Content

- The CBDC Initiative in Australia

- Mastercard's Technological Breakthrough

- Tokenization and Interoperability

- CBDC's Interaction with NFTs

- Secure Transactions and Allow-listing

- The Role of Multi Token Network

- Expansion of Blockchain Utilization

- Benefits of the Network

- Stakeholder Insights Mintable's Vision

- Cuscal's Perspective

- RBA’s CBDC Pilot Project

- Conclusion

- FAQs

- What is the main focus of Mastercard's CBDC initiative?

- How does the tokenization process work?

- What was the outcome of Mastercard's live demonstration?

- What role does the Multi Token Network play?

- How do stakeholders perceive this initiative?

- About Zerocap

- DISCLAIMER

14 Oct, 23

Mastercard’s CBDC Trial for Web3 Commerce

- The CBDC Initiative in Australia

- Mastercard's Technological Breakthrough

- Tokenization and Interoperability

- CBDC's Interaction with NFTs

- Secure Transactions and Allow-listing

- The Role of Multi Token Network

- Expansion of Blockchain Utilization

- Benefits of the Network

- Stakeholder Insights Mintable's Vision

- Cuscal's Perspective

- RBA’s CBDC Pilot Project

- Conclusion

- FAQs

- What is the main focus of Mastercard's CBDC initiative?

- How does the tokenization process work?

- What was the outcome of Mastercard's live demonstration?

- What role does the Multi Token Network play?

- How do stakeholders perceive this initiative?

- About Zerocap

- DISCLAIMER

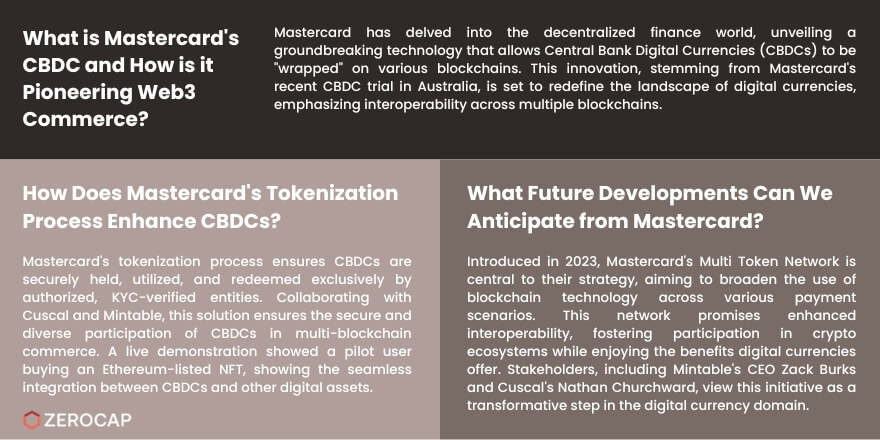

Diving deep into the world of decentralized finance, Mastercard’s CBDC trial recent efforts in Australia are revolutionizing the realm of digital currencies.

The CBDC Initiative in Australia

Australia’s CBDC initiative, led by the Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre, focused on exploring potential CBDC use cases1.

Mastercard’s Technological Breakthrough

Mastercard has unveiled a game-changing technology that enables CBDCs to be “wrapped” on different blockchains, offering consumers enhanced security and diverse participation in multi-blockchain commerce.

Tokenization and Interoperability

In partnership with Cuscal and Mintable, this new solution ensures that CBDCs are securely held, used, and redeemed only by authorized, KYC-verified entities.

CBDC’s Interaction with NFTs

The live demo showcased a pilot CBDC user purchasing an Ethereum-listed NFT. This process locked the CBDC amount on the RBA platform, minting equivalent CBDC tokens on Ethereum.

Secure Transactions and Allow-listing

Transfers of wrapped CBDCs are secure, with only ‘allow-listed’ Ethereum wallets being granted access, showcasing impeccable control even on public blockchains.

The Role of Multi Token Network

Introduced in 2023, Mastercard’s Multi Token Network is the backbone of their strategy, aiming to expand blockchain use across various payment scenarios.

Expansion of Blockchain Utilization

Mastercard’s Multi-Token Network is in beta and is pivotal in their strategy to proliferate blockchain tech across diverse payment use cases.

Benefits of the Network

The potential of the Multi Token Network is profound. It promises enhanced interoperability, promoting participation in crypto ecosystems while relishing the benefits these digital currencies present.

Stakeholder Insights Mintable’s Vision

Zack Burks, Mintable’s CEO, sees vast potential in NFTs, envisioning a world where digital currencies and NFTs are seamlessly linked, opening new commerce avenues1.

Cuscal’s Perspective

Nathan Churchward from Cuscal emphasizes the excitement of partnering with Mastercard, heralding a bright future for banking and payments in Australia.

RBA’s CBDC Pilot Project

RBA’s pilot project showcased innovative payment solutions for Australian entities, cementing the CBDC’s potential in revolutionizing digital transactions.

Conclusion

Mastercard’s foray into interoperable CBDCs for Web3 commerce underscores a transformative era in digital finance, promising a seamless, secure, and inclusive financial landscape.

FAQs

What is the main focus of Mastercard’s CBDC initiative?

Mastercard’s initiative emphasizes the interoperability of CBDCs across various blockchains.

How does the tokenization process work?

CBDCs are “wrapped” onto different blockchains, ensuring secure and diverse participation in commerce.

What was the outcome of Mastercard’s live demonstration?

It showcased a pilot CBDC user purchasing an NFT listed on Ethereum, highlighting seamless interoperability.

What role does the Multi Token Network play?

Introduced in 2023, it’s pivotal in Mastercard’s strategy to expand the use of blockchain tech across diverse payment scenarios.

How do stakeholders perceive this initiative?

Both Mintable and Cuscal view it as a transformative step in the digital currency space.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 25th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 18th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 11th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post