8 Dec, 23

What is the Golden Cross in Trading?

The Golden Cross, a term that resonates with significance in the trading world, is a pivotal indicator for both new and experienced traders. This article delves into the concept of the Golden Cross, a technical analysis tool used to predict potential bullish markets. Understanding the Golden Cross is crucial for traders who seek to enhance their strategy in various financial markets, from stocks to cryptocurrencies. In this exploration, we’ll uncover the mechanics, implications, strategies, and real-world examples of the Golden Cross, providing a comprehensive understanding of its role in trading.

Understanding the Golden Cross

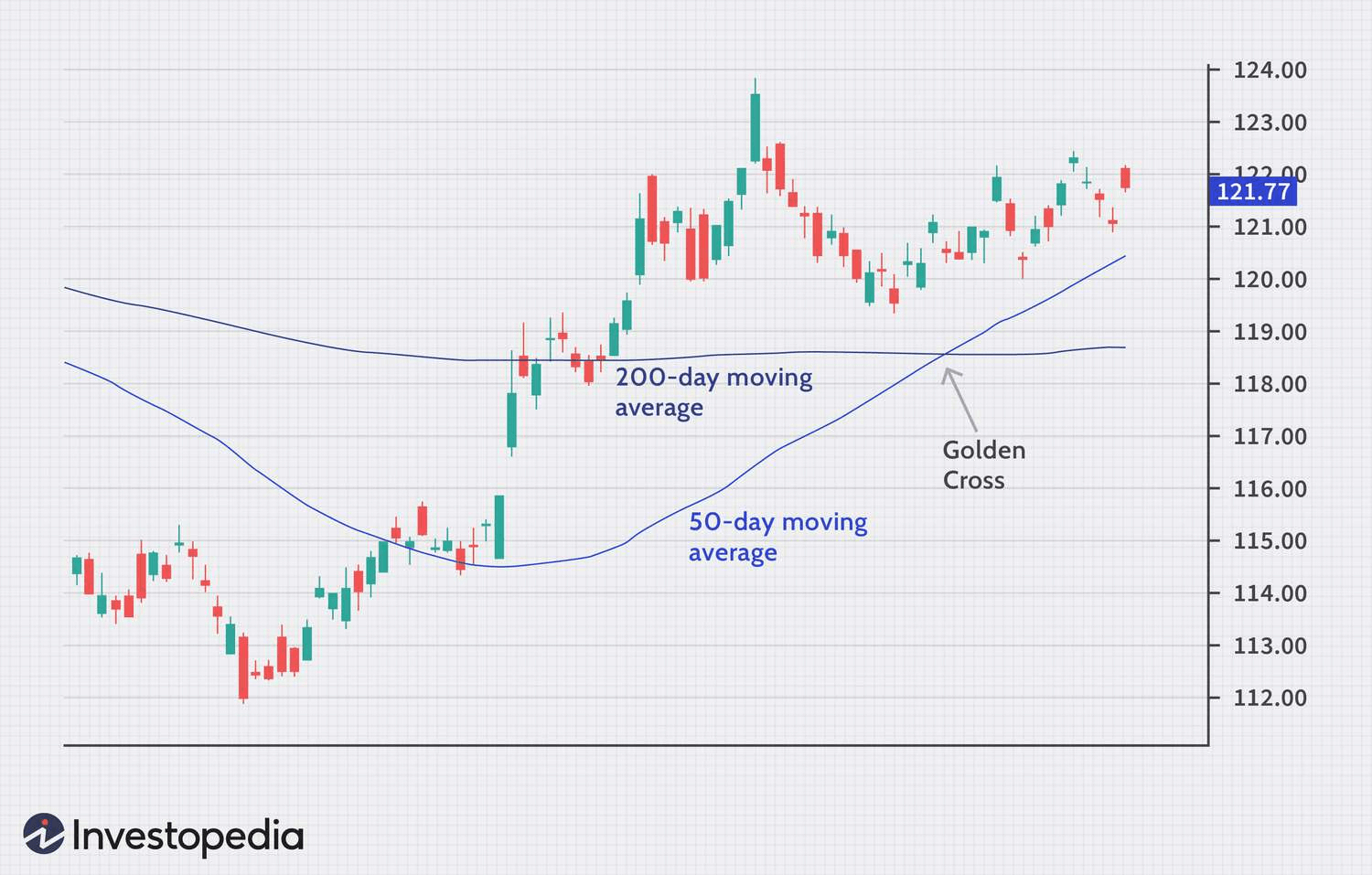

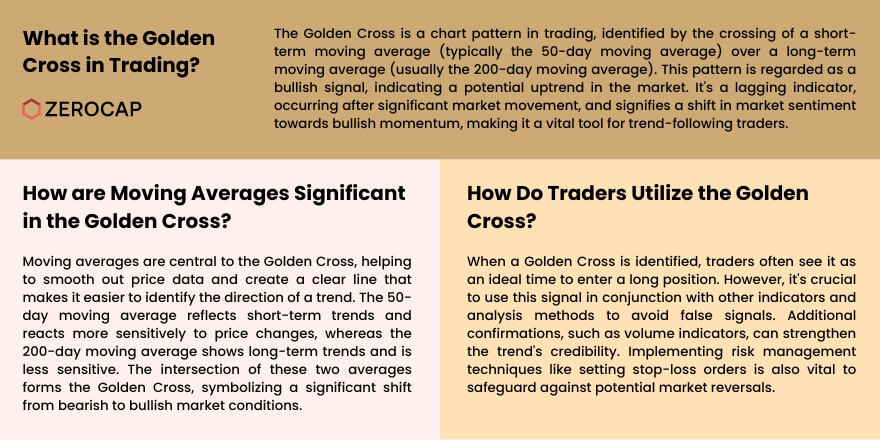

The Golden Cross is a chart pattern recognized by the crossing of a short-term moving average over a long-term moving average, typically the 50-day moving average crossing above the 200-day moving average. This event is considered a bullish signal, suggesting a potential uptrend in the market. It’s a lagging indicator, meaning it occurs after a significant move in the market. The Golden Cross reflects a shift in market sentiment, indicating that the current bullish momentum may continue, making it a crucial tool for trend-following traders.

The Significance of Moving Averages in the Golden Cross

Central to the Golden Cross are moving averages, which smooth out price data to create a single flowing line, making it easier to identify the trend direction. The 50-day and 200-day moving averages are particularly significant. The 50-day moving average reflects the short-term trend and is more sensitive to price changes. In contrast, the 200-day moving average indicates the long-term trend and is less sensitive. The crossing of these two averages is what forms the Golden Cross, symbolizing a strong shift from a bearish to a bullish market.

Trading Strategies Involving the Golden Cross

Upon identifying a Golden Cross, traders often consider it an opportune time to enter a long position. However, it’s essential to combine this signal with other indicators and analysis methods to avoid false signals. For instance, traders might look for additional confirmation from volume indicators, as a high trading volume can reinforce the strength of the trend. Risk management techniques, such as setting stop-loss orders, are also crucial to protect against unexpected market reversals.

Real-World Examples of the Golden Cross

The Golden Cross has been a reliable indicator in various historical market scenarios. For instance, in the stock market, a Golden Cross has preceded significant bull runs, such as the one seen in major indices following the 2008 financial crisis. In the cryptocurrency market, a Golden Cross has signaled the start of substantial price increases, as seen in Bitcoin’s price history. These examples demonstrate the Golden Cross’s potential as a predictive tool, though it’s important to remember that no indicator is infallible.

Conclusion

The Golden Cross is a powerful tool in the arsenal of traders, offering a signal for potential bullish trends. By understanding its mechanics, significance, and application in trading strategies, along with real-world examples, traders can better navigate the complexities of various markets. However, as with any trading strategy, it’s vital to use the Golden Cross in conjunction with other indicators and sound risk management practices to make informed trading decisions.

FAQs

- What exactly is a Golden Cross in trading? A Golden Cross occurs when a shorter-term moving average, like the 50-day average, crosses above a longer-term moving average, such as the 200-day average, signaling a potential bullish market trend.

- Why are the 50-day and 200-day moving averages important in the Golden Cross? The 50-day moving average represents short-term market trends and reacts more quickly to price changes, while the 200-day moving average reflects longer-term trends, providing a broader view of market momentum.

- Can the Golden Cross be used in all types of markets? Yes, the Golden Cross can be applied across various markets, including stocks, forex, and cryptocurrencies, as it is a universal indicator of market trends.

- How reliable is the Golden Cross as an indicator? While the Golden Cross is a widely respected indicator, it’s not infallible and should be used in conjunction with other analysis tools and risk management strategies.

- What should traders do upon identifying a Golden Cross? Traders often view a Golden Cross as an opportunity to enter a long position but should also look for additional confirmation from other indicators and practice sound risk management to protect against potential market reversals.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 19 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 12 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post