19 Apr, 21

Weekly Crypto Market Wrap, 19th April 2021

Week in Review

- The S&P 500 and Dow Jones Index continue to make new highs as bond yields fall.

- Coinbase closes at $328 after its first day of trading, implying a $65 billion market capitalisation. Over 1 million shares of the stock were purchased by ARK Investments over two days.

- Ethereum upgrades to the Berlin Hard Fork, introducing many gas optimisations and a security upgrade. Holders are anticipating the next upgrade, London, that introduces EIP-1559.

- Consensys, a full-stack Ethereum product provider for developers, raises $65 million from several prominent firms, such as JP Morgan, UBS, Mastercard and Alameda Research.

- Two Ethereum ETFs were approved for listing on the Toronto Stock Exchange.

- Rothschild Investment discloses holdings in the Grayscale Ethereum Trust, worth $6.29 million as of 18 April.

- Binance Coin rises to the 3rd largest cryptocurrency by market capitalisation, said to be driven by the Coinbase IPO.

- Dogecoin went parabolic, taking the spot of the 5th largest cryptocurrency this week.

- Turkey bans crypto payments.

- AXA Switzerland to allow customers to pay in bitcoin.

- HSBC prohibits customer purchases of Microstrategy shares.

Winners & Losers

- The week opened with BTC just under US$60,000, continuing the uptrend in anticipation of Coinbase’s midweek IPO. Early on Wednesday morning, a new ATH was hit at US$64,900 before the asset fell close to its long-term trendline support at US$56,400. Buy the rumour, sell the news was the case with the Coinbase IPO, leading to over ~US10B in liquidations for leveraged traders.

- Ethereum had a similarly bullish start to the week, establishing a new ATH by Friday at US$2,550. While correlation to Bitcoin remains influential, the main catalyst for the week’s increase was the success of the Berlin Hard Fork, an upgrade to the security and gas optimisation of the network. Overall, BTC recorded a 0.43% gain and ETH a 8.56% gain.

- Gold continued its uptrend primarily due to a weakening US dollar and suppressed treasury bond yields. The week opened at US$1,670 and rose to its highest in 7 weeks at US$1,845, recording +2.1%.

- Despite a retrace off last week’s low of ~1.61 in the US10Y, the key support level couldn’t hold this week, leading to a sell-off to the weekly (and monthly) low of 1.53 on Thursday. The asset closed at 1.58 this week, recording a 4.75% loss. Positive US economic data continues to suggest a faster economic recovery. However, new data this week had minimal influence on the US10Y. Some expect that the quicker recovery narrative has already been priced into the bonds market, suggesting that any more positive news may have a suppressed impact.

- Equity markets continued to rally to new highs as the US10Y dropped, suggesting a positive outlook. This further fueled the sell-off experienced last week in the VIX leading to a further 6.77% drop week on week.

- The S&P 500 continues to reach new highs, recording a 1.47% weekly gain. Increased consumer confidence alongside continued promising jobless claims fueled inflows.

- Continued all-time highs across a significant number of markets have been driven by positive sentiment surrounding the US and the broader global market’s projected Covid recovery speed. Markets are becoming increasingly desensitised to positive economic data which begs the question; how will they react if the frenzy slows or the expectations surrounding a quicker recovery are not met?

Macro, Technicals & Order Flow

Bitcoin

- The attention from Coinbase’s IPO definitely overflowed into bitcoin, breaking new highs this week along with higher levels of derivative open interest. There was a massive deleveraging and liquidation at the end of the week, causing a crypto wide dip. The exacerbated derivatives sell-off has led to over-extension across the market. However, this was very quickly bid up by the market, with BTC only spending under 15 minutes below 54,000 before beginning to recover.

- We mentioned last week that the break above highs could be a wild one. With greater spot liquidity over time, large scale liquidations such as this should be more contained, although we expect them to be a feature of this market more many more years to come. The lesson? Don’t over-leverage!

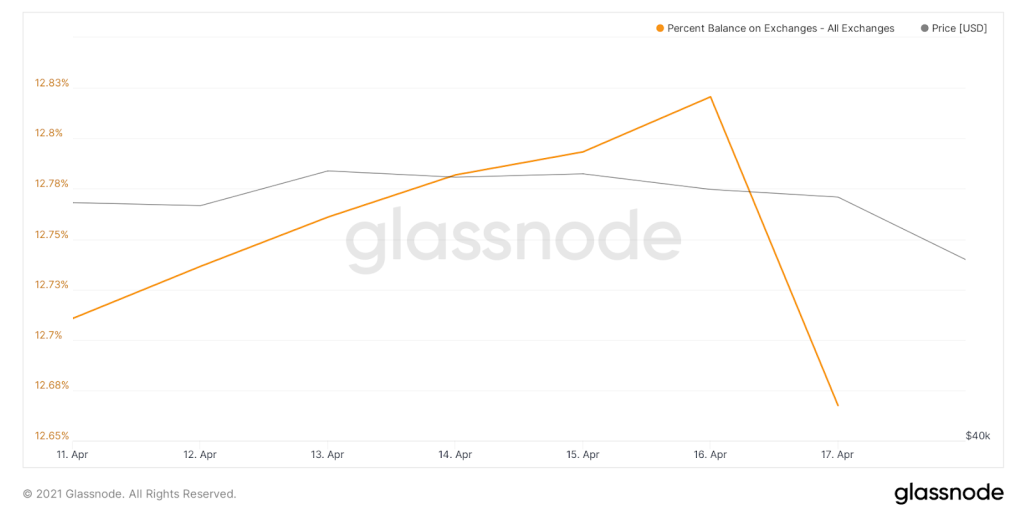

- Notably inflows to exchanges increased before the liquidations. This data point is becoming increasingly telling.

- Newsflow for the week – there has been some discussion and fear around governments banning bitcoin and other cryptocurrencies. Turkey has banned crypto payments, while corporations continue to integrate the asset into their payment systems. So what does this really mean for bitcoin? Turkey banning bitcoin is a response (amongst other things) because their residents are flooding out of the lira to safer stores of value. Myanmar is another example, where nations continue to struggle against the government-issued currency, as they have recently imposed withdrawal limits on their own currency. The deeper insight here is that the case for bitcoin is strengthening as a hedge against fiat.

Ethereum

- Ethereum had one helluva run before the liquidations took hold. Similarly short-lived to BTC’s move, we are seeing increasing non-leveraged inflows.

- Positive news for Ethereum continues to flow; Citibank explains DeFi, ETF listings, Consensys funding, successful upgrades, scaling solutions, NFT auctions, and more. The network is steadily cementing itself as the world’s settlement layer for all assets.

- Year on year – similar to bitcoin, ethereum balances on exchanges continue to decrease on the longer-term view. This may indicate an increase in longer-term holders and coincides with the increasing amount of ETH used in DeFi.

- From the newsdesk, zkSYNC announces a breakthrough scaling solution, 20,000 TPS+ and Ethereum Dapp compatible, slated to launch in August.

- Total value locked in DeFi projects shot up to $60.64 billion, an 18.5% increase from last week, supported by an increase in DeFi and ETH valuations, together with stablecoin inflows.

- The amount of ETH in the ETH 2.0 staking contract currently sits at 3,871,778, an increase of 2.4% from last week. This represents 3.28% of the total supply estimated to remain locked for ~ one year.

- As Ethereum pushes higher highs and generates institutional interest via DeFi, the attractiveness of an asset that has an intrinsic yield property via staking cannot be understated. If EIP1559 is successfully implemented and ETH becomes a deflationary asset that earns yield for stakers, what will that do to its price?

DeFi & Innovation

- Thorchain’s multichain guarded launch was a success, allowing users to swap between Bitcoin, Ethereum, Binance Chain, Litecoin and Bitcoin Cash without going to a centralised exchange.

- Yearn Finance continues to balloon as they hit over $3 billion in AUM.

- StakeDao launches V2, revealing more functionalities and a user-friendly interface aimed at integrating retail users into DeFi.

- Chainlink releases their 136-page whitepaper for its version 2.0.

- Edward Snowden auctions off an NFT based on his exposé for $5.44 million, while Sotheby’s auctions off an NFT by Pak for almost $17 million.

What to Watch

- Coinbase’s successful IPO sets the stage for other crypto companies to do the same. Will the asset class continue to claim mainstream media attention?

- There have also been claims that Coinbase employees who exercise their stock options will put those profits into cryptoassets. Does this hold true and will other crypto companies’ employees do the same?

- As concerns of fiat devaluation continue in countries outside of the U.S, will bitcoin be the choice store of value for citizens?

Insights

- Bitcoin Mining: An overview – What will happen when all bitcoin is mined? That is one of the few questions that we answer in this piece, which covers how mining works, the impact on the crypto ecosystem and what the future holds for this crucial role in the Blockchain network.

Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities |

| BTC | ETH | PAXG | S&P 500, ASX 200, VTI | HYG | CRBQX |

About Us

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.io

FAQs

What were the significant events in the crypto market during the week of 19th April 2021?

The week saw new highs in the S&P 500 and Dow Jones Index, Coinbase’s closing at $328 after its first day of trading, Ethereum’s upgrade to the Berlin Hard Fork, Consensys raising $65 million, approval of two Ethereum ETFs on the Toronto Stock Exchange, and Binance Coin rising to the 3rd largest cryptocurrency by market capitalization.

How did Bitcoin and Ethereum perform during the week?

Bitcoin reached a new all-time high at $64,900 before falling to $56,400, recording a 0.43% gain for the week. Ethereum also had a bullish start, establishing a new all-time high at $2,550, with an 8.56% gain for the week.

What were the notable developments in DeFi and Innovation?

Thorchain’s multichain guarded launch was successful, allowing users to swap between various cryptocurrencies without a centralized exchange. Yearn Finance’s AUM hit over $3 billion, StakeDao launched V2, Chainlink released its 136-page whitepaper for version 2.0, and significant NFT auctions took place.

What should investors watch for in the crypto market?

Investors should watch for the impact of Coinbase’s successful IPO on other crypto companies, the potential investment of Coinbase employees’ stock option profits into crypto assets, and the continued concerns of fiat devaluation in countries outside the U.S., which may lead to Bitcoin being the choice store of value.

What services does Zerocap offer?

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Their investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security.

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal views about cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are between 12 Apr. 2021 0:00 UTC to 18 Apr. 2021 23:59 UTC from TradingView. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content herein above.

About Us

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.io

FAQs

What were the significant events in the crypto market during the week of 19th April 2021?

The week saw new highs in the S&P 500 and Dow Jones Index, Coinbase’s closing at $328 after its first day of trading, Ethereum’s upgrade to the Berlin Hard Fork, Consensys raising $65 million, approval of two Ethereum ETFs on the Toronto Stock Exchange, and Binance Coin rising to the 3rd largest cryptocurrency by market capitalization.

How did Bitcoin and Ethereum perform during the week?

Bitcoin reached a new all-time high at $64,900 before falling to $56,400, recording a 0.43% gain for the week. Ethereum also had a bullish start, establishing a new all-time high at $2,550, with an 8.56% gain for the week.

What were the notable developments in DeFi and Innovation?

Thorchain’s multichain guarded launch was successful, allowing users to swap between various cryptocurrencies without a centralized exchange. Yearn Finance’s AUM hit over $3 billion, StakeDao launched V2, Chainlink released its 136-page whitepaper for version 2.0, and significant NFT auctions took place.

What should investors watch for in the crypto market?

Investors should watch for the impact of Coinbase’s successful IPO on other crypto companies, the potential investment of Coinbase employees’ stock option profits into crypto assets, and the continued concerns of fiat devaluation in countries outside the U.S., which may lead to Bitcoin being the choice store of value.

What services does Zerocap offer?

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Their investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security.

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal views about cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are between 12 Apr. 2021 0:00 UTC to 18 Apr. 2021 23:59 UTC from TradingView. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content herein above.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post