30 May, 22

Weekly Crypto Market Wrap, 30th May 2022

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- Fed’s FOMC Meeting: Minutes from meeting projects 50bps point hikes in June and July.

- US inflation rate slows to 6.3% signing that peak might be near – Personal consumption expenditures shows Americans keep spending momentum up despite reduction in buying power as observed via Core Price Index report.

- Stocks recover as Dow Jones and S&P 500 have best week since November 2020, Nasdaq bounced with a 6.84% run after hitting yearly lows.

- Fed Vice Chair Lael Brainard expects digital dollar to launch in five years, citing that the asset should co-exist with stablecoins.

- JPMorgan clients’ note states Bitcoin is currently undervalued by nearly 30%, now replacing real estate as the bank’s preferred alternative asset class – trials use of its own blockchain for collateral after-hours trading.

- One in ten eurozone households now own cryptocurrency; ECB survey.

- PayPal working hard to ”embrace everything we can” in crypto services, VP states.

- Terra 2.0 launches with new LUNA crypto – some exchanges show support for the new asset with airdrops for clients affected by the crash.

- Ethereum Name Service (ENS) reaches record high registrations.

- Andreessen Horowitz (a16z) closes new crypto Web3 fund at $4.5B.

- Essay by Ethereum co-founder Vitalik Buterin supports algorithmic stablecoins despite UST crash, but criticises exorbitant returns which makes projects “doomed to collapse.”

Winners & Losers

Macro Environment

- Six months since the start of the institutional migration from Risk Parity portfolios into the Crypto space, we are seeing reversal. Following the first US listing of a BTC Futures ETF, the allocation of portfolio flows on this side of the fence was obvious. It also took us to the short term peak of historical price levels. Six months on, the Terra/Luna collapse was the event that highlighted how important cryptocurrency as an asset class had become. Stocks and bonds reacted to the de-pegging of the UST stablecoin, and questions emerged on the vulnerability of the entire 1:1 backing of USD Tether. Following seven consecutive weekly declines on stocks and credit, we saw the first sign of dislocation between TradFi tech stocks and bonds, which saw substantial inflows against the defensive mood in cryptocurrencies. Financials and commodity shares climbed by 8% on average in the US, with the S&P 500 rallying by 6.6% for the week.

- In addition to restrictive sanctions against Russian oil and gas exports, US gasoline inventory is now at its lowest level since 2014. All signs are still supporting oil and gas prices to reach new highs, with BRENT prices rising by 6% for the week and US natural gas prices higher by 6.7% for the week.

- Yield curves worldwide are now pricing for a peak in inflationary expectations with the recession just around the corner—the environment where central bank over-tightening begins to crowd out private growth. Government bonds are still maintaining a bias for monetary policies to normalise in the front end of the curve. However, the back end from 5 years onward is now flattening out, with the expectation of easier monetary conditions. ECB this week announced they’d begin to normalise rates from the current minus 0.5% to zero or higher and the US is looking to hike by at least 100bps in the coming two months, while the APAC region will likely perform similar catchup, except for China, which is still in an easing climate given its COVID-19 lockdown.

Technicals & Order Flow

Bitcoin

- Bitcoin opened the week above the 30,000 level before gradually drifting lower. Price action coincided with a descending wedge drawn from May 10th and ground toward weekly lows below 29,500. Copious volume continues to be exchanged at around 29,500, adding to its significance as a key support level. Late week action favoured the bulls, breaking the descending wedge on higher prices. A break above this descending pattern in addition to growing downside support paints a positive picture for technicals, particularly on the back of the gap from the downside break of 35,000.

- Early in the week, the market-wide sentiment was dampened as investors awaited the release of the Fed’s FOMC minutes. Despite rate expectations being met, Bitcoin’s action continued to descend down toward the end of the week. This decoupled Bitcoin’s recent heightened correlation with equities, a positive sign despite the bearish pressure to Friday’s close.

- Within the digital asset space, often investors will de-risk into the weekend. However, JP Morgan’s articulation that Bitcoin is undervalued by 28% acted as a stimulus for the asset to edge higher into this week’s close.

- Broader market newsflow that has historically resulted in significant moves had relatively little impact this week, against the shift in Bitcoin’s correlation with equities this week. This change may be precedent to suggest that newsflow, specific to the digital asset space, will be the key driver of short term price action.

- Network value to transactions ratio is a metric that outlines whether Bitcoin’s value is reflected by its network’s activity. The metric currently resides at levels that imply that BTC is currently undervalued. Historically, this has coincided with significant price appreciation.

- The short-term holder profit and loss metric is useful in identifying cyclical bottoms. Recently, this metric dropped to its lowest levels since March 2020. Moreover, this metric may suggest price appreciation in the short term.

- Despite some on-chain indicators pointing toward a cyclical bottom, derivative traders are seemingly favouring downside protection in the short term. Contrastingly, looking out to the 30 December 2022 options expiry, there is notable growth in open interest at 70k, 80k and 100k strikes for calls. Among derivative traders, there is a clear juxtaposition between short and long-term price expectations.

- This week, the overarching bearish sentiment was driven by uncertainty and unease. While affirmation from JP Morgan acted to somewhat bolster sentiment, Bitcoin closed -2.7% WoW. Contrastingly, on-chain continues to paint a bullish picture. We’re seeing additional on-chain metrics suggesting that we’re close to or at the bottom of the cycle. However, it is important to note that the derivatives participants are valuing downside protection in the short term. Combined with the technical break higher, we are expecting higher prices this week.

Ethereum

- Ethereum edged lower for the eighth straight week. ETH initiated this week’s action with a failed break above 2,060. All subsequent rallies faded rapidly. Following Wednesday’s release of the Fed’s FOMC minutes, Ethereum dropped a further 16.6% with support at 1,700, which was defended heavily. Bulls garnered some strength over the weekend pushing prices higher, finally closing the week down 11.3% at $1,810. As I write, we are seeing a relief rally back into the range. If we break above 2,150 this week, we should see a nice move technically higher.

- During Wednesday’s release of FOMC minutes, Powell reiterated the Fed’s intention to continue to hike rates at future meetings. After an initially muted reaction, risk assets drove higher end over the remainder of the week whilst cryptocurrencies fell. Previously, we mentioned Bitcoin’s correlational divergence from equities. This narrative also proved true for Ethereum.

ETHBTC Daily Chart

- Notably, Ethereum’s price crumbled relative to Bitcoin, marking a familiar theme in bearish and risk-off environments. The ETH/BTC pair broke below a critical ascending trendline from the beginning of May 2021. The drastic move lower was exacerbated by a block re-organisation issue – caused by 25% of validators who did not upgrade software, resulting in a mismatch of block order for the chain. Sceptics used the event to criticise Ethereum’s instability amidst the upcoming move to proof-of-stake.

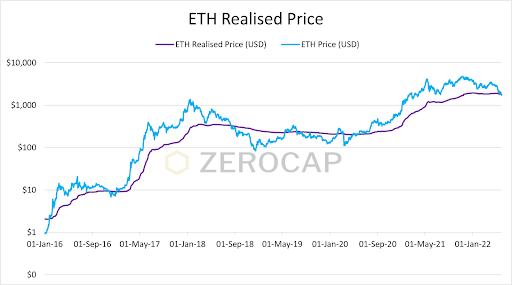

- Ethereum’s realised price, which measures realised market cap divided by the current supply, is sitting marginally above current price levels. Historically, falling below this level has signalled longer-term accumulation opportunities for bullish Ethereum holders.

- The overall percentage of Ethereum holders (supply) in profit continues to fall. We have seen in prior bear markets and capitulation events that this ratio tends to reach below 40% when reaching market bottoms. Currently, 54% of the supply is in profit.

- Ethereum’s transactional gas fees have dropped to levels not seen since the collapse of crypto markets in late May 2021. This drop-in fees is indicative of the lack of demand for block space on the smart contract platform, following increased investor uncertainty.

- After yet another turbulent week for Ethereum, the coming month will be crucial in determining the foundation for price action into the second half of 2022. Critics were quick to point out Ethereum’s technical flaws after a bug caused the block reorganisation. Now, all eyes are on the Ropsten testnet which performs a merge transition test on June 8th. Participants are looking for confidence and assurance that the merge will be a success, and these tests will provide early signals to investors on the outlook and time frame for the merge mainnet launch. Given we are seeing floors forming in intermarket assets, we could go higher from here. We only need the news to be ‘less-bad’ across the world.

Altcoins

- Terra’s newly launched token, Luna 2.0, is off to a rocky start. Upon listing, its price tanked over 70% within 24 hours. Some initial hype took the new token over $20. However, the token is now oscillating between $5 USD and $6 USD. In what can be seen as an attempt to retain faith in the network, Terra airdropped the new token to individuals who held Luna before its capitulation. Hence, the new token’s sell-off can be partially attributed to individuals attempting to recoup losses from the Luna collapse.

Innovation

- Andreessen Horowitz has closed their newly formed Web3 fund. The fund totals $4.5 billion USD. This fund brings a16z’s aggregate amount invested into cryptocurrency and Web3 to over $7.6 billion USD. Chris Dixon, the helm of a16z’s crypto funds, has expressed that the fund will focus on projects that have gained traction within the Web3 space. The community has praised the new fund and a16z’s ability to raise significant capital in light of current market conditions.

- MetaMask partners with Asset Reality, an on-chain cryptocurrency investigative firm, to improve the process of locating stolen crypto and NFTs. This partnership represents a holistic endeavour on behalf of MetaMask to promote security and community within the Web3 space. In addition to facilitating remuneration for victims of wallet exploits, Asset Reality’s involvement increases the likelihood of recovering lost assets. The firm can recommend exchanges to freeze wallets. This would thereby render assets inaccessible for attackers.

- StarkWare closes its Series D funding round after raising $100 million USD at an $8 billion USD valuation. StarkWare is working on scaling the Ethereum blockchain through Zero-Knowledge rollups – a solution lauded by Ethereum co-founder, Vitalik Buterin. The effectiveness of StarkWare’s layer 2 scaling technology has resulted in its valuation quadrupling from its Series C funding round value, 6 months ago.

NFTs & Metaverse

- OpenSea has announced its new NFT marketplace platform, Seaport. The new protocol, like OpenSea, will be built on the Ethereum blockchain. However, Seaport will include features such as the ability to barter with NFTs, bidding on specific traits as well as rarities, and will incorporate tipping mechanisms. Moreover, Seaport aims to embrace Web3. It will be open source and owned by the community.

- Seth Green, a well-known actor, was a recent victim of a phishing attack. This attack resulted in the loss of NFTs, including a Bored Ape Yacht Club (BAYC) NFT which was to star in his new TV show, White Horse Tavern. The attacker sold the Bored Ape. This event has sparked an ongoing debate relating to the commercial usage rights of NFTs. More specifically, whether Green or the new owner possesses the right to commercialise their NFT. One argument suggests that the buyer is legally protected. The owner, who unknowingly bought the NFT, can sue Green for the commercial use of the Bored Ape – contrasting contentions that suggest “code is not law”. Moreover, since the NFT is ‘stolen property,’ its commercial usage should be lawful.

What to Watch

- Initial results from Terra 2.0 – The new Luna crypto opened with an immediate nosedive; is there still support for the project?

- With Dow Jones and S&P 500 breaking out from long-losing streaks, will the Nasdaq follow?

- Official statements regarding rate hikes in June; several FED members to speak this week.

- US JOLTS Job Openings, on Wednesday.

- US Treasury Currency report, on Friday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal opinions about the cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are between 23 May. 2022 0:00 UTC to 29 May. 2022 23:59 UTC from TradingView. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content herein above.

This document is issued by Zerocap Pty Ltd (Zerocap), an Authorised Representative (#001289130) of AFSL 340799. This document is made available to you on the basis that you are a Wholesale or Professional Investor. This document is not intended for retail clients nor should it be distributed to retail investors. This document has been prepared for information purposes only and may not be relied on for any other purpose (including, without limitation, as legal, tax, financial or investment advice). Nothing in this document should be interpreted as an endorsement or recommendation of a particular investment or strategy. Any opinions expressed are general in nature and do not consider the objectives, financial situation or needs of any person. Before making an investment decision you should conduct your own due diligence, consider what is suitable for you and your personal circumstances and obtain your own independent advice. Zerocap Pty Ltd (Zerocap) makes no representation or warranty (express or implied) that any information contained in this document is accurate or complete. Information included in this document is based on matters as they exist as of the date of preparation of this document and will not be updated or otherwise revised. Certain statements reflect Zerocap’s views, estimates, opinions or predictions which may be based on proprietary models and assumptions, and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realised. There are significant uncertainties inherent in the forward-looking statements included in this document. Neither historical returns nor economic, market or other indications of performance should be considered as an indication of future results or performance. Investing in cryptocurrencies and/or digital assets involves a substantial degree of risk and could result in the loss of the entire amount invested. Nothing in this document is intended to imply that investing in cryptocurrencies and/or digital assets may be considered “conservative”, “safe”, “risk free”, or “risk averse”.

You should be aware that dealing in products that are leveraged carries significantly greater risk than non-leveraged products. As such, you could both gain and lose larger amounts. You may even sustain losses well in excess of your initial deposit and also in excess of the margin required to establish and maintain any positions in the leveraged products. Accordingly, you should carefully consider whether leveraged products are appropriate for you in light of your financial circumstances and risk profile.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post