16 Dec, 24

Weekly Crypto Market Wrap: 16th December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

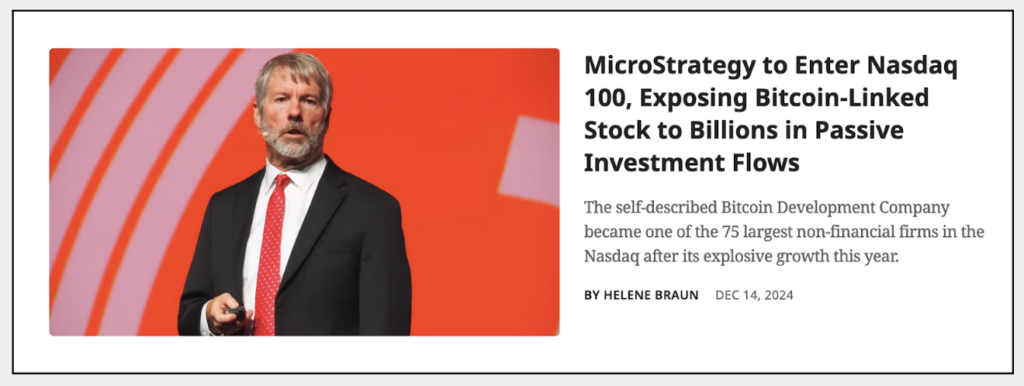

- Microstrategy joins the Nasdaq 100.

- Bitcoin spot ETFs recorded a net inflow of $2.17 billion last week, from December 9 to December 13. Meanwhile, Ethereum spot ETFs saw a record $855 million in net inflows during the same period.

- BlackRock has recommended a bitcoin allocation of 1% to 2% in multi-asset portfolios, as per a new report.

- Riot Platforms plans private offering of $500m Convertible Senior Notes for Bitcoin acquisition and corporate purposes.

- El Salvador is reportedly nearing a $1.3 billion loan agreement with the IMF within weeks, tied to its adoption of Bitcoin as legal tender and efforts to reduce its deficit.

- GFO-X has entered into a multi-firm partnership with ABN AMRO Clearing, IMC, Standard Chartered Bank and Virtu Financial, ahead of its launch in Q1 2025.

- Crypto.com partners with Deutsche Bank to expand corporate banking support across Singapore, Australia, and Hong Kong.

- Japanese crypto exchange Coincheck to trade on Nasdaq starting Dec. 11 after a $1.3B merger with Thunder Bridge Capital.

Technicals & Macro

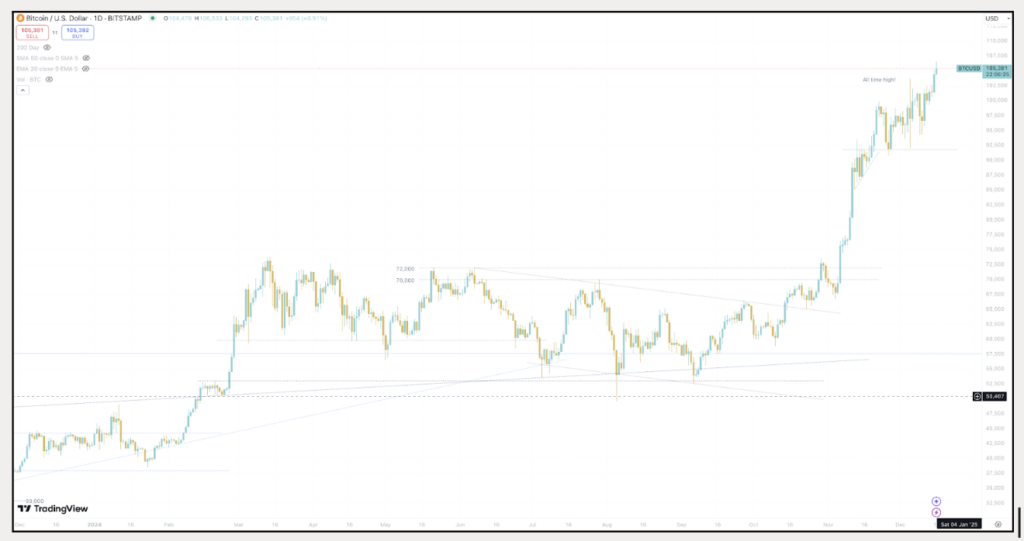

BTCUSD

Source: TradingView

Key levels

66,000 / 73,000 / 92,000 / ~106,533 (all-time high)

Another week, another all-time high.

We’ve hit 106,533 today, and there is buoyancy in price action as Europe gets going. Major news to hit the wires this week (which I can’t believe I didn’t consider earlier) is Microstrategy getting into the Nasdaq 100.

Source: Coindesk

This is huge – as it opens to the door to not so active capital. We’ve spoken in the past around the kind of capital that gets into bitcoin, and sure over the years this has shifted. In 2009 it was anarchists, technologists and drug dealers; in 2015 it was early adopters buying the break of $400, with little signs of institutional adoption; in 2020 it was the QE trade. In all of these examples, the market was actively bidding on BTC as a proxy, a view or a utility (transfer of value). Fast forward to now – and we have a very different dynamic at play. Passive capital.

I can’t tell you what’s sitting in my retirement account. I could be holding just about anything, I simply trust the superannuation fund to buy a basket of goods that broadly reflects the index. And that’s the key comrades, MSTR is now part of the index now – which means the capital base now includes all that soft passive capital that people don’t even think about. Those funds that buy the ETF, will, well – buy the ETF. This won’t hit the retirement capital pools from day one, but there are $550 billion in assets under management from current ETFs that track the Nasdaq stock market that could be first off the ranks to allocate. Notably – is that these ETFs have no appetite to time the market. They are buyers and sellers at any price, as long as it coincides with the rebalancing schedule.

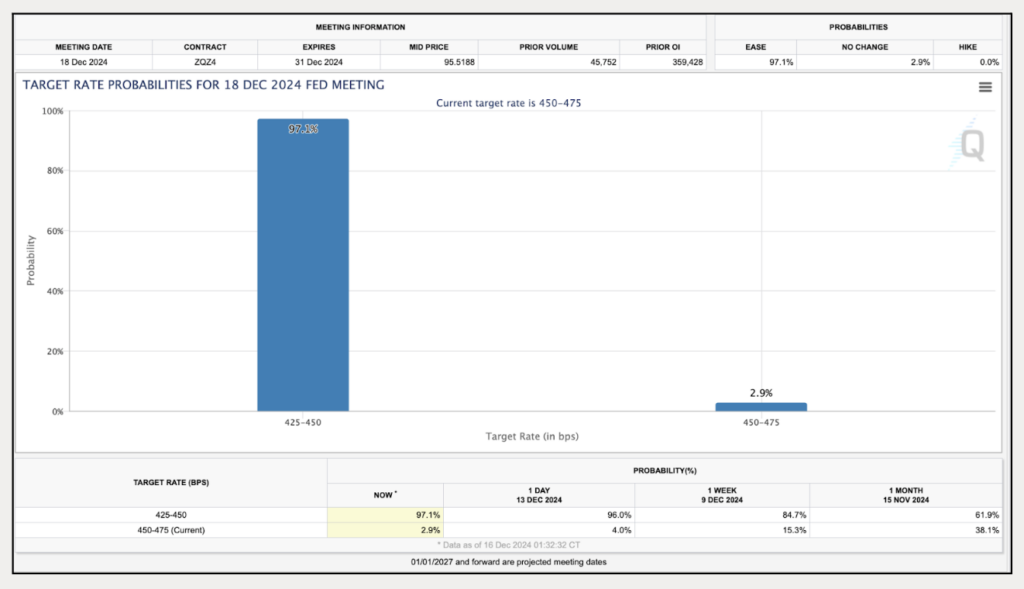

On the macro front, this week we’ve got the FOMC, which is now all but priced in for a 25bps cut. This said, the yield curve is a little uncertain on the pace of cuts into 2025, and has been swinging around. This could put a cap on risk assets leading into the new year. The question you’ve gotta ask yourself – is bitcoin trading as a risk asset right now? One could argue both sides, but one thing is for sure, there is some heat behind this move and the lower liquidity period into the end of December could see some wild swings.

Source: CME

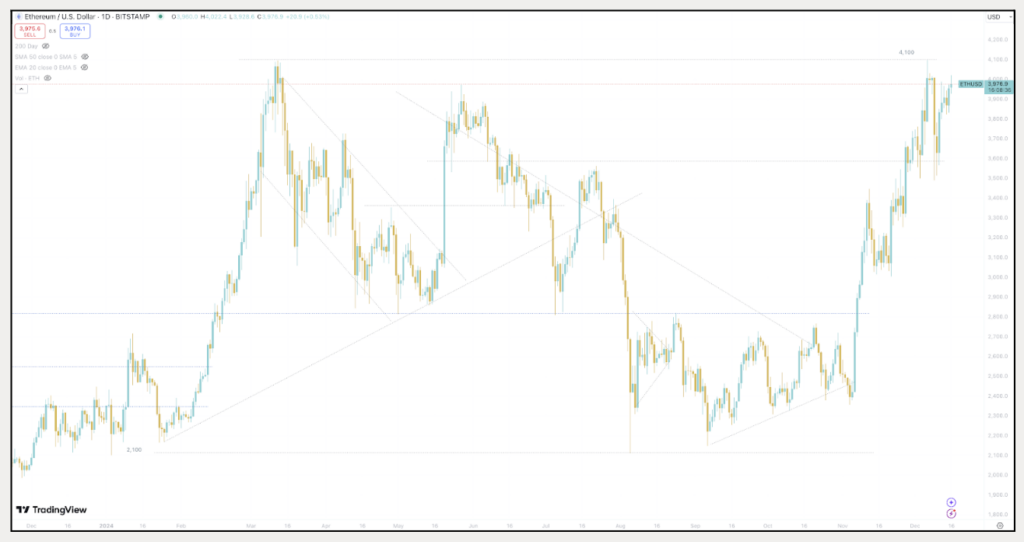

ETHUSD

Key levels

2,800 / 3,000 / 3,500 / 4,100

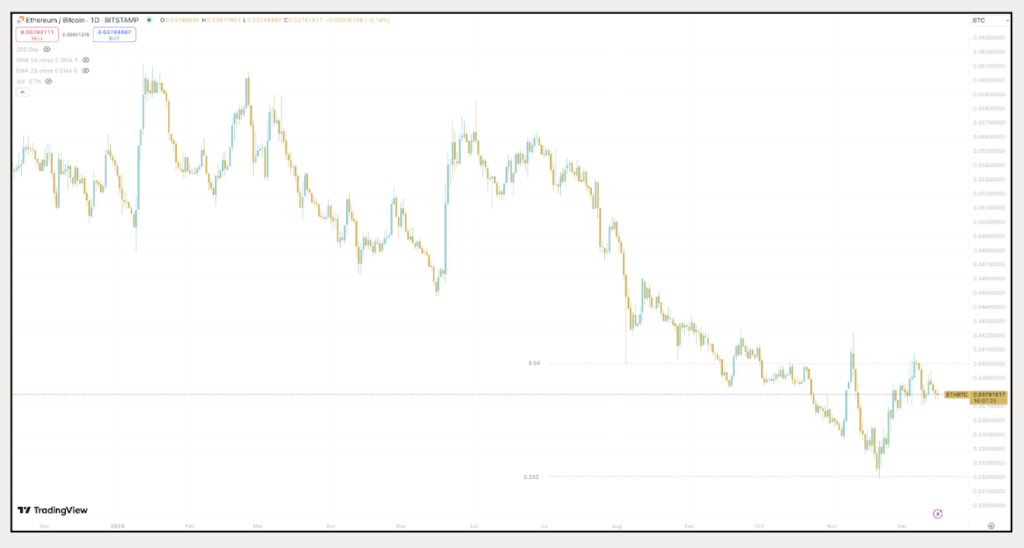

ETHBTC

Ethereum has had a good run, but can’t seem to break bitcoin dominance. ETHBTC is struggling above 0.04. I’ve said this a few times – until Trump takes office and works on his first 100-days, with the market digesting fact vs fiction, bitcoin should maintain dominance. Longer-term, ETH is still a great play in our view – but one that needs a little growth in the institutional space before we see the kind of allocation we are seeing into BTC right now.

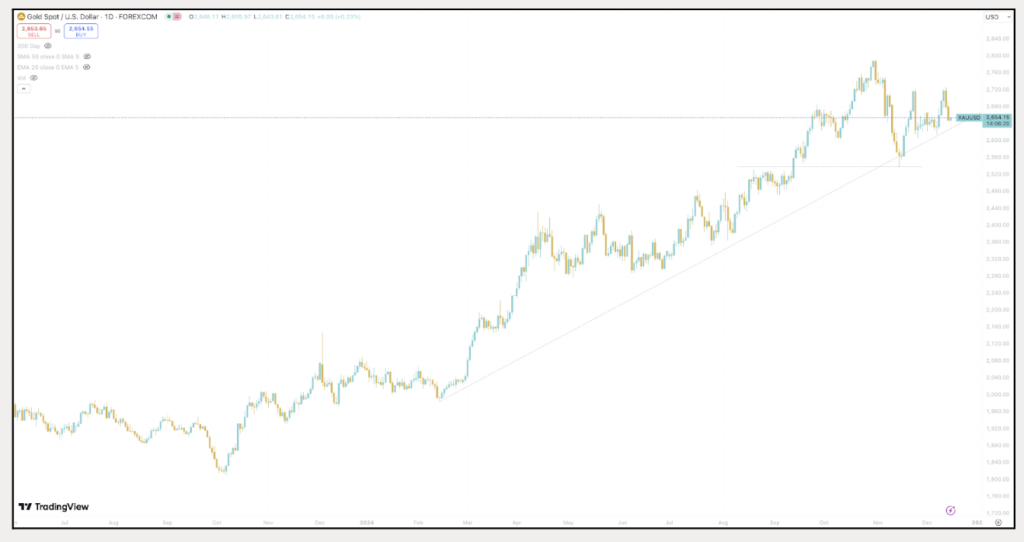

Gold hanging onto its trendline

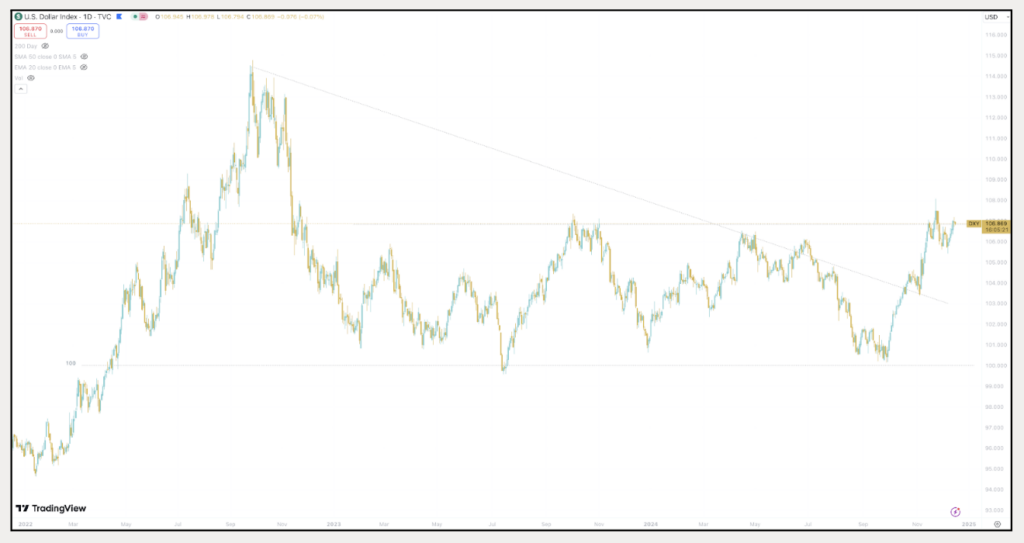

Dollar index hanging in the multi-year range

DXY working to break out – the yield curve and velocity of the cutting cycle will be key here to finding the next price range, but I’m not sure we’ll get much direction until Jan.

Be safe out there and watch the leverage after this recent BTC move.

Jon de Wet, CIO

Spot Desk

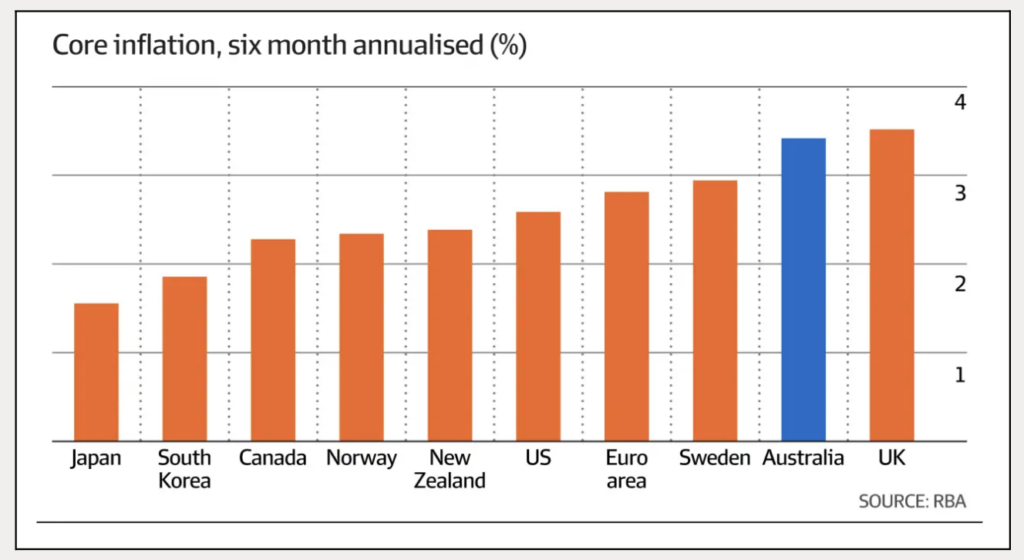

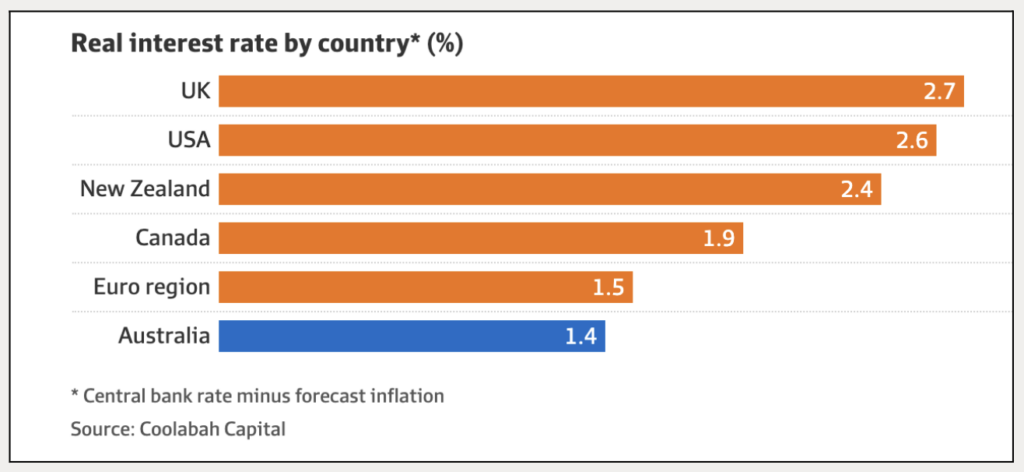

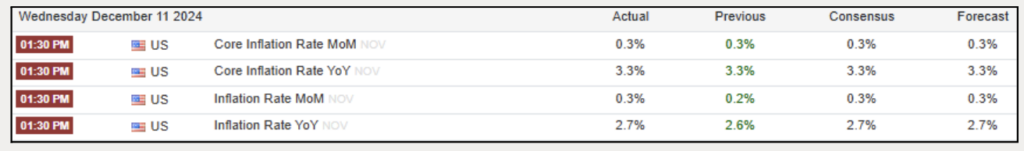

Last week AU RBA interest rate decision remained at 4.35%. The RBA hanging in there against a sea of other nations cutting. The following charts and good reminder of why – inflation up, real interest rate (adjusted for inflation) beneath other developed nations. And when your one tool is a hammer, well.. everything is a nail.

Meanwhile, US core and inflation rate MoM and YoY remained on consensus.

This resulted in AUD trading in the same price range that it was the prior week against USD, sitting currently at ~0.635, historically low.

Next week market participants should look out for any surprises surrounding the US Core PCE Price Index MoM forecasted to remain at 0.3% (Friday 1:30pm UTC), however this will likely be overshadowed by the expected FOMC cut.

On the desk..

Clients were heavily skewed to offramping USDT/AUD given historically low AUDUSD. AUD remained in constant high demand as we have observed whenever AUD/USD is trading below 0.65. BTC flow was skewed to the offer as investors added to their portfolios.

On balance, most of our crypto flow was largely skewed towards clients buying altcoins such as XRP, CRV, NEAR, BASEDAI, AR, AERO, CHEX. Do we see altcoins run on the back of the current BTC price? Our desk is definitely seeing this from many clients.

Zerocap’s OTC desk is dedicated to providing customized cryptocurrency liquidity solutions, offering competitive rates across major coins, altcoins, and memecoins, paired with key fiat currencies. We also ensure seamless trading experiences with T+0 settlement.

Please don’t hesitate to get in touch with us.

Oliver Davis, Trading Associate

Derivatives Desk

WHOLESALE INVESTORS ONLY*

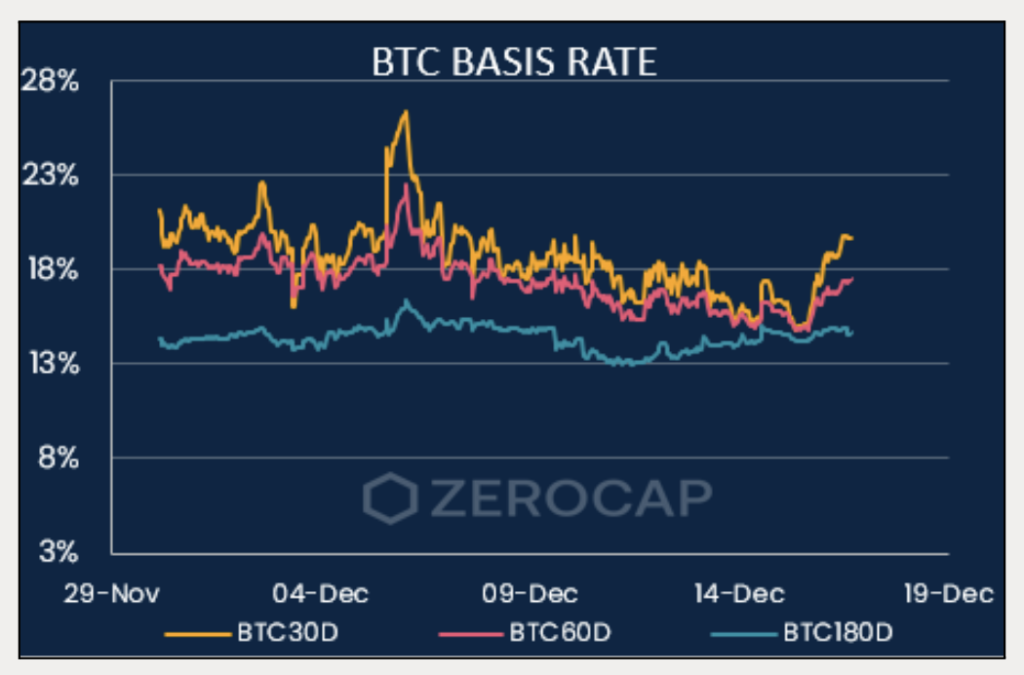

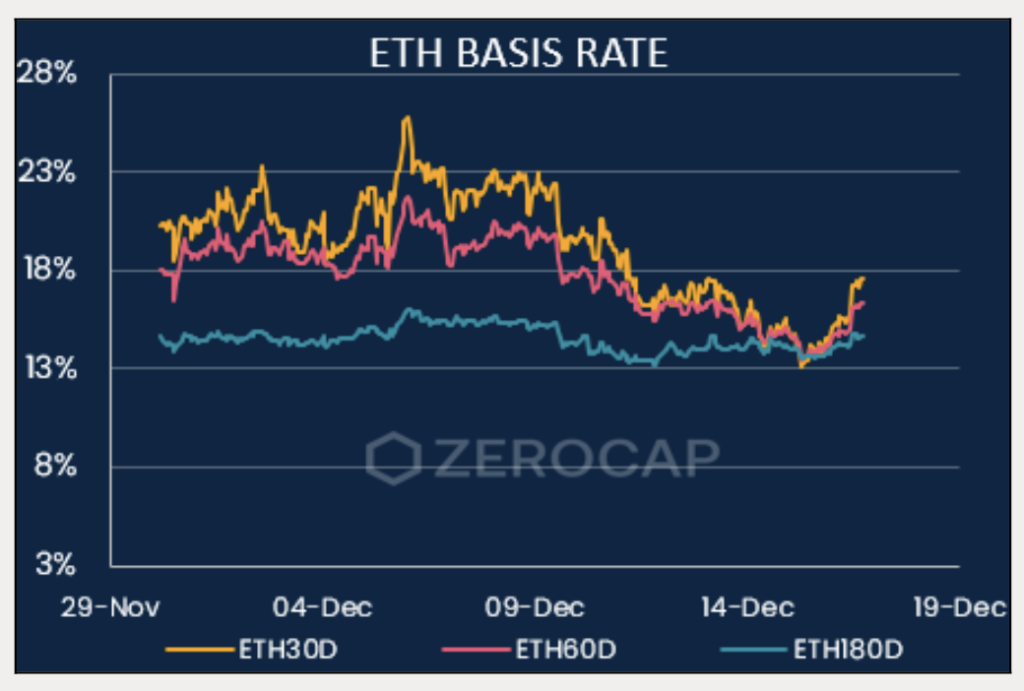

The Bitcoin basis rate has partially rebounded as Bitcoin approaches its all-time highs, with the 30-day annualized rate currently standing at 20.68%. Meanwhile, the Ethereum basis rate is at 18.06%, highlighting strong demand across both markets.

Trading the Basis involves shorting the future, and buying spot to be delta-neutral.

- It’s a high conviction trade with principal protection

- High payout % – it’s rare that the basis gets upward of 20%+

Get in touch with the desk for more information if you qualify as a wholesale investor.

Austin Sacks, Derivatives Analyst

What to Watch

- Chinese Activity Data (Mon): A spotlight on the health of the world’s second-largest economy, with retail sales growth expected to ease, industrial output steady, and a potential uptick in urban investment.

- FOMC Policy Decision (Wed): Markets brace for a widely anticipated 25bps rate cut, marking a shift in the Fed’s policy stance amid global growth uncertainties.

- PBoC Loan Prime Rate (Fri): Stability likely, but signals of China’s economic direction will be closely monitored.

- Japanese CPI (Thu): Inflation data expected to edge higher, adding intrigue to the BoJ’s policy calculus.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 22th April 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap Partners with BitGo to Deliver Secure, Real-Time Trading and Custody Infrastructure for Institutions

A Strategic Partnership for Secure Digital Asset Execution and Custody We’re pleased to announce our partnership with BitGo, a global leader in institutional digital asset

Weekly Crypto Market Wrap: 14th April 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post