Content

- Understanding Crypto Custody

- Types of Crypto Custody Solutions

- Hot Wallets

- Cold Wallets

- Third-Party Custodians

- Security Challenges in the Crypto Space

- The Significance of Crypto Custody Solutions

- Asset Protection

- Risk Mitigation

- Institutional Adoption

- Selecting the Right Custodian

- Security Measures

- Reputation and Track Record

- User Experience

- Industry Trends and Innovations

- Multi-Signature Wallets

- Decentralized Custody

- Insurance Coverage

- Best Practices for Secure Crypto Storage

- Diversification of Storage

- Regular Audits

- Disaster Recovery Plans

- The Future of Crypto Custody

- Conclusion

- FAQs

- About Zerocap

- DISCLAIMER

5 Sep, 23

Safeguarding Digital Assets: The Critical Role of Crypto Custody Solutions

- Understanding Crypto Custody

- Types of Crypto Custody Solutions

- Hot Wallets

- Cold Wallets

- Third-Party Custodians

- Security Challenges in the Crypto Space

- The Significance of Crypto Custody Solutions

- Asset Protection

- Risk Mitigation

- Institutional Adoption

- Selecting the Right Custodian

- Security Measures

- Reputation and Track Record

- User Experience

- Industry Trends and Innovations

- Multi-Signature Wallets

- Decentralized Custody

- Insurance Coverage

- Best Practices for Secure Crypto Storage

- Diversification of Storage

- Regular Audits

- Disaster Recovery Plans

- The Future of Crypto Custody

- Conclusion

- FAQs

- About Zerocap

- DISCLAIMER

In today’s rapidly evolving digital landscape, the rise of cryptocurrencies has brought both innovative opportunities and unprecedented security challenges. As individuals and institutions increasingly turn to cryptocurrencies to diversify their portfolios and engage in borderless transactions, the need to safeguard these valuable digital assets becomes paramount. This is where crypto custody solutions step in to play a critical role.

In the digital age, where data breaches and cyber threats are constant concerns, ensuring the security of one’s digital assets is of utmost importance. Cryptocurrencies, with their decentralized nature, have introduced a new level of financial sovereignty. However, this sovereignty comes with the responsibility of safeguarding these assets against a variety of risks.

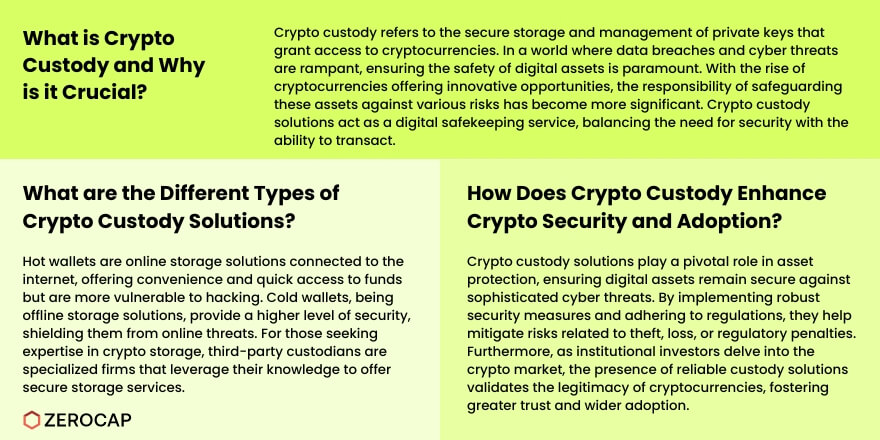

Understanding Crypto Custody

Crypto custody involves the safe storage and management of private keys that grant access to cryptocurrencies. It’s akin to a digital safekeeping service that prevents unauthorized access while allowing owners to engage in transactions. Crypto custody solutions bridge the gap between security and usability, catering to both individual and institutional investors.

Types of Crypto Custody Solutions

Hot Wallets

Hot wallets are online storage solutions that are connected to the internet. While they offer convenience and quick access to funds, they are susceptible to hacking due to their constant connectivity.

Cold Wallets

On the other hand, cold wallets are offline storage solutions that provide a higher level of security. They are not susceptible to online attacks, making them a preferred choice for long-term asset storage.

Third-Party Custodians

Many individuals and institutions opt for third-party custodians. These are specialized firms that offer secure crypto storage services, leveraging their expertise to safeguard assets effectively.

Security Challenges in the Crypto Space

The crypto space is not without its challenges. Hacking attempts and phishing attacks are prevalent, targeting both individuals and exchanges. Additionally, regulatory compliance and proper key management pose significant hurdles.

The Significance of Crypto Custody Solutions

Asset Protection

Crypto custody solutions provide a safe haven for digital assets, ensuring they remain secure even in the face of sophisticated cyber threats.

Risk Mitigation

By implementing robust security measures and staying compliant with regulations, crypto custodians help mitigate risks associated with theft, loss, or regulatory penalties.

Institutional Adoption

The involvement of institutional investors in the crypto market necessitates trustworthy custody solutions. This infusion of institutional capital further validates the legitimacy of cryptocurrencies.

Selecting the Right Custodian

When choosing a custodian, several factors come into play.

Security Measures

The custodian’s security protocols, such as encryption, multi-factor authentication, and geographically distributed storage, determine the level of asset protection.

Reputation and Track Record

A custodian’s reputation within the industry and its track record in safeguarding assets are crucial indicators of its reliability.

User Experience

A user-friendly interface and seamless transaction processes contribute to a positive experience for crypto asset holders.

Industry Trends and Innovations

Multi-Signature Wallets

Multi-signature wallets require multiple private keys to authorize transactions, adding an extra layer of security.

Decentralized Custody

Decentralized custody solutions distribute assets across multiple locations, reducing the risk of a single point of failure.

Insurance Coverage

Some custodians offer insurance coverage to protect against potential losses, giving asset holders additional peace of mind.

Best Practices for Secure Crypto Storage

Diversification of Storage

Storing assets across different types of custody solutions reduces vulnerability to specific types of attacks.

Regular Audits

Periodic audits by third-party security firms ensure that the custodian’s security measures remain effective and up-to-date.

Disaster Recovery Plans

Having comprehensive plans in place for disaster recovery ensures that assets can be restored even in worst-case scenarios.

The Future of Crypto Custody

As cryptocurrencies gain wider acceptance, the integration of crypto custody solutions with traditional finance is likely to increase. Advancements in key management and secure storage will redefine the standards of asset security.

Conclusion

Safeguarding digital assets is an evolving challenge that requires robust and adaptive solutions. Crypto custody solutions not only provide security against various threats but also pave the way for a future where cryptocurrencies can be embraced with confidence. With the right custodian and security practices in place, individuals and institutions can harness the full potential of the digital asset revolution.

FAQs

- What is a crypto custody solution? A crypto custody solution is a service that securely stores private keys, ensuring the safety of digital assets like cryptocurrencies.

- Why can’t I just store my crypto on an exchange? Exchanges are vulnerable to hacking and regulatory issues. Custody solutions offer an extra layer of protection.

- How do custodians prevent hacking attempts? Custodians use advanced encryption, multi-factor authentication, and offline storage to prevent unauthorized access.

- Are crypto custody solutions regulated? Regulations vary by jurisdiction, but reputable custodians adhere to industry best practices and compliance standards.

- What happens to my assets if the custodian goes out of business? Reputable custodians have contingency plans and insurance coverage to ensure asset retrieval even in such scenarios.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 25th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 18th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 11th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post