19 May, 24

The FIT21 Act and What it Means for Digital Assets

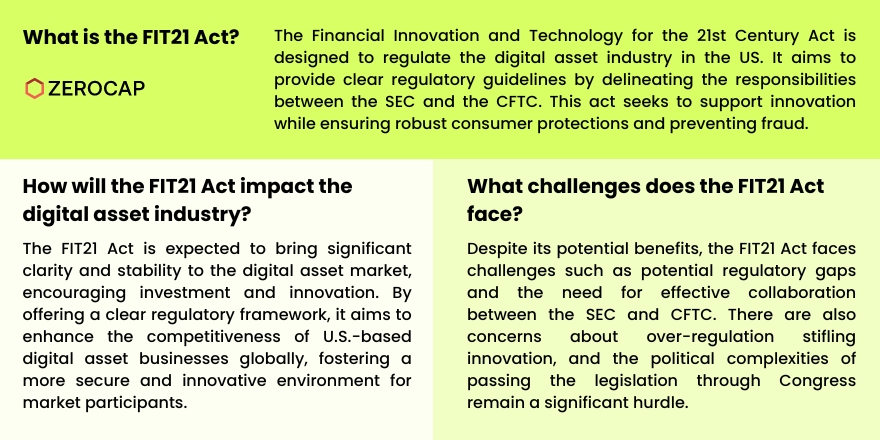

The Financial Innovation and Technology for the 21st Century Act (FIT21) represents a significant stride towards comprehensive digital asset regulation in the United States. Introduced to provide a clear regulatory framework, FIT21 aims to address the longstanding uncertainties that have plagued the digital asset ecosystem. This legislation is seen as a milestone for the cryptocurrency industry, which has been hindered by regulatory ambiguity and inconsistent enforcement.

The Genesis of FIT21

The FIT21 Act was introduced by the House Financial Services and Agriculture Committees, reflecting a bipartisan effort to bring clarity and stability to the digital asset market. Key proponents, including Congressman Patrick McHenry and French Hill, emphasized the need for clear rules and consumer protections. The Act was developed in response to the growing demand for a regulatory environment that supports innovation while safeguarding investors.

Key Provisions of the FIT21 Act

FIT21 seeks to delineate the regulatory responsibilities of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). The Act aims to clarify the jurisdictional boundaries between these two regulatory bodies, which has been a major source of confusion. The SEC will oversee digital assets classified as securities, while the CFTC will regulate commodities and derivatives.

Additionally, the legislation includes robust consumer protection measures designed to prevent fraud and market manipulation. It mandates comprehensive disclosure requirements for digital asset issuers and establishes clear guidelines for market participants.

Impact on the Digital Asset Industry

The passage of FIT21 is expected to have a transformative impact on the digital asset industry. By providing a clear regulatory framework, the Act aims to foster innovation and encourage investment in the U.S. digital asset market. Industry leaders have welcomed the legislation, seeing it as a crucial step towards achieving regulatory clarity and ensuring the sustainable growth of the cryptocurrency ecosystem.

Moreover, FIT21 is anticipated to enhance the competitiveness of U.S.-based digital asset businesses on a global scale. With other countries advancing their regulatory frameworks, this legislation positions the U.S. as a leader in financial and technological innovation.

Challenges and Criticisms

Despite the positive reception, FIT21 has faced some criticism and challenges. Critics argue that the legislation might still leave certain regulatory gaps and ambiguities. There are concerns about how effectively the SEC and CFTC will collaborate to enforce the new rules. Some industry stakeholders also worry about potential over-regulation that could stifle innovation.

Additionally, the political landscape poses challenges to the swift passage and implementation of FIT21. While the bill has garnered bipartisan support, it must still navigate the complexities of congressional approval and potential amendments.

Future Prospects

The future of FIT21 and its impact on digital asset regulation will depend on several factors. Effective implementation and enforcement will be critical to its success. Continuous engagement with industry stakeholders will also be essential to address emerging issues and ensure that the regulatory framework evolves in line with technological advancements.

The FIT21 Act represents a pivotal moment for the digital asset industry, signaling a commitment to creating a stable and innovative regulatory environment. As the legislation progresses through Congress, it will be crucial to monitor its development and the implications for both market participants and consumers.

Conclusion

The FIT21 Act is a landmark piece of legislation that aims to provide much-needed clarity and stability to the U.S. digital asset market. By delineating regulatory responsibilities and enhancing consumer protections, FIT21 has the potential to foster innovation and strengthen the U.S. position in the global digital asset landscape. While challenges remain, the bipartisan support for FIT21 underscores the recognition of the importance of a well-regulated digital asset ecosystem.

FAQs

1. What is the FIT21 Act? The FIT21 Act, or the Financial Innovation and Technology for the 21st Century Act, is a comprehensive legislative proposal aimed at providing clear regulatory guidelines for digital assets in the U.S.

2. Who introduced the FIT21 Act? The Act was introduced by the House Financial Services and Agriculture Committees, with key proponents including Congressman Patrick McHenry and French Hill.

3. What are the main goals of the FIT21 Act? The main goals are to clarify the regulatory roles of the SEC and CFTC, enhance consumer protections, and create a stable environment for digital asset innovation.

4. How will the FIT21 Act affect the digital asset industry? The Act is expected to provide regulatory clarity, fostering innovation and investment in the U.S. digital asset market while ensuring consumer protection.

5. What challenges does the FIT21 Act face? Challenges include potential regulatory gaps, the need for effective collaboration between the SEC and CFTC, and the political complexities of passing the legislation through Congress.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 19 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 12 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post