Content

- The Power of a Crypto White Paper

- Technological Innovation

- Project's Vision and Mission

- Tokenomics: Beyond the Buzzword

- Strategic Partnerships

- Crypto Community Engagement

- Transparency and Regular Updates

- Crypto Security Measures

- Robust Crypto Marketing Strategy

- Crypto Testimonials and Reviews

- Crypto Roadmaps and Future Planning

- Crypto Regulatory Compliance

- Final Thoughts

- FAQs

- About Zerocap

- DISCLAIMER

1 Nov, 23

How do Crypto Projects Attract Investors?

- The Power of a Crypto White Paper

- Technological Innovation

- Project's Vision and Mission

- Tokenomics: Beyond the Buzzword

- Strategic Partnerships

- Crypto Community Engagement

- Transparency and Regular Updates

- Crypto Security Measures

- Robust Crypto Marketing Strategy

- Crypto Testimonials and Reviews

- Crypto Roadmaps and Future Planning

- Crypto Regulatory Compliance

- Final Thoughts

- FAQs

- About Zerocap

- DISCLAIMER

The realm of cryptocurrency is filled with buzzwords, promises, and sometimes, unfortunately, empty hype. But amidst all this, how do genuine crypto projects attract investors, stand out and grab the attention of those all-important pieces of the success puzzle? Let’s deep dive.

Ever stopped to wonder what drives the massive growth behind some crypto projects? At the heart of every successful project lies a multitude of factors that lure investors. A crypto project is essentially a startup initiative aiming to create or improve upon blockchain-based solutions. And just like any startup, to kickstart its journey, it needs capital. That’s where attracting investors becomes paramount.

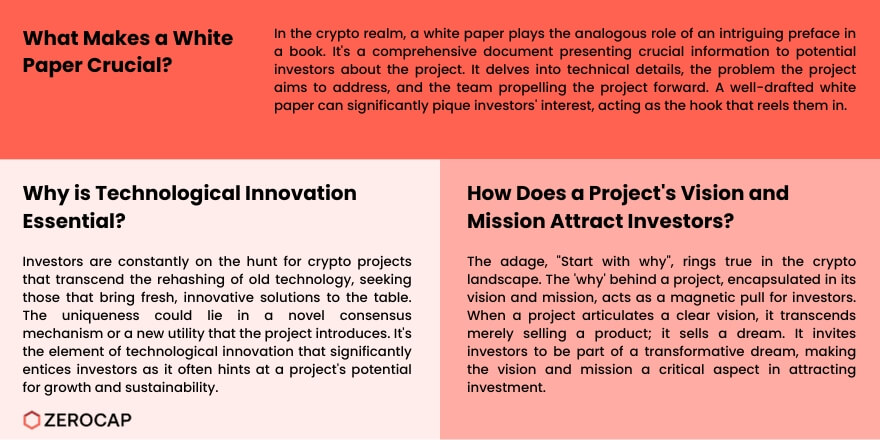

The Power of a Crypto White Paper

Do you remember reading through an intriguing preface of a book and thinking, “This sounds promising!”? In the crypto world, a white paper serves a similar purpose. A comprehensive document, it provides potential investors with everything they need to know about a project. From technical details, the problem it aims to solve, to the team behind it – a well-drafted white paper can be the hook that reels investors in.

Technological Innovation

Would you invest in a cassette player today? Likely not. The same applies to crypto. Investors hunt for projects that are not just rehashing old technology but bringing something new to the table. Whether it’s a unique consensus mechanism or a novel utility, innovation is king.

Project’s Vision and Mission

Ever heard the saying, “Start with why”? The ‘why’ behind a project can be its most magnetic pull. When a project communicates a clear vision, it’s not just selling a product; it’s selling a dream. And who wouldn’t want to be a part of a transformative dream?

Tokenomics: Beyond the Buzzword

This isn’t just a fancy term thrown around in the crypto circles. Tokenomics refers to how a crypto token works within its broader ecosystem. For investors, understanding tokenomics is crucial. It can provide insights into the token’s potential value growth and overall project sustainability.

Strategic Partnerships

Alone we can do so little; together we can do so much. Partnerships can validate a project’s credibility. When crypto projects ally with reputable firms, it sends out a message – “We’re serious, and we’re here to make a difference.”

Crypto Community Engagement

Ever seen a restaurant filled with patrons and felt the urge to dine there? A robust and engaged community can act as a beacon for potential investors. Through platforms like Telegram, Twitter, and Reddit, projects can foster a sense of belonging and trust.

Transparency and Regular Updates

Remember the age-old advice, “Honesty is the best policy”? In the crypto world, it’s more relevant than ever. Regular updates, open communication channels, and clarity about project developments can instil confidence like no other.

Crypto Security Measures

No one wants to board a ship that’s likely to sink, right? Ensuring top-notch security can seal the deal for many investors. After all, in a space riddled with scams, safeguarding investments becomes the top priority.

Robust Crypto Marketing Strategy

Even the best projects can falter without visibility. A well-orchestrated marketing campaign can spotlight a project, ensuring it doesn’t get lost in the crowded crypto space.

Crypto Testimonials and Reviews

When was the last time you tried a new restaurant without checking its reviews? Positive feedback and testimonials can act as powerful endorsements, nudging potential investors to jump on board.

Crypto Roadmaps and Future Planning

A clear roadmap can provide a glimpse into a project’s ambitions. It’s like seeing the trailer of a movie and deciding, “This is something I’d watch!”.

Crypto Regulatory Compliance

With governments worldwide keeping a keen eye on crypto, regulatory compliance cannot be an afterthought. Adhering to legal standards can be the reassurance investors need.

Final Thoughts

Attracting investors to a crypto project is no mean feat. It requires a blend of innovation, transparency, and vision. As the crypto world evolves, the playbook for attracting investors will change, but the underlying principles will remain rooted in trust and potential.

FAQs

- What role does a crypto white paper play in attracting investors?

- A crypto white paper is akin to the preface of a book, providing potential investors with comprehensive details about a project. It covers technical aspects, the problem the project aims to solve, the team behind it, and more. A well-drafted white paper can captivate investors, making them more inclined to invest.

- Why is technological innovation crucial for crypto projects?

- Investors are on the lookout for crypto projects that offer something novel, rather than just reiterations of existing technology. Whether it’s a unique consensus mechanism or a new utility, innovation is a key factor that can draw investors.

- How do strategic partnerships validate a crypto project’s credibility?

- When crypto projects form alliances with reputable firms, it sends a strong message about their seriousness and intent. Such partnerships can bolster a project’s credibility, making it more appealing to potential investors.

- Why is community engagement vital for a crypto project’s success?

- A vibrant and engaged community can act as a magnet for potential investors. Active participation on platforms like Telegram, Twitter, and Reddit fosters trust and a sense of belonging, which can be instrumental in attracting investment.

- How do crypto security measures influence investor decisions?

- Ensuring top-tier security is paramount for crypto projects. In an industry known for scams and vulnerabilities, robust security measures can be the deciding factor for many investors, ensuring their investments are safeguarded.

- What is tokenomics, and why is it significant for investors?

- Tokenomics refers to the workings of a crypto token within its broader ecosystem. For investors, understanding tokenomics is essential as it offers insights into the token’s potential value growth and the overall sustainability of the project.

- How do testimonials and reviews impact a crypto project’s appeal?

- Positive feedback and testimonials act as powerful endorsements. Just as one might check reviews before trying a new restaurant, potential investors often seek testimonials to gauge the credibility and success of a crypto project.

- Why is regulatory compliance crucial for crypto projects?

- With global governments closely monitoring the crypto space, adhering to legal standards and regulations is imperative. Regulatory compliance provides the reassurance investors seek, ensuring that the project operates within legal bounds.

- How does a clear roadmap benefit a crypto project?

- A clear roadmap offers a glimpse into a project’s future plans and ambitions. It acts as a trailer, enticing investors by showcasing what the project aims to achieve in the coming years.

- Why is transparency pivotal for attracting investors to a crypto project?

- Transparency, coupled with regular updates and open communication channels, instils confidence in investors. Being upfront about project developments and challenges fosters trust and can be a significant factor in drawing investment.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Zerocap Partners with Fireblocks: One of their First Institutional Crypto Custody Providers

Zerocap is One of the First Institutional Crypto Custody Providers to Join the Fireblocks Global Custodian Partner Program. Read more in recent articles in Coindesk,

Weekly Crypto Market Wrap, 15th July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

Weekly Crypto Market Wrap, 8th July 2024

Download the PDF Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post