19 Oct, 23

What are Bitcoin Ordinals?

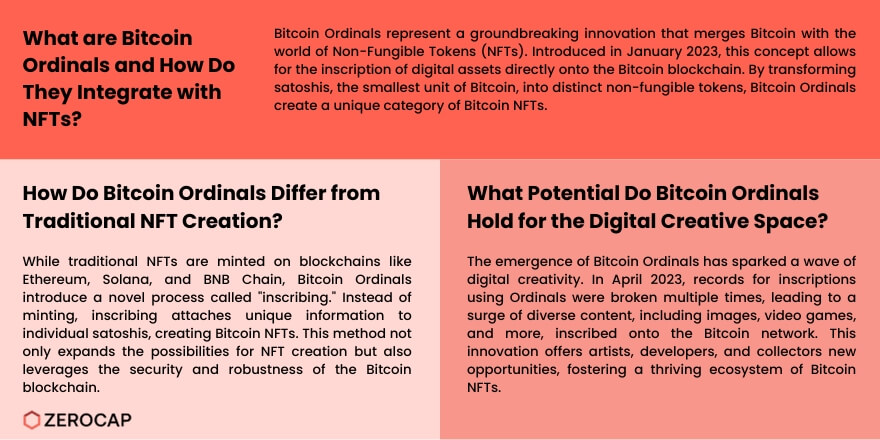

In recent times, the cryptocurrency space has witnessed an innovation known as Bitcoin Ordinals, intertwining the realms of Bitcoin and Non-Fungible Tokens (NFTs). This breakthrough, primarily occurring in January 2023, has brought about a surge of interest among blockchain enthusiasts and developers alike. The terminology “Bitcoin Ordinals” refers to a new protocol enabling the inscription of digital assets directly onto the Bitcoin blockchain, thereby creating a novel category of Bitcoin NFTs. The essence of Bitcoin Ordinals lies in the transformation of satoshis, the smallest unit of Bitcoin, into distinct non-fungible tokens by inscribing them with unique information.

Understanding Bitcoin Ordinals

Bitcoin Ordinals emerge from a straightforward yet ingenious idea: inscribing digital assets onto individual satoshis, which are the smallest divisible units of a Bitcoin, valued at 0.00000001 BTC. Each satoshi, when inscribed with a piece of unique information—be it text, an image, or other forms of data—becomes a de-facto NFT, holding a distinct value and identity on the blockchain.

The Brainchild of Casey Rodarmor

The concept of Bitcoin Ordinals was brought to light by Bitcoin developer Casey Rodarmor. This innovation allows for a new type of non-fungible token native to the Bitcoin network, marking a significant milestone in Bitcoin’s evolution. Since its launch in January 2023, Bitcoin Ordinals have been making headlines, heralding a new era of NFTs on the Bitcoin blockchain.

Inscribing vs. Minting

Traditionally, NFTs have been minted on blockchains like Ethereum, Solana, and BNB Chain. However, Bitcoin Ordinals divert from this practice by introducing a process known as “inscribing.” Inscribing allows for the attachment of information to individual satoshis, thereby creating Bitcoin NFTs without the need for minting. This process has not only broadened the horizons for NFT creation but also leveraged the robustness and security of the Bitcoin blockchain.

Bitcoin Ordinals: Fueling Digital Creativity

The advent of Bitcoin Ordinals has ignited a flurry of digital creativity. In April 2023 alone, the daily record for inscriptions using Ordinals was shattered four times, with a deluge of images, video games, and other content being inscribed onto the Bitcoin network. This innovation has opened up new vistas for artists, developers, and collectors, creating a vibrant ecosystem of Bitcoin NFTs that continues to flourish.

Conclusion

Bitcoin Ordinals symbolize a significant stride towards a more flexible and creative use of the Bitcoin blockchain. By enabling the creation of NFTs directly on the Bitcoin network, Bitcoin Ordinals have not only enriched the NFT space but have also showcased the untapped potential of Bitcoin beyond a mere transactional currency.

These innovative strides underscore the ever-evolving nature of blockchain technology, promising a fruitful confluence of Bitcoin and NFTs in the days to come.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 2 March 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap Launches Institutional OTC Desk for Tokenized Gold Trading

Zerocap’s institutional OTC desk enables investors to access tokenized gold efficiently, supporting portfolio diversification and inflation hedging strategies. The core objective is to provide seamless

Weekly Crypto Market Wrap: 23 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post