Content

- Understanding the Psychology Behind Price Anchoring

- The Concept of Anchoring in Decision Making

- How Price Anchoring Influences Buyer’s Perception

- The History and Evolution of Price Anchoring

- Examples of Price Anchoring in Different Industries

- Retail Industry

- Real Estate

- Online Marketplaces

- Strategies for Effective Price Anchoring

- Setting the Initial Price

- Presenting Price Comparisons

- The Impact of Price Anchoring on Sales

- Short-Term Versus Long-Term Effects

- Ethical Considerations in Price Anchoring

- Fair Pricing Policies

- Transparency with Customers

- Price Anchoring in Digital Marketing

- E-commerce Strategies

- Email Marketing Techniques

- The Role of Price Anchoring in Discounting and Sales Promotions

- Consumer Behavior and Price Anchoring

- Cognitive Biases in Shopping

- The Role of Brand Perception

- Price Anchoring in Subscription Services

- How to Avoid Being Influenced by Price Anchoring as a Consumer

- The Future of Price Anchoring

- Conclusion

- FAQs

- About Zerocap

- DISCLAIMER

8 Nov, 23

What is Price Anchoring?

- Understanding the Psychology Behind Price Anchoring

- The Concept of Anchoring in Decision Making

- How Price Anchoring Influences Buyer’s Perception

- The History and Evolution of Price Anchoring

- Examples of Price Anchoring in Different Industries

- Retail Industry

- Real Estate

- Online Marketplaces

- Strategies for Effective Price Anchoring

- Setting the Initial Price

- Presenting Price Comparisons

- The Impact of Price Anchoring on Sales

- Short-Term Versus Long-Term Effects

- Ethical Considerations in Price Anchoring

- Fair Pricing Policies

- Transparency with Customers

- Price Anchoring in Digital Marketing

- E-commerce Strategies

- Email Marketing Techniques

- The Role of Price Anchoring in Discounting and Sales Promotions

- Consumer Behavior and Price Anchoring

- Cognitive Biases in Shopping

- The Role of Brand Perception

- Price Anchoring in Subscription Services

- How to Avoid Being Influenced by Price Anchoring as a Consumer

- The Future of Price Anchoring

- Conclusion

- FAQs

- About Zerocap

- DISCLAIMER

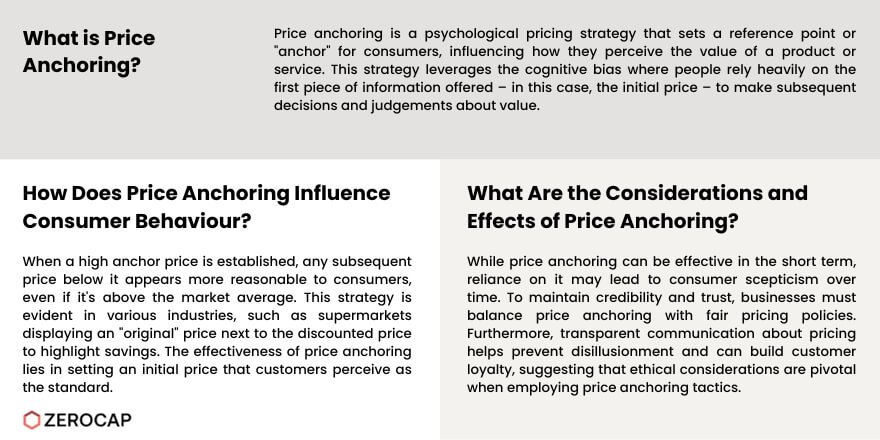

Price anchoring is a prevalent psychological pricing strategy that influences how consumers perceive the value of a product or service. By establishing a reference point or “anchor,” sellers can steer customers towards a price they believe is a good deal. But what makes this strategy so effective, and how has it evolved over time?

Understanding the Psychology Behind Price Anchoring

The Concept of Anchoring in Decision Making

Anchoring is a cognitive bias that refers to the human tendency to rely too heavily on the first piece of information offered when making decisions. In pricing, the initial price sets the stage for customer expectations and comparisons.

How Price Anchoring Influences Buyer’s Perception

When a high anchor price is set, any price below it seems reasonable by comparison, even if it’s higher than the market average. This perception is what sellers aim to achieve with price anchoring.

The History and Evolution of Price Anchoring

Tracing back to market bazaars and early trade practices, price anchoring has been around as long as trading itself. The evolution of this tactic has been shaped by consumer behavior and advances in marketing techniques.

Examples of Price Anchoring in Different Industries

Retail Industry

Supermarkets often use price anchoring by showing the “original” price alongside the discounted price, making the savings seem more significant.

Real Estate

Real estate agents may show clients a mix of high-priced and moderately-priced homes, making the latter seem more appealing.

Online Marketplaces

E-commerce platforms display crossed-out prices next to sale prices to indicate a bargain, a classic example of price anchoring.

Strategies for Effective Price Anchoring

Setting the Initial Price

The key to price anchoring is setting an initial price that customers see as the standard against which they judge all other prices.

Presenting Price Comparisons

By presenting the anchor price alongside the current price, businesses guide customers towards perceiving the offered price as a steal.

The Impact of Price Anchoring on Sales

Short-Term Versus Long-Term Effects

While effective in the short term, overusing it can lead to long-term skepticism among consumers.

Ethical Considerations in Price Anchoring

Fair Pricing Policies

Businesses must balance price anchoring strategies with fair pricing policies to maintain trust and credibility.

Transparency with Customers

Clear communication about pricing can prevent customer disillusionment and foster loyalty.

Price Anchoring in Digital Marketing

E-commerce Strategies

Online sellers use price anchoring by displaying the manufacturer’s suggested retail price (MSRP) against their lower price.

Email Marketing Techniques

Marketers often highlight the original price in email campaigns to anchor customers before revealing the sale price.

The Role of Price Anchoring in Discounting and Sales Promotions

Sales promotions often rely on price anchoring to make discounts appear more substantial, thus encouraging purchases.

Consumer Behavior and Price Anchoring

Cognitive Biases in Shopping

Understanding common biases like anchoring can help consumers make more informed decisions.

The Role of Brand Perception

A strong brand can serve as an anchor itself, with consumers using it as a benchmark for quality and pricing.

Price Anchoring in Subscription Services

Subscription services often showcase annual plans as better value next to higher monthly rates, utilizing price anchoring to promote long-term commitments.

How to Avoid Being Influenced by Price Anchoring as a Consumer

As a savvy consumer, it’s essential to recognise price anchoring tactics. Doing your research, understanding the true value of a product, and comparing market prices can help you see beyond the anchor and make choices that are right for your budget and needs.

The Future of Price Anchoring

Moving forward, price anchoring will likely become more sophisticated with the rise of personalised pricing and AI-driven marketing. These trends suggest a future where price anchors could be tailored to individual consumers, making it an even more potent force in commerce.

Conclusion

Price anchoring is a double-edged sword; it can be a powerful sales tool but must be wielded with care to avoid consumer backlash. As we navigate an ever-evolving marketplace, understanding the dynamics of it will be crucial for both buyers and sellers.

FAQs

- What is the main purpose of price anchoring? Price anchoring aims to set a reference price in the consumer’s mind, making any lower price seem like a good deal.

- Can it backfire on sellers? If used excessively, consumers may become sceptical, potentially harming trust and brand reputation.

- How can I recognise it while shopping? Look for original prices struck through next to sale prices or items compared against higher-priced alternatives.

- Is price anchoring an ethical practice? It can be, as long as it’s used transparently and doesn’t mislead consumers.

- Will it remain effective in the future? It’s likely to evolve but will remain effective, especially as personalisation in pricing becomes more prevalent.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 15th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 8th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post