Content

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What significant DeFi trade did JPMorgan execute in partnership with the Monetary Authority of Singapore’s (MAS) Project Guardian?

- What is the significance of Meta's integration with the blockchain-storage platform Arweave (AR)?

- What are the implications of the EU’s MiCA bill section for crypto influencers?

- What recent developments have occurred in the Ethereum blockchain?

- What recent developments have occurred in the Solana blockchain?

8 Nov, 22

Weekly Crypto Market Wrap, 7th November 2022

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What significant DeFi trade did JPMorgan execute in partnership with the Monetary Authority of Singapore’s (MAS) Project Guardian?

- What is the significance of Meta's integration with the blockchain-storage platform Arweave (AR)?

- What are the implications of the EU’s MiCA bill section for crypto influencers?

- What recent developments have occurred in the Ethereum blockchain?

- What recent developments have occurred in the Solana blockchain?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- JPMorgan executes its first on-chain DeFi trade, uses Polygon’s public blockchain.

- Following NFT displaying, Meta currently testing NFT minting and trading on Instagram – announces integration with blockchain-storage platform Arweave (AR).

- EU’s MiCA bill section warns crypto influencers: social media crypto comments without legal disclosure and profiting from such “will be considered market manipulation.”

- 38% of US voters to consider candidates’ crypto opinions in midterms; Grayscale survey.

- A week after Twitter takeover, Elon Musk begins firing employees – several file lawsuits.

- Solana (SOL) unveils Google partnership, their Saga smartphones, open-sourced Web3 stores and more at “Solana Breakpoint” yearly conference.

- Singapore-based bank DBS uses DeFi to trade FX and state securities.

- Bank of International Settlements (BIS) will test DeFi implementation for CBDCs/FX.

- NY’s FED offers first results of wholesale CBDC trial; FX spot settlement in 10 seconds.

- MakerDAO co-founder passes away in Puerto Rico at 29 years old.

- Bank of England raises interest rates to 3%, largest hike in 33 years – warns of longest recession since the 1930s.

- Despite market optimism, FED hikes rates to another 75 bps – Chair Jerome Powell states Reserve won’t be pausing hikes, as US JOLTS Job Openings rise.

Winners & Losers

Macro Environment

- Mixed market sentiment continued to divide markets last week. Traders who were looking for a slight relief in the pace of Federal Reserve (FED) rate hikes were disappointed on Wednesday, which saw the United States (US) FED raise the target funds rate by 75 basis points (bps) – marking the 4th consecutive 75 bps rate hike this year. The Bank of England (BOE) joined the US FED in raising rates by 75 bps on Thursday – marking the single largest rate hike since 1989. The S&P 500 was down over -2.4% on Wednesday’s close along with the NASDAQ 100 similarly down almost -3.5%, 10 Year US Treasury yields higher at 4.096%. The FED Open Market committee’s statement released post-hike, reiterated its ultimate goal of full employment, and commitment to a 2% rate of inflation. The statement however left some wiggle room on future hikes, positing softer-slightly dovish language. The FED further announced that the effects of “cumulative tightening,” and monetary policy time lags on economic activity and inflation will now be weighed into future rate increases. Upcoming US midterm elections, and positive market sentiment have seen futures pricing in a 50 bps rate hike in December’s FOMC meeting.

- Tuesday saw the Reserve Bank of Australia raise the cash rate by 25 bps to 2.85% – a nine-year high for borrowing costs in Australia. Analysts were divided on the increase, some calling for a larger increase to tame inflation, having surged to 7.3% in Q3 2022 – a level not seen since Q2 1990. Phillip Lowe’s statement released after the meeting justified the hike, the RBA now with the view that inflation will “peak at around 8% later this year,” and then decline next year. The likely move is attributed to improving “global supply-side problems, recent declines in some commodity prices and slower growth in demand.” Lowe touched upon the stronger labour market, and corresponding wage growth – rising +2.6% in June YoY. The RBA continues to monitor movements in wages, and firm price-setting behaviour in order to prevent a potential wage-price spiral.

- Stronger than expected US Non-Farm Payroll numbers were released on Friday, seeing 261,000 new jobs created in October vs the predicted 200,000. Despite surprising to the upside, the print signalled a slowing labour market when viewed in conjunction with October’s unemployment numbers – rising +0.2% to 3.7%, also above market expectations of 3.6%. The dollar was sold off as a result, with the DXY falling from its weekly high of 113.148 on Thursday to 110.729 on Friday. Treasuries finished the week strong, 2 years up at 4.66%, along with 10 years at 4.16% – the 2&10 Year yield curve inversion sitting at 50 bps. The Euro looked to be closing in on parity once again up at $0.99578 on Friday, the pound was steady at $1.137 and AUD stronger at $0.647.

Technicals & Order Flow

Bitcoin

- Early last week, Bitcoin faced some sideways action centred around the 20,450 level. In the face of mid-week selling, the 20,000 support was firmly protected affirming its strength as short-term support. Later, an influx of positive momentum pushed prices above 21,000, an important psychological level for traders. However, over the weekend Bitcoin’s positive action tapered and the price reverted lower, closing at 1.34% WoW.

- Price edged lower in the opening parts of the week as traders de-risked into the Fed’s November Rate Hike. Initially, participants responded positively to the 75bp hike which met expectations. However, following hawkish undertones from Fed Chair Powell’s comments, markets were quick to revert lower.

- Sentiment was bolstered later in the week following NFP data out of the U.S. which came in higher than expected. As investors reconsidered overall market strength even in the face of continued hikes, equities rallied and Bitcoin followed.

- Historically, Bitcoin has been notorious for its volatility profile. Interestingly, for the first time in its history Bitcoin’s 30d rolling volatility is less than both the S&P 500 and Nasdaq. Despite ongoing wider macro uncertainty, Bitcoin has exhibited relatively impressive resilience and has consolidated within a tight range.

- Bitcoin’s Seller Exhaustion Constant is a metric defined as the product of percentage supply in profit and 30-day price volatility. Often used as a cyclical measure, the metric associates low volatility and high losses with broader capitulation. Moreover, this metric is in a region that has historically acted as a predecessor for growth.

- Since the start of October, Bitcoin’s 25d skew has edged lower. This behaviour is consistent with decreasing demand for puts relative to calls. Notably, in preparation for last week’s Fed rate hike, traders bid up downside protection in the anticipation of heightened volatility. Similarly, following Friday’s NFP data, Bitcoin’s 25d skew increased.

- Last week, Bitcoin’s action corresponded to economic data out of the U.S. As the hawkish monetary stance persists, broader asset markets continue to suffer. Ongoing ambiguity has caused volatility in equities to increase. Contrastingly, Bitcoin’s continued consolidation at current levels has seen its volatility decrease to levels comparable with indexes such as the S&P 500. While on-chain metrics continue to point toward cyclical bottoms, some traders are still accounting for downside moves. Participants now look to this coming week’s inflation data out of the U.S. as a key determinant of short-term action.

Ethereum

- Ethereum had a slow start last week after failing to hold the 1,600 level the weekend prior. With a host of economic data releases scheduled for the week, many market participants remained sidelined due to concerns over heightened volatility. By Wednesday evening, price had grinded lower ahead of the FOMC’s decision to raise their target funds rate by another 75 bps. While price rallied off the back of this release, Jerome Powell’s press conference following the event reiterated the Fed’s commitment to tightening which resulted in a full retrace into further selling. In the hours following the event, price found a bottom and proceeded to rally 11.69% by Friday. Following this, the majority of the weekend had relatively subdued price action before price rolled over into Sunday close. WoW ETH returned -1.41%.

ETHBTC Daily Chart

- Overall ETH/BTC had a challenging week at the 0.077 resistance level. Despite multiple breakout attempts, the pair was unable to make any meaningful progress. It is likely that due to the economic calendar heavy week, crypto asset correlation remained elevated as players de-risked across the board. As a result, ETH/BTC consolidated. Should the 0.077 level remain resistance, a return to 0.073 is not off the cards, particularly because this key breakout level is yet to be retested as support. Conversely, a break above could mean a retest of 0.082, levels not seen since the ETH merge.

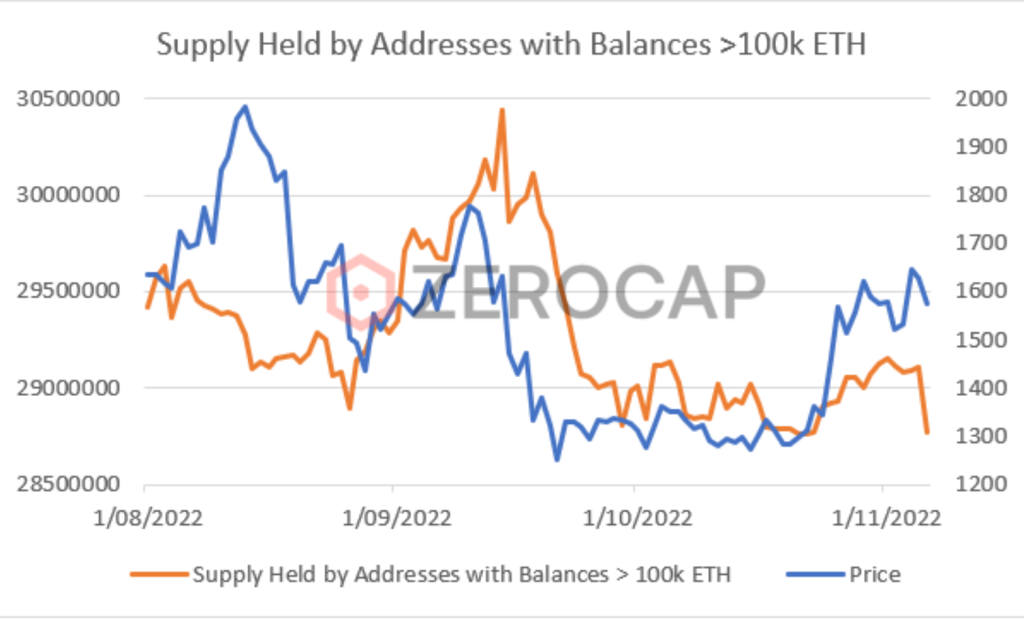

- As was the case last week with smaller wallets, we are now seeing aggressive ETH distribution from the network’s largest holders to those with smaller balances. While selling into rallies is common amongst whales, the gradient of the move is the concerning piece. It is likely that a portion of this sell pressure is a result of merge narrative bag holders exiting previously underwater positions. It is also important to note that all wallet classes below the 100k bracket have seen increases in accumulation, absorbing most of the aforementioned sell pressure.

- Vitalik Buterin, co-founder of Ethereum, released a new iteration of the blockchain’s roadmap. The most significant change in this iteration of Ethereum’s roadmap was the increase of a novel stage, named The Scourge. The Scourge concentrates on making Ethereum censorship-resistant and resolving issues relating to Maximal Extractable Value (MEV) that currently plague the blockchain. Furthermore, a number of aesthetic changes were made along with the addition of more concrete milestones for each stage.

- Buterin also proposed a tentative roadmap relating to the growth and adoption of rollups. This plan details how rollups and layer 2s will lose their training wheels, becoming decentralised with respect to their sequencers and compression of transactions. The community has positively responded to Vitalik’s proposed milestones, yet are involving themselves in determining future iterations of the roadmap.

DeFi

- Global financial giant, JP Morgan, completed its first DeFi transaction on a public blockchain in partnership with the Monetary Authority of Singapore’s (MAS) Project Guardian. The DeFi trade was executed on the Polygon blockchain using a modified Aave smart contract. As well as JP Morgan, Singapore’s largest bank, DBS, and SBI Digital Holdings took part in the pilot project. Subsequent to this proof of concept, the relevant parties will be focusing on enabling conglomerates to tokenise and trade real-world assets on public blockchains.

- Popular crypto derivatives exchange, Deribit, faced a hot wallet attack, resulting in hackers exploiting US$ 28 million in stolen funds. As a result, Deribit halted withdrawals whilst simultaneously emphasising on Twitter that stolen funds will be covered by the exchange’s reserves. This was the first time that Deribit experienced a DeFi-esque exploit, fundamentally highlighting that even centralised companies are vulnerable to wallet attacks.

Innovation

- Following Google Cloud’s endeavours to become an Ethereum validator, the subsidiary has partnered with Solana to validate its blockchain. In addition to this, Google Cloud will be adding Solana validators to its offerings through its Blockchain Node Engine and BigQuery services. Accordingly, Google Cloud will entirely manage Solana-based nodes, reducing the time taken to run a validator and further making it more accessible. Following the news Solana’s native token, SOL, jumped 15% in price. However, it has since retraced around 13% in the following days.

- Matter Labs, the company behind zero-knowledge Ethereum virtual machine (zkEVM) protocol, zkSync, has launched the second iteration of its mainnet under the classification of “baby alpha”. The release of zkSync 2.0 marks the launch of an effective scalability layer 2 protocol that is highly compatible with the Ethereum mainnet. Furthermore, zkSync 2.0 is the first zkEVM to be publicly launched – likely to be followed by Polygon Hermez’ protocol that is soon to be released. According to Matter Labs, once this phase has been completed and documented, zkSync will reach its “fair alpha” stage – when developers will be able to port their Ethereum-based projects onto the zkEVM.

Altcoins

- During the past week, 20% of those validating the Solana network went offline due to their reliance on cloud providers. In late August, Hetzner, a German cloud hosting provider, announced that they would not allow their services to be used for validating blockchains. Consequently, the company kicked all users running any clients related to Solana off of its platform. Fundamentally, this foregrounds the centralisation risks relating to validators relying on dominant cloud providers.

- Circle, issuer of the USDC stablecoin, has announced that it will be launching its Euro Coin on the Solana blockchain in the first half of 2023. Despite launching in June, EUROC already has a circulating supply of just under 81 million, equating to US$ 80.3 million. Currently, the Euro stablecoin is only natively supported on the Ethereum blockchain, however, when Circle launches on Solana, holders of EUROC will be able to redeem their token for €1.

- As part of its foray into the web3 space, Meta is utilising the decentralised file storage blockchain, Arweave (AR), to permanently store digital collectibles from Instagram. As such, upon Instagram users minting and porting their NFTs onto the social media platform, the metadata and file will not be stored with Meta’s centralised servers, but instead on Arweave. Consequent to this announcement, Arweave’s AR token rose by over 70%. It has since seen a 21% decline in value.

NFTs & Metaverse

- Meta revealed that NFT creators on Instagram would be able to sell and create their own NFTs on the social media platform. However, despite the use of Polygon’s chain and NFT smart contracts, Instagram is using the words “digital assets” and “make” instead of NFTs and mint. As part of this process, Instagram is not taking a cut of sales, yet, given that sales will primarily be conducted through the App Store, users will need to pay the 30% fee charged by Apple. Furthermore, Meta will be increasing Instagram’s NFT-related offerings to support the Solana blockchain and Phantom wallet.

- In response to the royalty debate within the NFT industry, OpenSea has announced that it will be creating tools to assist NFT creators in enforcing on-chain royalties. The company is considering a wide range of solutions, however, is ultimately not open to removing creator royalties as has been done by Magic Eden and X2Y2. Initially, OpenSea is providing an enforcement system that allows Ethereum NFT creators to insert into their own smart contracts. This code leverages a blacklist that blocks the NFT contract from being traded on any zero-royalty marketplace.

- Over the last week, Art Gobblers, a collection created by Paradigm and Justin Roiland of Rick and Morty, launched, surging to a floor price of 15 ETH and bringing in over 40k ETH in trading volume. Despite this success, Art Gobblers also faced controversy around giving influencers places on the whitelist on the assumption that they would shill the collection, ergo increasing hype around the project. Art Gobblers is nonetheless unique given that certain individuals’ art can be “consumed” by one’s NFT, changing the Art Gobbler to include the new drawing. Currently, the floor price of the collection is sitting just above 6 ETH.

What to Watch

- US’ Midterm Congressional Elections, on Tuesday.

- US CPI report, on Thursday.

- UK’s GDP, on Friday.

Insights

Bitcoin History – What Led to the First Cryptocurrency: Innovation Analyst Nathan Lenga discusses the known history (and theories) of how Bitcoin came to fruition – from the reasoning behind a digital currency, Satoshi Nakamoto’s origins and the cryptographic influences on Bitcoin through the Cypherpunk Movement.

Disclaimer

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What significant DeFi trade did JPMorgan execute in partnership with the Monetary Authority of Singapore’s (MAS) Project Guardian?

JPMorgan executed its first DeFi trade on a public blockchain in partnership with the Monetary Authority of Singapore’s (MAS) Project Guardian. The DeFi trade was carried out on the Polygon blockchain using a modified Aave smart contract.

What is the significance of Meta’s integration with the blockchain-storage platform Arweave (AR)?

Meta is currently testing NFT minting and trading on Instagram and has announced its integration with the blockchain-storage platform Arweave (AR). This means that when Instagram users mint and port their NFTs onto the social media platform, the metadata and file will not be stored with Meta’s centralised servers, but instead on Arweave.

What are the implications of the EU’s MiCA bill section for crypto influencers?

The EU’s MiCA bill section warns crypto influencers that social media crypto comments without legal disclosure and profiting from such will be considered market manipulation. This could have significant implications for how influencers engage with their audience about cryptocurrencies.

What recent developments have occurred in the Ethereum blockchain?

Ethereum co-founder, Vitalik Buterin, released a new iteration of the blockchain’s roadmap. The most significant change in this iteration of Ethereum’s roadmap was the increase of a novel stage, named The Scourge. The Scourge focuses on making Ethereum censorship-resistant and resolving issues relating to Maximal Extractable Value (MEV) that currently plague the blockchain.

What recent developments have occurred in the Solana blockchain?

Solana has recently partnered with Google Cloud to validate its blockchain. In addition to this, Google Cloud will be adding Solana validators to its offerings through its Blockchain Node Engine and BigQuery services. This partnership will make running a Solana validator more accessible and efficient.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post