6 Dec, 23

What is Crypto Yield and How Does it Work?

Crypto yield, often synonymous with yield farming, is a revolutionary approach in the cryptocurrency sphere, offering a way to earn passive income from cryptocurrency assets. The concept, relatively new, has garnered significant attention in the crypto community. This article delves into the intricacies of crypto yield, how it works, its benefits, risks, and strategies.

Understanding Crypto Yield

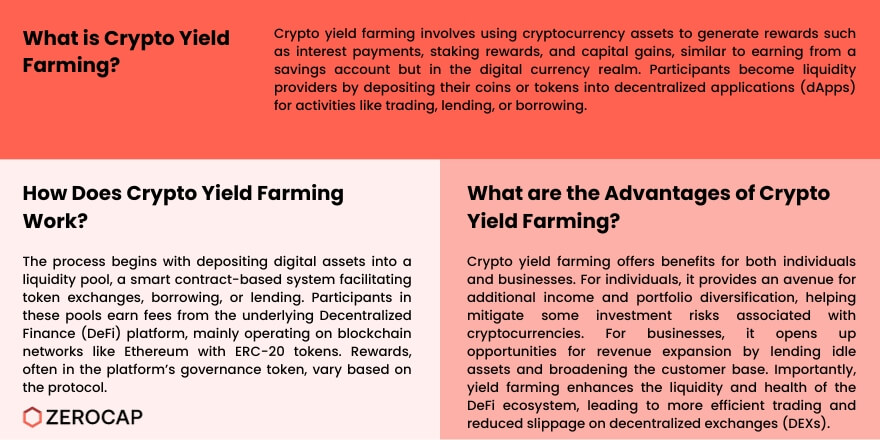

Crypto yield, or yield farming, involves utilizing cryptocurrency assets to generate rewards in various forms, such as interest payments, staking rewards, and capital gains. It’s akin to earning income from a savings account, but in the digital currency domain. Participants deposit their coins or tokens into decentralized applications (dApps) for activities like trading, lending, or borrowing, thus becoming liquidity providers.

How Crypto Yield Farming Works

The process starts with depositing digital assets into a liquidity pool, a type of smart contract that powers marketplaces for token exchange, borrowing, or lending. By contributing to these pools, participants earn fees generated by the underlying DeFi (Decentralized Finance) platform. This system operates primarily on blockchain networks like Ethereum, utilizing ERC-20 tokens. The rewards are often paid out in the platform’s governance token and vary based on the chosen protocol.

Benefits of Crypto Yield

Crypto yield farming offers several advantages. For individuals, it’s a way to earn additional income and diversify their crypto portfolio. It aids in mitigating some investment risks associated with cryptocurrencies. For businesses, it presents opportunities for revenue expansion by lending idle assets and attracting a broader customer base. Moreover, yield farming contributes to the liquidity and overall health of the DeFi ecosystem, enabling more efficient trading and reduced slippage on decentralized exchanges (DEXs).

Risks and Challenges

However, yield farming is not without risks. These include impermanent loss, network risks, liquidity risks, counterparty risks, and regulatory risks. Impermanent loss occurs when the value of tokens in a liquidity pool changes significantly, potentially leading to losses. The volatile nature of cryptocurrencies also adds to the risk factor, as the value of rewards can fluctuate dramatically. Additionally, smart contract vulnerabilities could lead to the loss of deposited funds.

Strategies for Maximizing Returns

Several strategies can enhance yield farming returns. These include lending idle assets, staking coins, and using various decentralized autonomous funds (DAFs). Platforms like Compound offer rewards for both supplying and borrowing assets, encouraging users to actively manage their investments to maximize returns. Yield farmers often shift their funds between different protocols to chase higher yields.

Conclusion

Crypto yield farming presents an exciting, albeit risky, avenue for generating passive income in the cryptocurrency world. While it offers potentially high returns, it requires a keen understanding of the DeFi ecosystem and a careful assessment of the associated risks. As with any investment, due diligence and a cautious approach are imperative for anyone looking to venture into yield farming.

FAQs

- What is a Hard Fork in Simple Terms? A hard fork in blockchain is a major change to the network’s protocol that makes previously invalid blocks/transactions valid, creating a permanent divergence from the previous version.

- Does a Hard Fork Create a New Currency? Often, yes. A hard fork can result in the creation of a new cryptocurrency, as seen with Bitcoin Cash emerging from a Bitcoin hard fork.

- Is a Hard Fork Good or Bad? It depends. Hard forks can bring beneficial updates or resolve key issues but can also lead to community splits and instability in the short term.

- How Does a Hard Fork Differ from a Soft Fork? A hard fork is a non-backward-compatible upgrade requiring all nodes to update, while a soft fork is backward-compatible and doesn’t require all nodes to upgrade.

- Can Users Lose Money in a Hard Fork? Users need to be cautious during a hard fork, as it can lead to temporary instability. However, they often receive an equivalent amount of the new currency, which could mitigate potential losses.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 2 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 19 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 12 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post