Content

- The Mechanics of a Bitcoin ETF

- Traditional ETFs vs. Bitcoin ETFs

- Benefits of Bitcoin ETFs

- Increased Accessibility

- Professional Management

- Enhanced Liquidity

- Impacts on the Crypto Market

- Potential for Market Stability

- Increase in Mainstream Adoption

- Enhanced Regulatory Clarity

- Concerns and Criticisms

- Potential for Market Manipulation

- Overreliance on Traditional Finance

- Conclusion

- Is Investing in a Bitcoin ETF Right for You?

- About Zerocap

- DISCLAIMER

19 Oct, 23

Why is a Bitcoin ETF Useful for Investors and the Crypto Market?

- The Mechanics of a Bitcoin ETF

- Traditional ETFs vs. Bitcoin ETFs

- Benefits of Bitcoin ETFs

- Increased Accessibility

- Professional Management

- Enhanced Liquidity

- Impacts on the Crypto Market

- Potential for Market Stability

- Increase in Mainstream Adoption

- Enhanced Regulatory Clarity

- Concerns and Criticisms

- Potential for Market Manipulation

- Overreliance on Traditional Finance

- Conclusion

- Is Investing in a Bitcoin ETF Right for You?

- About Zerocap

- DISCLAIMER

Ever wonder why the term “Bitcoin ETF” keeps popping up in the financial news? Investors’ eyes light up at the idea of a Bitcoin ETF. But what exactly is it, and why is it such a big deal?

The Mechanics of a Bitcoin ETF

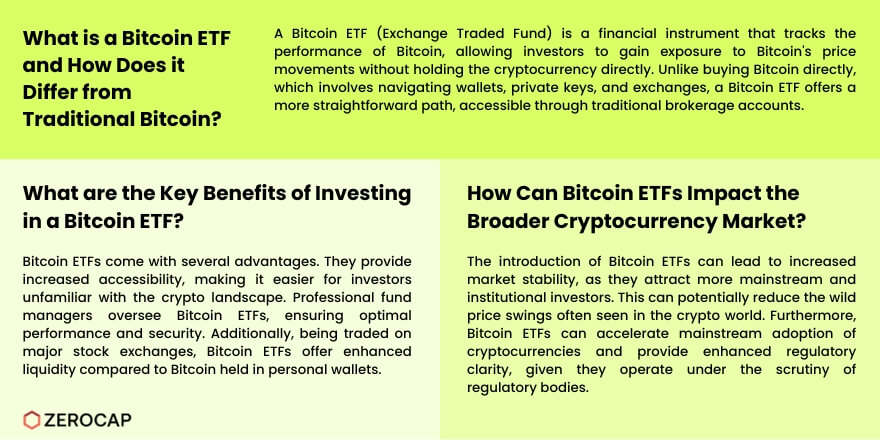

To get the ball rolling, let’s break down the concept. An ETF, or Exchange Traded Fund, is like a basket of assets – stocks, bonds, or commodities – that tracks the performance of an index. Similarly, a Bitcoin ETF tracks the performance of Bitcoin, offering investors a new way to get a slice of the Bitcoin pie without holding the cryptocurrency directly.

Traditional ETFs vs. Bitcoin ETFs

In essence, traditional ETFs and Bitcoin ETFs function on the same principle. However, while traditional ETFs might hold assets like stocks, a Bitcoin ETF is backed by Bitcoin itself.

Benefits of Bitcoin ETFs

Bitcoin ETFs aren’t just shiny new toys in the financial playground. They offer tangible benefits.

Increased Accessibility

Buying Bitcoin directly might seem like navigating a maze for some. Wallets, private keys, and exchanges can be confusing. Bitcoin ETFs offer a straightforward path, accessible through traditional brokerage accounts.

Professional Management

Sometimes, it’s best to let the pros handle things. With Bitcoin ETFs, professional fund managers oversee the assets, ensuring optimal performance.

Enhanced Liquidity

Liquidity is the ease with which an asset can be quickly bought or sold. Bitcoin ETFs, traded on major stock exchanges, offer higher liquidity than Bitcoin held in personal wallets.

Impacts on the Crypto Market

Potential for Market Stability

More institutional involvement often brings more stability. With more mainstream investors diving into Bitcoin via ETFs, the wild price swings of the crypto world might become less severe.

Increase in Mainstream Adoption

Remember when online shopping was a novelty? Now, it’s the norm. Similarly, as Bitcoin ETFs gain traction, they might pave the way for broader cryptocurrency adoption.

Enhanced Regulatory Clarity

Let’s face it, the crypto world can sometimes feel like the Wild West. Bitcoin ETFs, under the watchful eye of regulatory bodies, can bring more clarity and rules to the game.

Concerns and Criticisms

Potential for Market Manipulation

Not everyone’s on the Bitcoin ETF bandwagon. Some fear that large institutions could manipulate Bitcoin prices, affecting the broader market.

Overreliance on Traditional Finance

The essence of crypto is decentralization. Relying on traditional finance structures for crypto exposure might seem counterintuitive to some purists.

Conclusion

Is Investing in a Bitcoin ETF Right for You?

Bitcoin ETFs undeniably offer exciting opportunities for investors and the crypto market. But like choosing the perfect ice cream flavor on a sunny day, it’s essential to know your preferences. Dive deep, do your research, and see if this investment avenue aligns with your financial goals.

FAQs

- What is the main difference between a Bitcoin ETF and directly buying Bitcoin?

- A Bitcoin ETF offers exposure to Bitcoin’s price movements without the need to hold the actual cryptocurrency.

- Are Bitcoin ETFs available globally?

- Regulations vary by country. While some nations have approved Bitcoin ETFs, others are still evaluating their stance.

- How do Bitcoin ETFs affect Bitcoin’s price?

- They can increase demand for Bitcoin, potentially leading to price appreciation. However, market dynamics are multifaceted and can be influenced by various factors.

- Can I redeem my Bitcoin ETF shares for actual Bitcoin?

- Generally, individual investors cannot redeem ETF shares for Bitcoin. Instead, they trade them on stock exchanges.

- Do Bitcoin ETFs pay dividends?

- It depends on the ETF’s structure. Some might reinvest earnings, while others could distribute them to shareholders.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 2 March 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap Launches Institutional OTC Desk for Tokenized Gold Trading

Zerocap’s institutional OTC desk enables investors to access tokenized gold efficiently, supporting portfolio diversification and inflation hedging strategies. The core objective is to provide seamless

Weekly Crypto Market Wrap: 23 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post