3 Apr, 24

What is BUIDL? BlackRock’s New Tokenised Fund

Cover image source: Exame/Bloomberg/Getty

In a groundbreaking move that marries traditional finance with the cutting-edge world of blockchain technology, BlackRock, the world’s largest asset manager, has introduced its first tokenised fund, BUIDL. This pioneering initiative leverages the Ethereum blockchain to offer a new avenue for achieving US dollar yields, setting a precedent for the future of investment and asset management.

What Makes BUIDL Unique?

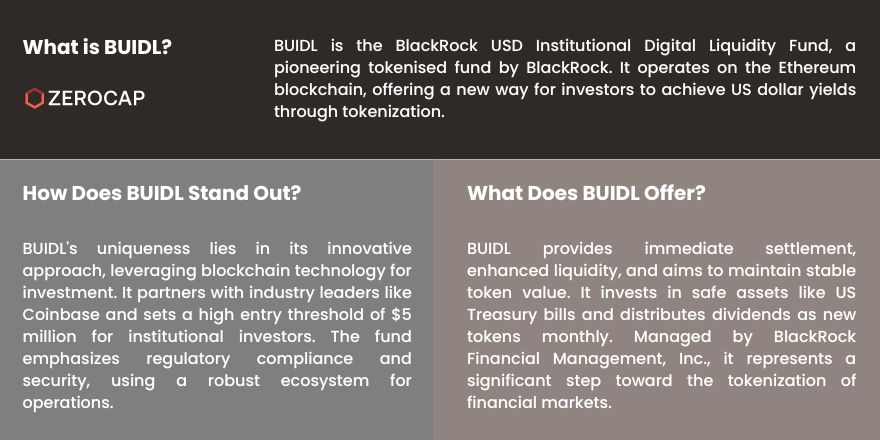

BUIDL, the BlackRock USD Institutional Digital Liquidity Fund, represents a significant leap forward in the financial industry’s embrace of digital assets. Here’s what sets it apart:

- Innovative Approach to Investment: BUIDL operates on the Ethereum blockchain, providing a secure and transparent platform for investors to earn yields on their US dollars through tokenization. This method offers a novel way to engage with the digital asset space, combining the reliability of traditional financial mechanisms with the efficiency of blockchain technology.

- Strategic Partnerships: A key factor in BUIDL’s launch is the collaboration with prominent industry players. Coinbase, a leading cryptocurrency exchange, serves as a vital infrastructure provider for the fund. This partnership underscores the potential of combining expertise from the realms of traditional finance and blockchain to create innovative solutions.

- High Entry Threshold: Reflecting its target market of institutional investors, BUIDL has set an initial investment minimum of $5 million. This high entry bar ensures that the fund caters to entities or individuals with significant capital, looking for stable and secure investment opportunities within the digital assets space.

- Regulatory Compliance and Security: BUIDL emphasizes compliance and security, issuing shares under specific SEC rules to ensure investor protection. The fund’s strategy focuses on safe assets like US Treasury bills and operates with a robust ecosystem including Anchorage Digital Bank NA, BitGo, and Fireblocks to secure and manage the fund’s operations.

- Forward-Thinking Financial Solutions: Beyond offering immediate settlement and enhanced liquidity, BUIDL aims to maintain a stable token value, distributing dividends as new tokens monthly. Its assets are fully allocated to cash, US Treasury bills, and repurchase agreements, managed by BlackRock Financial Management, Inc., with BNY Mellon acting as custodian.

Conclusion

BUIDL stands at the forefront of integrating blockchain technology with traditional investment strategies. By offering a secure, efficient, and compliant way to invest in digital assets, BlackRock is not only broadening the appeal of blockchain but also paving the way for future financial innovations. As blockchain continues to evolve, BUIDL represents a significant step toward the tokenization of financial markets, offering a glimpse into the future of global finance.

FAQs

- What is BUIDL?

- BUIDL is the BlackRock USD Institutional Digital Liquidity Fund, a tokenised fund created by BlackRock that operates on the Ethereum blockchain to offer US dollar yields through tokenization.

- How does BUIDL work?

- BUIDL allows investors to purchase tokens representing shares in the fund, which invests in safe assets like US Treasury bills. It offers immediate settlement, enhanced liquidity, and aims to maintain a stable token value while distributing dividends monthly.

- Who can invest in BUIDL?

- BUIDL is targeted at qualified institutional investors, with an initial minimum investment requirement of $5 million.

- What are the key benefits of investing in BUIDL?

- The key benefits include access to a secure and transparent platform for earning US dollar yields, immediate settlement, enhanced liquidity, and participation in the digital asset space with the backing of traditional financial mechanisms.

- How is BUIDL compliant with regulations?

- BUIDL complies with specific SEC rules for issuing shares, ensuring investor protection. It’s part of a regulated ecosystem involving key financial and technology partners to maintain security and operational integrity.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 9 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

The Bitcoin to IBIT Swap: A Structured Approach to Managing BTC Exposure

Zerocap’s Bitcoin to IBIT swap enables investors to transition BTC exposure into IBIT efficiently, supporting portfolio rebalancing strategies. The core objective is to exchange physical

Weekly Crypto Market Wrap: 2 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post