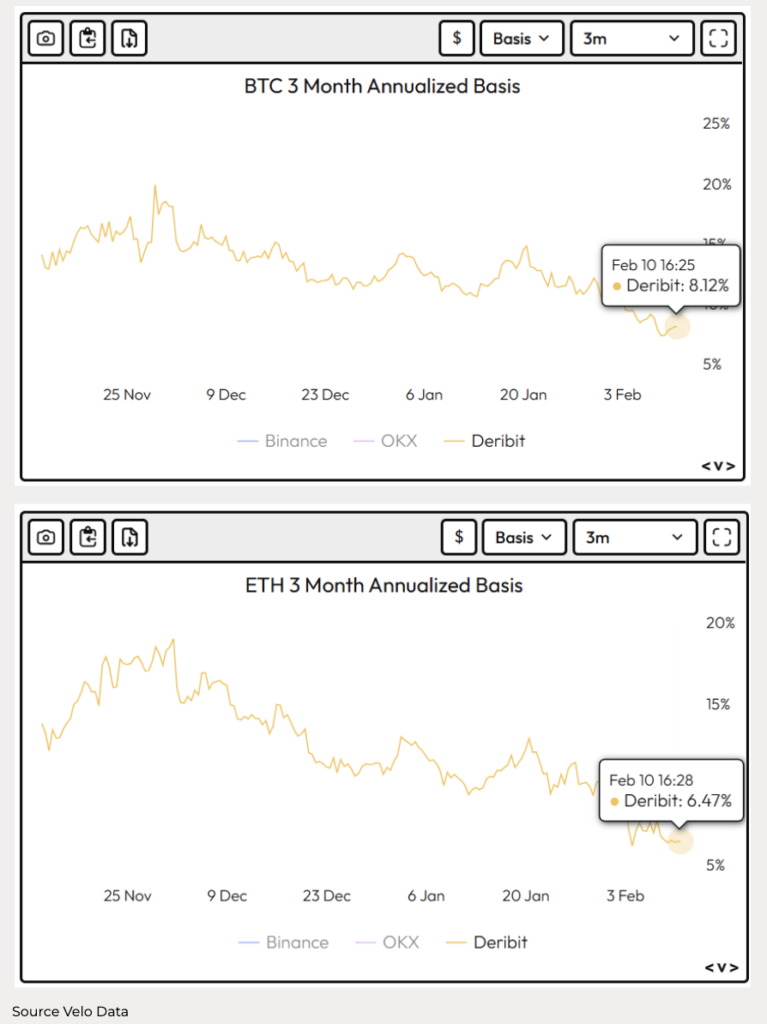

Basis Rates on BTC and ETH continue to move lower:

90-day annualised Basis Rates on BTC and ETH are both down >110 bps on the week – 8.12% (BTC) and 6.47% (ET

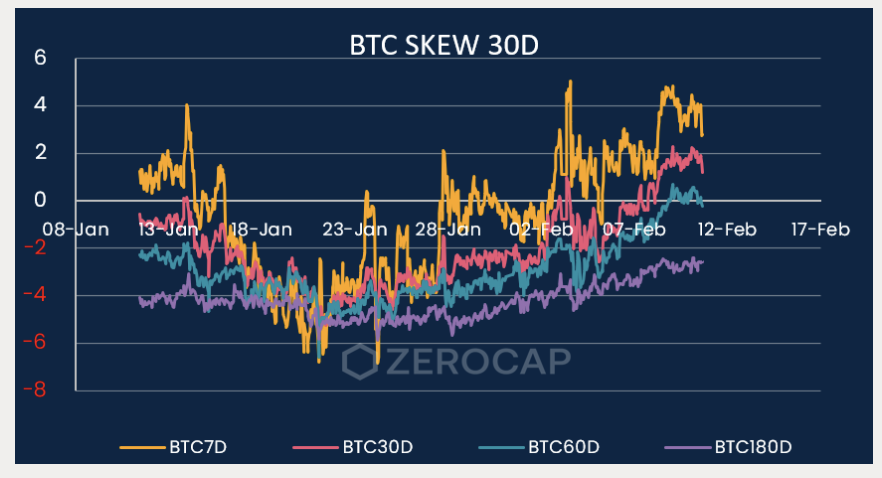

Over the week, 30-day skew on BTC puts has moved towards puts – making them more expensive than calls at the moment (see chart below):

Given the skew towards puts and the fact that basis rates are at yearly lows, we see value in Yield Entry Notes at the moment – a way to take advantage of the heightened put prices. We like BTC Yield Entry Notes with strike prices below 90k.

Yield Entry Note sample terms:

For a 1-month BTC Yield Entry Note with 90k Strike Price one can generate 2% Yield (~24% annualised). There are two possible outcomes at expiry:

BTC expires above 90k: investment paid back in cash + earns 2% yield (paid in cash).

BTC expires below 90k: investment used to buy BTC at 90k + earns 2% yield (paid in BTC).

What to Watch

- NZ Inflation Forecasts (Thursday): The RBNZ’s quarterly inflation expectations will be closely watched, especially given the NZD’s recent depreciation. This could impact monetary policy and trade with Australia.

- US-China Tariffs: China’s new tariffs on US coal, LNG, and industrial goods could disrupt global supply chains. Australia, as a key exporter of these commodities, may see increased demand or price volatility.

- Fed Chair Powell Testimonies (Tuesday/Wednesday): Powell’s comments on inflation and future rate cuts could influence global markets, including Australia’s bond yields and AUD performance.

- US CPI (Wednesday): A strong US inflation reading could delay Fed rate cuts, strengthening the USD and putting downward pressure on the AUD.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post