20 Jan, 26

Weekly Crypto Market Wrap: 19 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

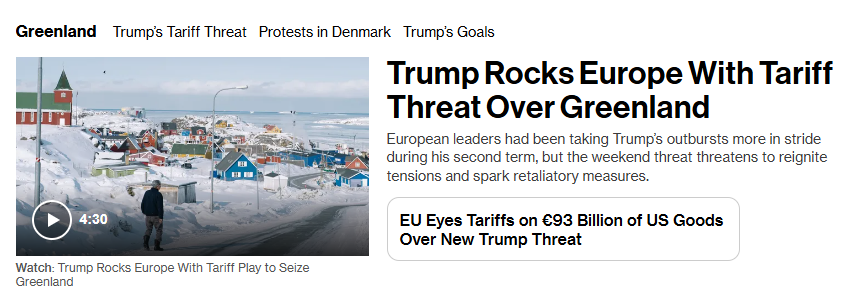

- Trump announces new tariffs on eight European countries over Greenland; EU prepares up to €93bn in retaliation

- White House – Coinbase clash puts CLARITY Act support at risk over stablecoin yield rules

- CME to add Cardano, Chainlink and Stellar futures to crypto derivatives lineup amid shift towards 24/7 trading

- South Korea passes framework enabling issuance of tokenised securities

- Goldman Sachs explores tokenisation and prediction markets as U.S. regulatory clarity improves

Technicals & Macro

Markets

Markets remained resilient last week, navigating a series of macro and political crosscurrents with surprising calm. U.S. equities were mixed as small- and mid-caps extended year-to-date leadership. The Russell 2000 and S&P MidCap 400 hit new all-time highs, while large-cap indexes gave back some ground. Value continued to outperform growth, and early earnings season delivered a split outcome across banks, while TSMC’s upside surprise helped support AI-linked sentiment.

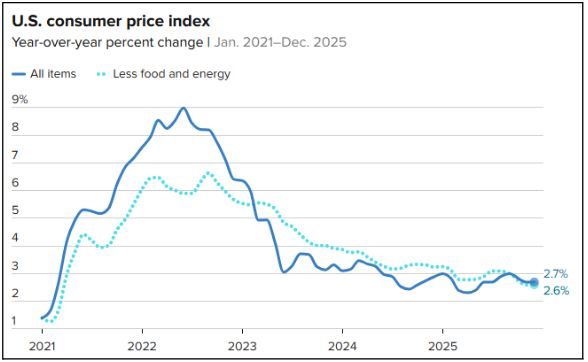

Source: U.S. Bureau of Labor Statistics (Data as of Jan. 13, 2026)

The inflation backdrop remains supportive. Core CPI rose just 2.6% year-on-year in December, the slowest pace since March 2021, while producer prices ticked higher but remain well-contained. Retail sales beat expectations, and housing data surprised to the upside. Mortgage rates continued to fall, with the 30-year fixed rate approaching 6%, helping drive a rebound in existing and new home sales.

Source: x.com (@gilmoreport) – The Orange Swan

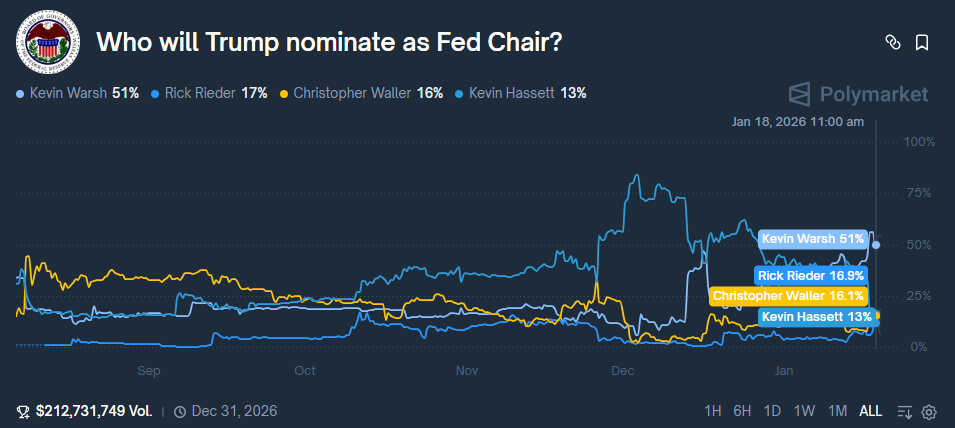

Though markets are not being driven by data alone. Much of the tension is coming from political noise. President Trump’s barrage of early-2026 headlines included military intervention in Venezuela, tariff threats toward Europe and Iran, and renewed efforts to replace Fed Chair Powell. A DOJ subpoena over Fed building renovations has sparked concern about central bank independence. Markets are watching closely for a potential leadership transition at the Fed, with Kevin Warsh now floated as a more conventional successor to Powell.

Source: Polymarket

A Supreme Court ruling on Trump’s tariff authority is also in focus. A ruling against the administration could create near-term volatility around trade policy, refund liabilities, and deficit expectations.

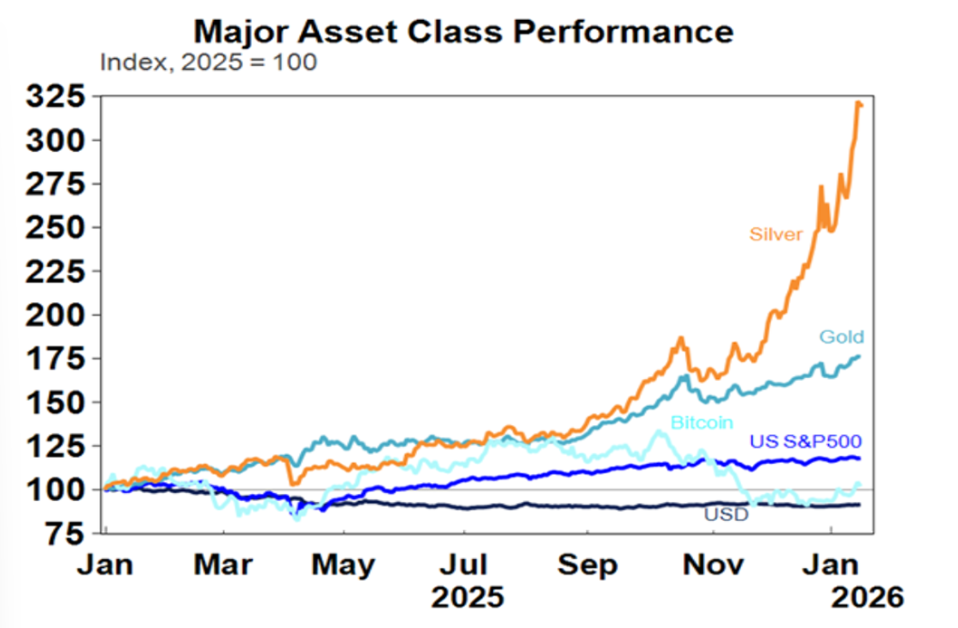

Source: AMP

Despite this, markets have held up. Equities and the USD remain higher year-to-date, and rates have yet to meaningfully reprice. The assumption remains that political theatrics will meet institutional resistance and that the White House ultimately wants stable asset prices heading into the midterms.

Crypto

Source: TradingView

Last week, Bitcoin broke above the $95,000 level that had capped price action since November, and traded closer $97,000. The move comes as digital assets begin to catch up to the broader rally in equities and precious metals. With gold pricing in fiat debasement and geopolitical risk for weeks, Bitcoin’s relative underperformance has started to reverse. Its cheaper valuation versus hard assets may now be triggering renewed rotation into the crypto space.

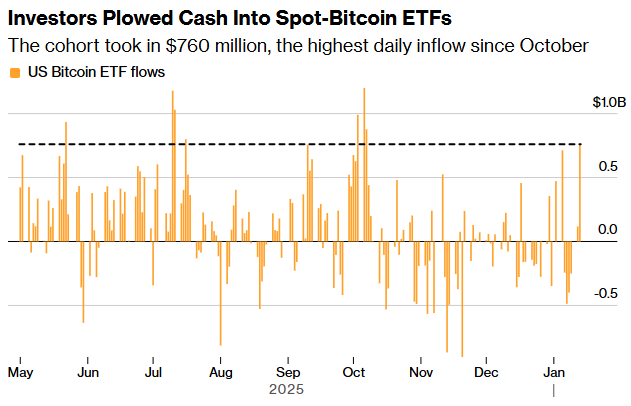

Source: Bloomberg

Spot Bitcoin ETFs are seeing strong demand. On Tuesday, the group recorded $760 million in net inflows, the largest daily total since the October crypto drawdown. Fidelity’s FBTC alone accounted for $351 million. Ether is participating in the move as well, gaining 6% midweek and pushing year-to-date returns to over 13%. Ether ETFs also attracted $130 million in new capital during the session.

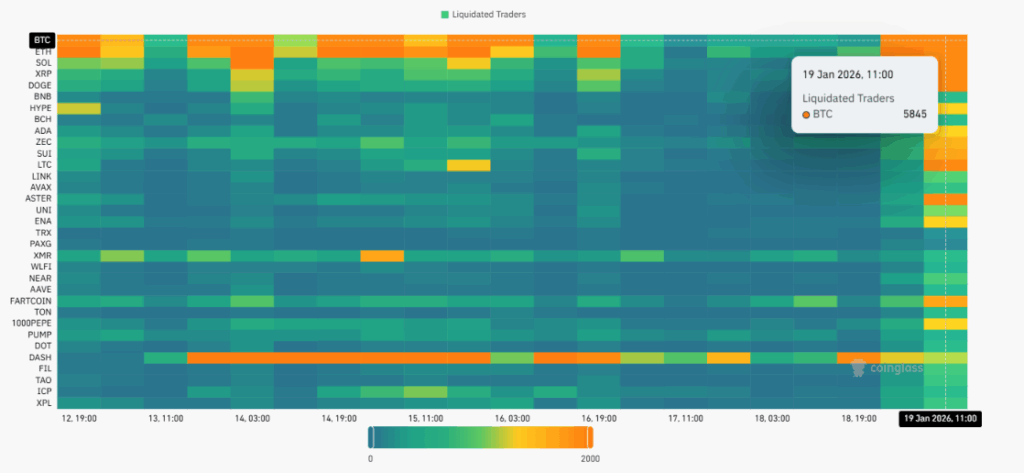

Source: Coinglass

While flows and price momentum are clearly turning, the market remains highly levered. A sharp move earlier today triggered a $869 million long liquidation cascade, with over $229 million from BTC and $154 million from ETH. This was one of the largest liquidation events since Q4 last year and was likely triggered by a rapid repricing across risk assets following several macro headlines.

Source: Bloomberg

Specifically, President Trump imposed a 10% tariff on eight European countries over Greenland, escalating to 25% by June if no deal is struck. The EU immediately began preparing EUR 93 billion in retaliatory tariffs, while Iran issued direct military warnings in response to U.S. rhetoric. The sudden geopolitical repricing appears to have tripped long-side leverage across crypto, leading to the sharp flush.

Despite the volatility, the market recovered relatively quickly with BTC finding its feet in this range, suggesting strong underlying bid and that much of this macro noise is priced. The setup resembles early-stage risk-on rotation, where structural flows (ETF demand, asset reallocation) are more durable than short-term positioning noise. With ETF flows returning and Bitcoin reclaiming macro narrative relevance, the outlook still remains constructive.

Stay safe!

Emir Ibrahim, Analyst

Spot Desk

Client flow dynamics this week remained consistent with behaviour transitions into year-end, characterised by an extreme concentration of volumes in majors. Bitcoin (BTC) and Ethereum (ETH) saw the highest activity with split directionality; BTC skewed toward the buy side, whereas ETH volumes were dominated by selling. Solana (SOL) was exclusively bid for the week in a display of recovering sentiment following October’s broad-based market liquidations, with participants potentially interpreting futures volumes well below pre-event levels to indicate a market cleared of excess leverage and a cleaner structural slate for upside. In stablecoin flows, we saw balanced activity in USDT/AUD, a significant uptick in USDT/USDC to USD off-ramping and steady demand for AUDD as a robust alternative to traditional banking rails.

Despite a tumultuous geopolitical backdrop, Bitcoin saw strong performance last week, climbing from $91,013 to highs of $97,924 – aided by strong U.S. spot ETF performance as US$1.4 billion of inflows marked the strongest weekly intake since October. However, this momentum stalled over the weekend session as BTC consolidated around 95,000 before a sharp risk-off move this morning saw BTC drop from $95,498 to $91,910 in just two hours, tracking a gap down in U.S. equity futures and a continuation of the parabolic surge in precious metals on market open. ETH followed, retracing much of its weekly gains in the morning’s downward move to close the week modestly green at $3,284 before continuing to slide into Monday’s Asia session alongside broader risk.

AUD/USD remained remarkably rangebound amidst the geopolitical volatility, opening at 0.6678 and trading between 0.6667 and 0.6729 to close just a pip higher at 0.6679 – in a relatively muted response to U.S. Core CPI YoY coming in softer than expectations at 2.6%. In global headlines, President Trump announced 10% tariffs on eight European nations over Greenland, sparking a €93 billion retaliatory threat from the EU and an emergency meeting for European leaders set for Thursday; meanwhile, last-minute lobbying from Gulf allies persuaded the U.S. to hold off on military strikes against Iran. Locally, markets look ahead to Thursday’s Australian unemployment print while the MoM Core PCE Price Index – the Fed’s preferred inflation gauge – headlines economic data prints out of the US for the week.

Beyond immediate price action, regulation and institutional adoption continue to drive the crypto headline cycle. CME Group will add Cardano, Chainlink, and Stellar to its derivatives lineup on February 9 as they ease towards 24/7 markets and an “always-on” model in 2026, while the CLARITY Act faces hurdles as Coinbase and the White House clash over stablecoin yield provisions. BitMine Immersion Technologies announced a $200 million investment into MrBeast’s Beast Industries, linking the largest ETH treasury with a 460 million-subscriber creator ecosystem. On the banking front, Goldman Sachs confirmed active exploration of tokenisation and stablecoin technology, while South Korea’s legislature passed amendments establishing a legal basis for tokenised securities.

As U.S. markets return from the MLK Day holiday, all eyes turn to Tuesday’s cash open to see if the current risk slide can find a floor.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions and competitive pricing across majors, stablecoins, and altcoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Ben Mensah, Trading Analyst

Derivatives Desk

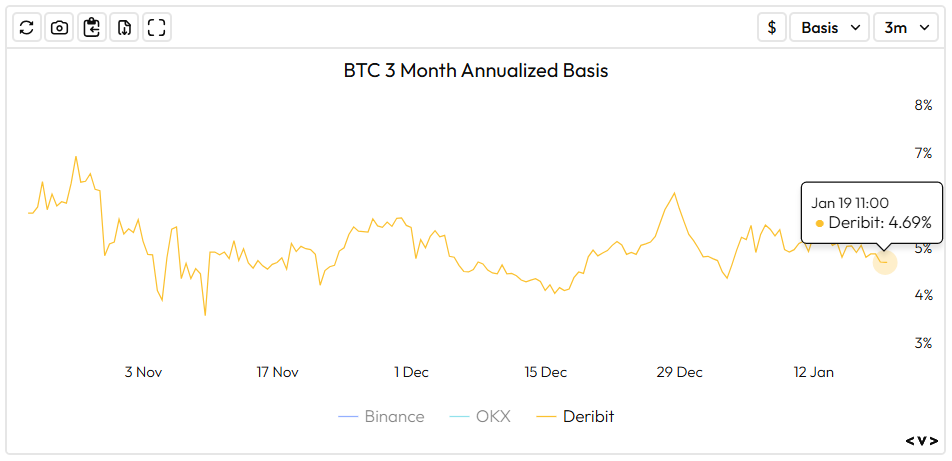

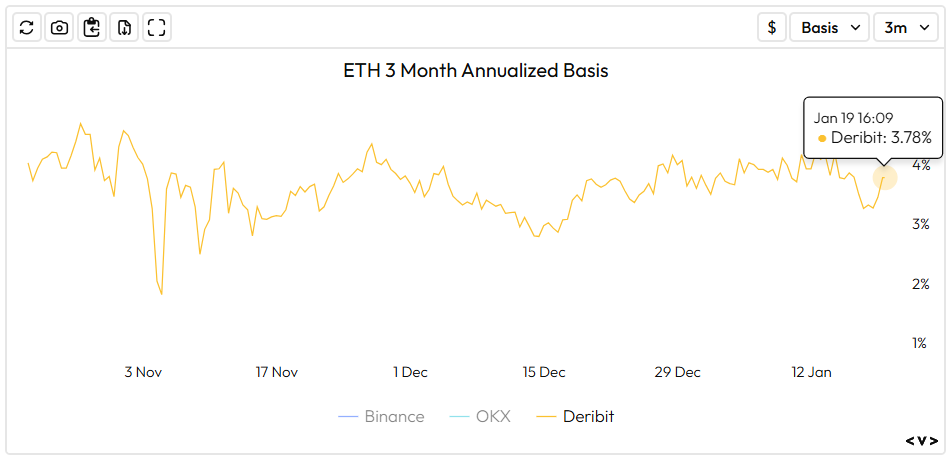

Basis rates traded lower this week. The BTC 90-day basis rate is down 65 bps to 4.69%. ETH’s is down to 3.78%.

Source: Velodata

Trade Idea: Jun ’26 Bull-Call Spread ($120k/$150k)

- Strategy: $120k / $150k Bull-Call Spread

- Expiry: June 2026 Expiry

- Cost Basis: ~2.7% / $2,500 USD per unit

- Potential Payout: 12x Premium Spent

The strategy is predicated on three specific market factors currently observed in early 2026:

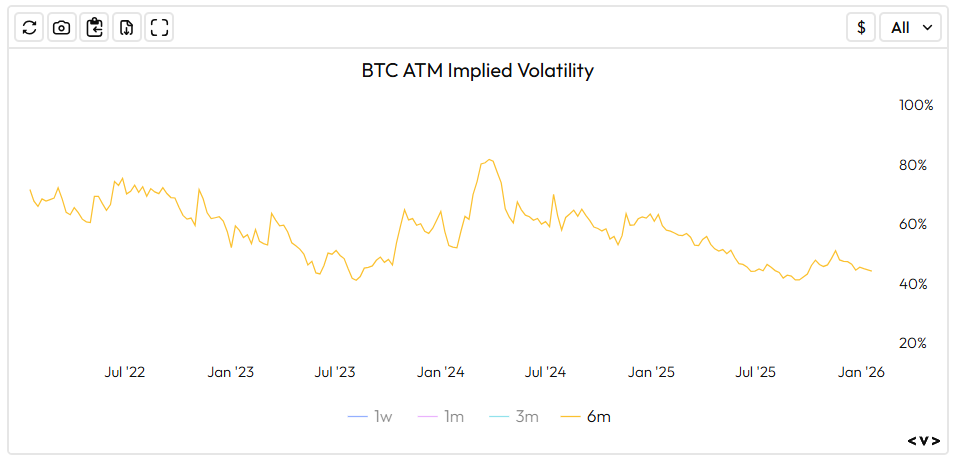

1. Volatility at a Discount: After a sluggish 2025, long-term ATM Implied Volatility (IV) has dwindled, making option prices cheaper than usual.

Source: Velodata

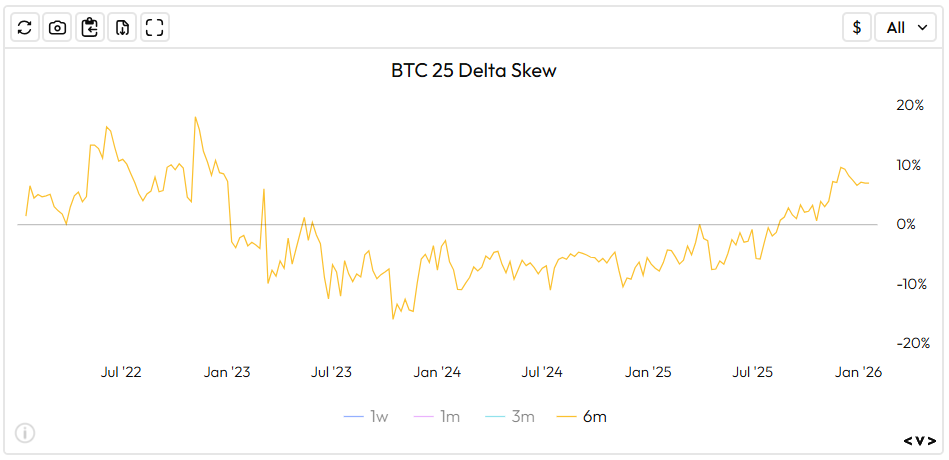

2. Skew Advantage: Current risk reversals show a distinct bias toward puts (downside protection). This makes OTM upside exposure via calls cheap.

Source: Velodata

3. Low Basis Rates: With current basis rates compressed, the structural “cost of carry” is at a cyclical low. Since lower rates reduce the forward premium in option pricing models, upside calls are currently priced at a relative discount (chart shown above).

Hit the Derivs Desk up for refreshed Pricing!

What to Watch

MON: CN GDP Growth Rate YoY, CA Inflation Rate YoY

TUE: GB Unemployment Rate YoY

WED: GB Inflation Rate YoY, US API Crude Oil Stock Change

THUR: AU Unemployment Rate, US Core PCE Price Index MoM (Oct and Nov), US GDP Growth Rate QoQ, JP Inflation Rate YoY, BOJ Interest Rate Decision

FRI: GB Retail Sales YoY

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 12 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 15th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post