Content

- What are crypto ICOs?

- Crypto ICOs: A Brief History

- The ICO Bubble

- Lessons Learned

- Ethereum Primer

- 2020 & Beyond

- FAQs

- What is an ICO and How Does it Differ from an IPO?

- What Role Did Ethereum Play in the ICO Boom?

- What Lessons Were Learned from the ICO Bubble?

- What is the Connection Between ICOs and the Concept of Decentralised Finance (DeFi)?

- What is the Future of Ethereum and ICOs?

29 Jul, 20

Crypto ICOs: A Brief History

- What are crypto ICOs?

- Crypto ICOs: A Brief History

- The ICO Bubble

- Lessons Learned

- Ethereum Primer

- 2020 & Beyond

- FAQs

- What is an ICO and How Does it Differ from an IPO?

- What Role Did Ethereum Play in the ICO Boom?

- What Lessons Were Learned from the ICO Bubble?

- What is the Connection Between ICOs and the Concept of Decentralised Finance (DeFi)?

- What is the Future of Ethereum and ICOs?

In this piece, we will look at crypto ICOs: a brief history of what they are, how many of the cryptocurrencies you may already know of came into existence through crypto ICOs, the role that Ethereum played and the lessons learnt from this overly crypto-exuberant time.

Let’s get some terminology out of the way:

ICO — Initial Coin Offering.

Rekked — Getting completely destroyed.

FOMO — Fear of missing out.

HODL — Crypto version of ‘hold’ and has been popularised as a trading strategy.

Moon — When an asset’s price is shooting up rapidly… like a rocket as it is on its way to the moon.

Whale — an investor with large amounts of capital to allocate.

For the majority of the population, ICOs busted on the scene like the DeLorean time machine bringing MJ Fox and his futuristic appeal to turn the tide of history through decentralisation, blockchain, crypto kitties and Shiba Inu Doge memes.

Whether a project needed it or not, decentralisation was the universal catch-cry of the masses, and blockchain the public speaking point for a generation of crypto enthusiasts and corporates looking to change the world, or simply get rich.

Even though ICOs had been around since 2013, it was 2017 that provided the perfect storm of conditions for retail investors, who had traditionally been left out of the wealth creation channels of the wholesale, accredited and sophisticated markets. Now the general public and retail investors had an opportunity to get in early and capitalise on an unregulated opportunity, promising life-changing wealth in a very short time frame.

Additionally, they also were given those sour satori moments of clarity, through the long time-honoured tradition of getting wrecked. Lessons and education sometimes comes with a tertiary degree, and sometimes, with the unpleasant experience of getting completely wiped out, or as the kids on the internet say, getting rekked.

What are crypto ICOs?

ICOs (Initial Coin Offerings) are the crypto sphere’s version of an IPO (Initial Public Offering) without all the rigmarole, red tape, investor security and compliance. Traditionally, when a company needs funding, it has a couple of choices; either the equity or debt markets. With ICOs, a new market emerged, where companies now had the opportunity to crowdsale (the crypto sphere’s version of crowdfunding) their project in return for non-equity utility tokens.

Supporters and speculators invested in these crowdsales with the hope of outsized returns when liquidating on crypto exchanges and OTC markets.

It should be noted that ICOs are always tied to some form of decentralisation and blockchain technology.

ICOs mimic IPOs in that they are both used to raise capital, and that is really where the similarities end.

Some of the key differences between a crypto ICO and an IPO are:

- In an IPO you buy a share of the company. In an ICO you buy a token, which represents a variety of things within the project’s ecosystem e.g. utility, value, voting, staking etc.

- IPO, founders are required to give up equity. ICO they aren’t.

- IPOs are regulated. ICOs are unregulated and thus scams and fraud are more prevalent, alongside moral hazard.

- IPOs typically require a broker to fund through, whereas in an ICO the investor can contribute directly to the project through the nominated cryptocurrency (e.g. Ethereum)

Much like an IPO, there are different stages of funding for an ICOs, which is roughly broken down into 3 stages:

- Private sale, which would be only open to select crypto whales and funds.

- Pre-ICO where early investors from the public are able to invest and get the bigger bonuses on offer to the public.

- ICO which in itself may have different tiers of bonuses available to the public.

Crypto ICOs: A Brief History

ICOs only became possible with the advent of bitcoin and the blockchain.

Bitcoin solved the problem of double spending and reversibility of digital payments. And paved the way for a new class of digital currencies and assets to emerge, it was Ethereum that made it possible to scale with smart contract technology, and for projects to issue crowdsale contracts and their own Ethereum tokens.

More than just being a system of smart contracts, Ethereum became the default platform for the ICO mania and billions of dollars in funding for a plethora of decentralised crypto projects.

ICOs do have a brief history: the first ICO was conceived in 2012 by J.R. Willett when he published his white paper ‘The Second Bitcoin White Paper’. It wasn’t until 2013 through a kickstarter-esque model that he launched Mastercoin (now called Omni), and raised USD$500,000 worth of bitcoin.

Willett was able to raise this capital based on a white paper and a promise of technological advancement, which in the case of Mastercoin was the promise of developing a protocol on top of Bitcoin that would use blockchain technology to store digital contracts. What was unique about Willett’s approach was that his inability to raise capital through traditional channels forced him to create an alternative crowd-funding model with minimal red-tape and paperwork, and allowed the retail market to capitalise on the opportunity. This was one of the differentiating factors from IPOs — projects were able to connect to their supporters and community, and interact with them at a much more personalised level.

Since Mastercoin’s successful capital raise in 2013, thousands of companies jumped on and fully embraced what Willett had created, and deployed the ICO model to amplify their own capital raising efforts. Many of these projects had no business plan, no working product, a small team, and in some odd cases, no legitimate or real person fronting the project. What then followed was a Bieber-level fever that spread across the world; anyone with an idea, a marketing plan, and a white paper could raise millions. The ICO mania peaked between mid 2017 and early 2018:

- In 2017 there were 875 ICOs that raised in a total of 6.2bn USD, where in the peak of the market in December alone over 1.6bn USD was raised.

- In 2018 there were 1,253 ICOs that raised 7.8bn USD, which saw a gradual decline over the year from January (1.5bn USD raised) through to December (74.5m USD raised).

Essentially what we saw was the equivalent of pets.com during the dot-com boom, amplified by frictionless Ethereum transfers and an unsophisticated investor base. Check this animation from 2017 of what 4 years of ICO activity looks like.

The ICO Bubble

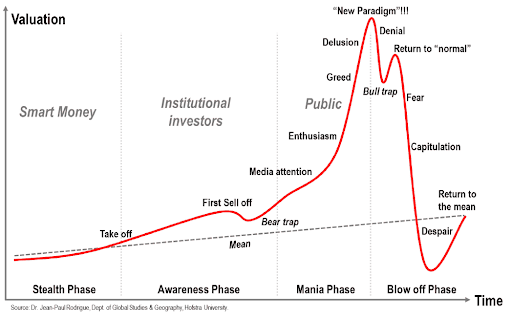

Bubbles bring out the best and worst in us. When it’s taking off, people feel like a financial gurus as they willingly suspend disbelief, comforted by the delusion that it will keep going up through the media attention, the enthusiasm, past the greed and the new paradigm to the moon.

Yet what investors and speculators typically find, as with other bubbles, is the cold harsh reality that asset trend lines don’t care about your hopes and dreams. As in the past, the ICO bubble crashed, and it crashed hard.

One of the key indicators of bubbles are cabbies — when your taxi driver starts giving you ICO recommendations, be wary and consider selling!!! ICOs brief history are exciting, but also used as an opportunity to take advantage of novel investors.

To understand the ICO bubble through a brief history, and how projects like EOS (4.2bn raised), Telegram (1.7bn raised) and TaTaTu (575m raised) were able to temporarily displace the investment rationale of investors, we have to understand the the nature of bubbles, the mentality of the investors, and the conditions that made it possible.

Bubbles by their very nature reflect the irrational exuberance of the investor market and activate the avarice DNA laying dormant in each one of us. Bubbles form because of that inherent need within us to transform our lot in life, and manifest in unsubstantiated beliefs that the asset’s price will continue to increase. Because of the infrequent nature of bubbles, every time one starts forming, investors think that it is going to be different from the last time.

One of the driving factors in the crypto ICOs bubble were the honey badger stories of bitcoin — PR’d as the asset that went from cents to thousands of dollars. Investors started looking at these ICOs whose tokens were 10 to 20 cents, and invested with the belief that they had found the next Bitcoin, wholeheartedly justifying ridiculous business cases. Like we needed to decentralise dog walking service providers!

Projects didn’t raise millions of dollars because of the problem they were solving, they raised millions because investors wanted to see the 10x returns on projects they had read about in the media, or that were recommended to them by their favourite crypto guru. And for a period, we saw some projects that were not just 10x’ing, but 100x’ing within weeks of launching.

Lessons Learned

What we learned from this extremely tumultuous period in crypto-history was that investors were willing to put their money into projects that didn’t necessarily have a working product, a well-written White Paper, or even a business plan. In short, if you had tokens to sell in mania, there were definitely people willing to buy them. And if you knew a little about digital marketing and hype, then you had the potential to raise millions. Yet, in the hubris of the crypto ICO market, 95% of projects failed, and investors lost roughly 90% of the value of most of their ICOs they invested in.

What we learned:

- That the human brain is lazy, and would rather outsource its decision making functions on investing to friends, social media groups, and YouTube crypto gurus.

- That if you asked 9 out of 10 investors to tell you about the ICO projects they had invested in, they wouldn’t know the project, but they would know the advisor that the project had on board. An advisor with a good name (perception is reality) was a stamp of approval to the project.

- That, as with other asset classes, smart money gets in early at the lows, sells at the highs, and dumb money gets in at the highs, sells at the lows.

- That ultimately, crypto VC funds got just as rekked as the retail investor market.

So how does all this relate to what we are doing today?

Bubbles aren’t always ‘bad’. They lay the foundation for innovation, and activate much greater risk taking in startups that would ever be possible without the large and sudden inflows of capital. The dot-com bubble was responsible for Voice-Over-IP, ecommerce and more — virtually the web as we know it today.

The massive output of innovation over such a short duration was only possible due to the bubble itself.

Although the bubble has popped, we were left with the foundations of what the internet ultimately became — Amazon, Ebay, Skype, eventually Youtube and Netflix.

Despite ICOs brief history, our view is that the ICO boom was necessary for the testing and development of foundational technology, and that this foundational technology is forming the next wave of innovation.

The key assets? Bitcoin and Ethereum.

Think of them as the internet after the dot-com boom. Alive and well, taken through the ringer, separated from the rest of the noise (ICOs) and well worth consideration as more than just a get-rich scheme, but as compelling additions to any discerning investor’s portfolio.

We’ve run through our case for Bitcoin over the past few months, and so has Chris, well forever. We are now building an interesting business case for another digital asset that complements Bitcoin. Ethereum.

Ethereum Primer

Bitcoin is a censorship resistant, non-sovereign store of wealth, whilst Ethereum is smart-money. Think of Bitcoin as digital gold, and Ethereum as the iPhone. Both are valuable in very different ways. During the crypto ICO boom Ethereum was widely used as the payment mechanism and onramp for funding many of these projects due to its programmability.

If I want to start my own token that is used to power my online cat shop, I can (fairly) easily set up this token in the Ethereum language (ERC-20).

CATNIP Token is born.

I determine the circulating supply, inflation (if any), and governance rules.

Customers can buy and sell this token on an exchange, or decentralised exchange, creating a free-market for my cat shop.

The more the token is used, the higher its value.

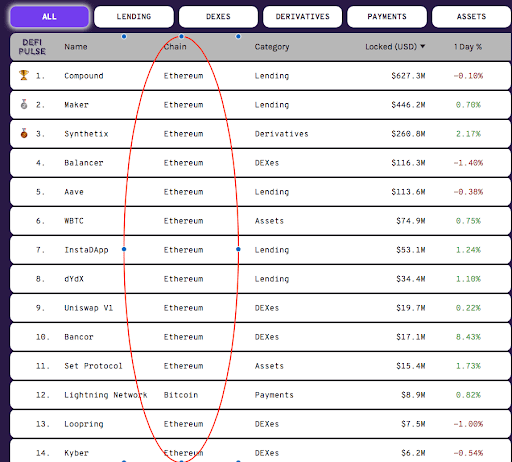

During the ICO boom, this model led to moral hazard as (many) people, opportunists and projects launched, invested and participated in the hope of fast and free money. And whilst the boom went bust, the Ethereum protocol survived, opening the door for the legitimate projects to continue building on. And build they did:

2020 & Beyond

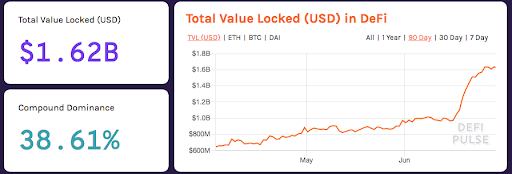

Introducing Defi — Decentralised Finance. A movement that is very quickly gaining traction due to Covid-era QE, constricting yields and a growing distrust of banks. In a nutshell, these projects are working to create frictionless finance by removing the middle-man in transactions, whilst bringing transparency by using public blockchain ledgers. You know why the banks make so much goddamn money? Because they sit in between depositors, borrowers and transactions, defining their own clip.

And what a clip they take. Defi is the leveller.

Imagine jumping on the train at the beginning of a bubble, rather than the end? Whilst backing any individual Defi project is inherently risky, backing the protocol on which they sit is (much) less risky.

And which protocol is that?

Although ICOs brief history has plenty of development to do, it all points to the Ethereum network leading the future. We’ll leave this with you for now as we’ll be releasing a business case for Ethereum in the coming weeks.

Happy disrupting!

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at [email protected] or visit our website www.zerocap.com

Originally published at https://capitalistexploits.at on July 25, 2020

FAQs

What is an ICO and How Does it Differ from an IPO?

An Initial Coin Offering (ICO) is a fundraising mechanism in the cryptocurrency world, which is somewhat similar to an Initial Public Offering (IPO) in the traditional financial world. However, in an ICO, investors buy tokens of a cryptocurrency, not shares of a company. ICOs are unregulated, making them susceptible to scams and fraud, while IPOs are regulated and require a broker for funding.

What Role Did Ethereum Play in the ICO Boom?

Ethereum played a significant role in the ICO boom due to its smart contract technology. It allowed projects to issue crowdsale contracts and their own Ethereum tokens. Ethereum became the default platform for the ICO mania, facilitating billions of dollars in funding for a plethora of decentralised crypto projects.

What Lessons Were Learned from the ICO Bubble?

The ICO bubble taught investors about the risks of investing in unregulated markets. It showed that many projects could raise millions without a working product, a well-written white paper, or even a business plan. However, 95% of these projects failed, and investors lost roughly 90% of the value of most of their ICOs they invested in.

What is the Connection Between ICOs and the Concept of Decentralised Finance (DeFi)?

The ICO boom laid the foundation for the testing and development of foundational technology, which is forming the next wave of innovation in the form of Decentralised Finance (DeFi). DeFi projects are working to create frictionless finance by removing the middleman in transactions, while bringing transparency by using public blockchain ledgers.

What is the Future of Ethereum and ICOs?

Despite the ICO bubble, Ethereum survived and continues to be a significant player in the crypto space. It is the protocol on which many DeFi projects are built. While backing any individual DeFi project is inherently risky, backing the Ethereum protocol is considered less risky. The future of Ethereum and ICOs is tied to the development and success of these DeFi projects

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 15th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 8th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post