Content

- The Fundamental Concept: Bitcoin Mining

- The Role of Scarcity: Bitcoin's Fixed Supply

- Bitcoin Halving Explained

- Market Implications of Bitcoin Halving

- The Broader Perspective: A Sustainable Model

- BitcoinEnvironmental Considerations

- Future Bitcoin Halvings and The Endgame

- Conclusion: A Pillar of Bitcoin's Value Proposition

- FAQs

- About Zerocap

- DISCLAIMER

29 Oct, 23

What is Bitcoin Halving and Why does it Matter?

- The Fundamental Concept: Bitcoin Mining

- The Role of Scarcity: Bitcoin's Fixed Supply

- Bitcoin Halving Explained

- Market Implications of Bitcoin Halving

- The Broader Perspective: A Sustainable Model

- BitcoinEnvironmental Considerations

- Future Bitcoin Halvings and The Endgame

- Conclusion: A Pillar of Bitcoin's Value Proposition

- FAQs

- About Zerocap

- DISCLAIMER

Since its inception in 2009, Bitcoin has consistently remained in the limelight, capturing the imagination of financial experts, investors, and the general public alike. However, not everyone understands the intricacies of its underlying protocol. One such essential aspect is the Bitcoin halving. But what exactly is it, and why does it garner such attention?

The Fundamental Concept: Bitcoin Mining

Before delving into halving, we must first understand Bitcoin mining. At its core, Bitcoin operates on a decentralised network of computers. These machines validate and record transactions on a public ledger called the blockchain. In exchange for this service, miners are rewarded with newly minted bitcoins. This process is aptly termed as ‘mining’ because, akin to gold mining, there is effort involved, and new bitcoins are introduced into circulation.

The Role of Scarcity: Bitcoin’s Fixed Supply

Bitcoin’s design ensures there will only ever be 21 million bitcoins. This fixed supply introduces scarcity, a characteristic that, in part, bestows Bitcoin with its value. As more bitcoins are mined, the remaining amount becomes harder to extract, mirroring the extraction of precious metals from the earth.

Bitcoin Halving Explained

Approximately every four years, or technically every 210,000 blocks, the rewards that miners receive for their efforts are halved. This phenomenon is known as Bitcoin halving. Initially, the reward was 50 bitcoins per block. However, after the first halving in 2012, this number dropped to 25. In 2016, it was further reduced to 12.5, and in 2020, miners began receiving 6.25 bitcoins per block.

Why is this significant? It’s a deflationary mechanism. By regularly decreasing the rate at which new bitcoins are introduced, halving ensures that Bitcoin doesn’t suffer from inflation and devaluation, a problem that plagues many traditional currencies.

Market Implications of Bitcoin Halving

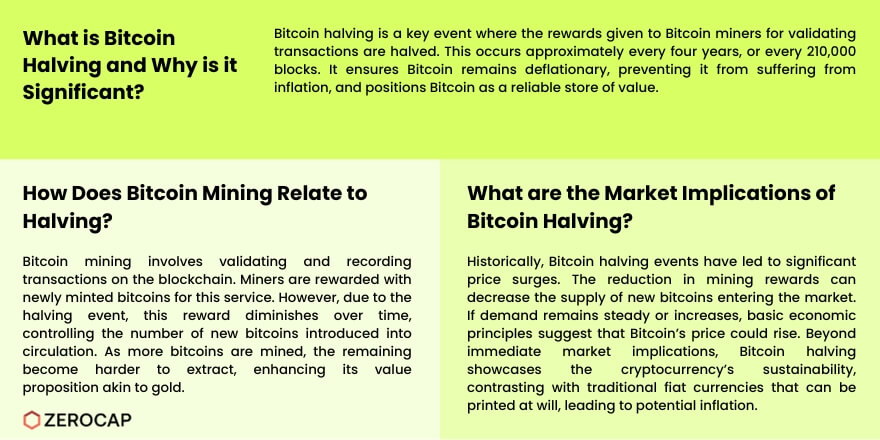

Every Bitcoin halving event has been closely watched by investors and market analysts. Historically, these events have been precursors to significant price surges. With reduced rewards, there’s a possibility of decreased supply entering the market, especially if mining becomes unprofitable for some miners. Simultaneously, if demand remains consistent or increases, basic economic principles dictate that the price of Bitcoin could rise.

The Broader Perspective: A Sustainable Model

Beyond the immediate market implications, Bitcoin halving showcases the cryptocurrency’s sustainability. Traditional fiat currencies can be printed at will by central banks, leading to potential inflation. In contrast, Bitcoin’s model ensures a predictable and decreasing supply, underpinning its proposition as ‘digital gold’.

BitcoinEnvironmental Considerations

The energy consumption of Bitcoin mining operations is often criticised. As rewards decrease, miners need more computational power to earn the same rewards. This can increase energy consumption. It’s essential to balance the economic benefits of halving with its environmental footprint, a topic that warrants in-depth exploration.

Future Bitcoin Halvings and The Endgame

With the current reward at 6.25 bitcoins, there will be more halving events until the reward becomes negligible, and the maximum supply of 21 million bitcoins is reached. This is estimated to occur in the year 2140. Post this period, miners will rely on transaction fees as their primary incentive.

Conclusion: A Pillar of Bitcoin’s Value Proposition

Bitcoin halving, with its embedded deflationary mechanism, is a cornerstone of Bitcoin’s economic model. It ensures scarcity, potentially drives price appreciation, and positions Bitcoin as a reliable store of value in the digital realm. As with any financial instrument, understanding the underlying mechanics, such as halving, is crucial for informed decision-making.

FAQs

- What is Bitcoin Halving and its Importance? Bitcoin halving is an event where the rewards given to Bitcoin miners for validating transactions are halved. This occurs approximately every four years, or every 210,000 blocks. It ensures Bitcoin remains deflationary, preventing it from suffering from inflation, and positions Bitcoin as a reliable store of value.

- How is Bitcoin Mining Related to Halving? Bitcoin mining involves validating and recording transactions on the blockchain. For this service, miners are rewarded with newly minted bitcoins. However, the reward diminishes over time due to the halving event, thereby controlling the number of new bitcoins introduced into circulation.

- Why is Bitcoin Often Termed as ‘Digital Gold’? Just as gold is limited and requires effort to extract, Bitcoin has a fixed supply of 21 million coins, introducing scarcity. As more bitcoins are mined, the remaining become harder to extract. The halving mechanism further ensures this scarcity, enhancing its value proposition akin to gold.

- How Does Bitcoin Halving Impact Market Prices? Historically, Bitcoin halving events have led to significant price surges. The reduction in mining rewards can decrease the supply of new bitcoins entering the market. If demand remains steady or increases, basic economic principles suggest that Bitcoin’s price could rise.

- What Happens When All Bitcoins Are Mined? The maximum supply of bitcoins is capped at 21 million, expected to be reached by 2140. Post this, miners won’t receive block rewards and will rely on transaction fees as their primary incentive for validating transactions on the blockchain.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post