Content

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- Insights

- FAQs

- What were the major events in the crypto market for the week of 26th April 2021?

- How did Bitcoin and Ethereum perform during the week?

- What are the insights into DeFi and Innovation for the week?

- What are the key technical aspects and order flow for Bitcoin and Ethereum?

- What should investors watch for in the coming weeks?

- Disclaimer

26 Apr, 21

Weekly Crypto Market Wrap, 26th April 2021

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- Insights

- FAQs

- What were the major events in the crypto market for the week of 26th April 2021?

- How did Bitcoin and Ethereum perform during the week?

- What are the insights into DeFi and Innovation for the week?

- What are the key technical aspects and order flow for Bitcoin and Ethereum?

- What should investors watch for in the coming weeks?

- Disclaimer

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at [email protected] or visit our website www.zerocap.com

Week in Review

- Biden proposes higher tax rates aimed at the wealthy, causing a dip in U.S. equities and affecting crypto market segments. Equities have since recovered while the broader crypto market struggles.

- The deputy governor of the People’s Bank of China calls Bitcoin an investment alternative.

- New Bitcoin and Ethereum ETFs continue to appear on the Toronto Stock Exchange, while the SEC is currently reviewing three applications for a Bitcoin ETF.

- Venmo allows the purchase and selling of cryptocurrencies on their platform.

- Coinbase announces support for USDT on their exchange,

- Paxos, a stablecoin issuer and custody solution, has been granted a federal trust charter by the Office of the Comptroller of the Currency.

- BitGo, a crypto custody provider, expands its insurance coverage to $700m.

- Binance US acquires Brian Brooks, former Acting Comptroller of the Currency.

- Blockfi’s board of directors is joined by former CFTC chair Giancarlo.

- Boss of a Turkish crypto exchange goes missing, along with customers’ access to $2b worth of funds, highlighting the importance of regulation, custody and DeFi.

Winners & Losers

- After a severe drop at the beginning of the week due to proposed tax increases in the US and severe disruption to Bitcoin’s hash rate alongside a chain of leveraged trader liquidations, the asset spent the first half of the week consolidating around the US$55,000 mark. Unable to hold this level, BTC plummeted below US$55,000, reaching as low as US$47,000 before finishing the week consolidating below the critical psychological level of US$50,000. The broader crypto market is facing high levels of fear as inexperienced investors hold underwater positions. Continued downside is a possibility, although this move remains a natural part of market cycles and the long-term strength of the asset.

- Ethereum had a mixed week, decoupling further from Bitcoin’s correlation, as the asset hit a new ATH at US$2,645 despite the bearish outlook for BTC. The change in correlation between the two assets is indicative of how and where funds are flowing in the ecosystem. If Bitcoin continues to cool off, we can expect this disparity to grow. Overall, BTC recorded a 12.86% loss and ETH a 3.52% gain.

- Gold held its range as surging Covid-19 cases renewed fears of a delayed economic recovery. A weakening equities market combined with shrinking bond yields led some to safe-haven buying of gold as the opportunity cost of holding the asset decreased. The week opened at US$1,800 and closed -1.4% down at US$1,775 despite a generally bid week.

- A relatively volatile week saw the US10Y close -1.18% down at 1.56. Fear surrounding the global economic recovery spiked this week as India faced a vicious new wave of Covid-19. The US dollar continued to weaken, contributing to dropping bond yields which were also impacted heavily by Biden’s plan to increase taxes as a method of fueling fiscal stimulus.

- Equity markets experienced the same dip as the crypto markets, although they appear to have weathered the storm so far. This led to some large back and forth in the VIX, which experienced multiple 15% moves back and forth throughout the week. Overall, the VIX ended the week by up 1.7% WoW. Uncertainty surrounding the economic recovery remains the key focus in the coming weeks and will impact the direction of equity markets. As such, the VIX will remain an important indicator of market sentiment.

- As suggested last week, negative economic data significantly impacted the markets this week, prompting many to realise we are not out of the woods yet. Overall, market sentiment will have a proportionally bigger impact on prices in the coming weeks.

Macro, Technicals & Order Flow

Bitcoin

- We’ve seen a nice break below the ascending trendline from December 2020. As I write this, we are seeing an attempt to break back above. The daily close will be indicative of Europe and the US session’s take on where bitcoin will sit in this range. A close above 53,000 is bullish for the asset, however keep in mind that newsflow around economic recovery and vaccine rollouts could lead to a volatile week.

- Korea’s BTC premium, which has ramped up to 20% since March, has declined to 2%, cooling off the euphoria in its market. A peak in the Kimchi premium has a statistically significant correlation with an impending down-move. This played out this time, but we are still dubious of this indicator.

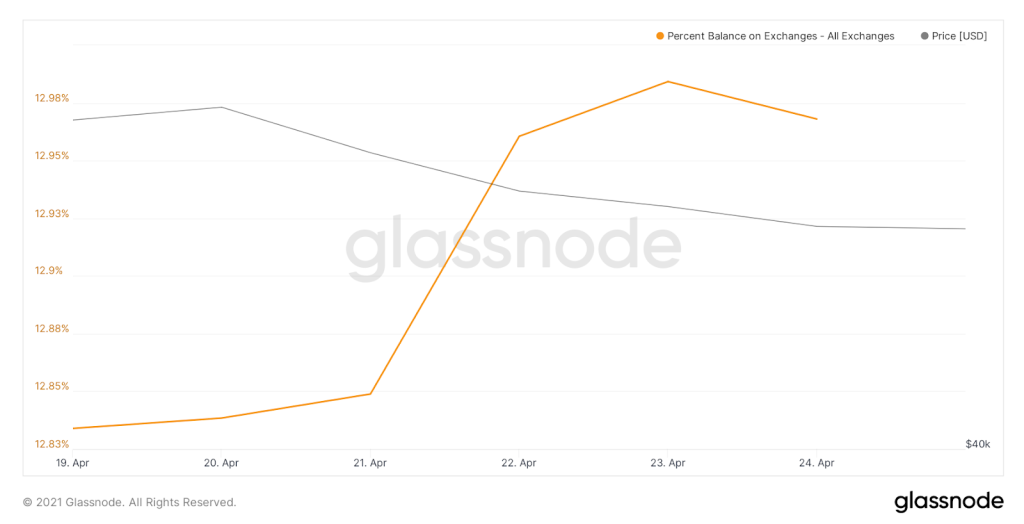

- Inflows of BTC to exchanges rose this week, in line with the sell-off.

- The recent sell-off in BTC has flushed out most of the leverage in the system, resetting its futures funding rates. As open interest stays at lower levels, it is unlikely that we will see violent downside movements of BTC in the short-term.

Ethereum

- ETH holds its ground as BTC takes a dive. This is a fairly strong indication that DeFi platforms are a contender against broader market sentiment. Interesting to note that some key contenders to ethereum also rallied while the rest of the market slumped. Protocols that can scale are driving the narrative here, and DeFi is the killer app.

- Orderflow held its ground above the ascending trendline from March. The daily chart is showing multiple rejects against this trendline. Higher lows against a compressing wedge – we feel highs are going to be broken again this week.

- The key level is at 2,550. Prior highs before the fast false break. Filling the gap on volume is a sign of latent demand, and higher prices. Keep an eye of these factors this week.

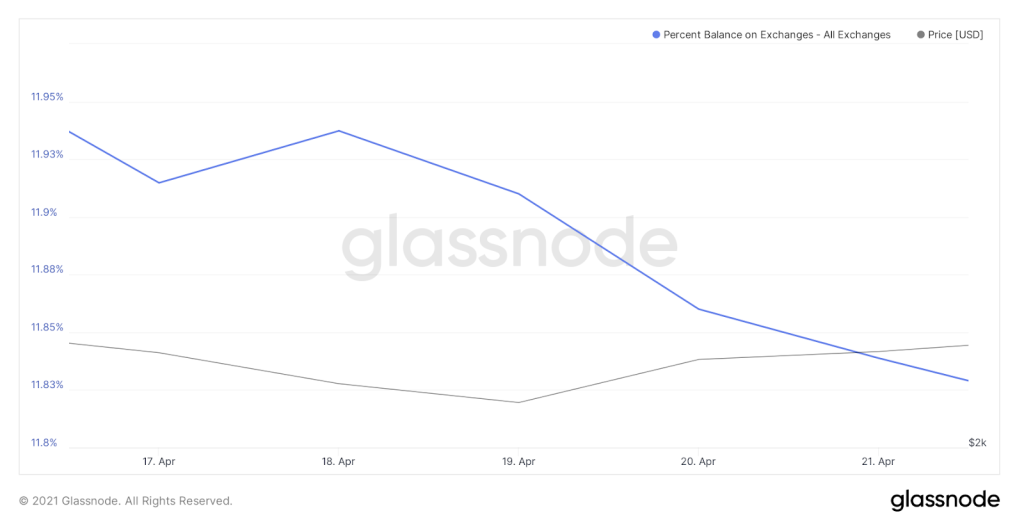

- ETH continues its trending outflow from exchanges, while it settles a record $1.5 trillion in transactions in Q1 2021.

- On newsflow, we are getting closer to lower fees on the network. After Ethereum’s Berlin upgrade, developers such as Vitalik and Péter Szilágyi agree that it is safe to increase gas limits of the network, allowing Ethereum to process more transactions per block. The upgrade has been implemented, as we see relief from high transaction fees on the weekend. Furthermore, ethereum core developer, Tim Beiko, proposes a timeframe for the implementation of EIP1559 to be on July 14.

- We have seen how Bitcoin halvings have affected its price in the past, as sell pressure decreases due to lower issuance of BTC to miners. EIP1559 on Ethereum also reduces the amount of ETH issued to miners. Our view is that this leads the next major move.

- Total value locked in DeFi projects dipped to $53.12 billion, a 12.4% decrease from last week, mainly caused by corrections in DeFi tokens.

- The amount of ETH in the ETH 2.0 staking contract currently sits at 3,965,346, an increase of 2.42% from last week. This represents 3.43% of the total supply estimated to remain locked for ~ one year.

DeFi & Innovation

- MakerDao allows tokenised real-estate to be used as collateral in their protocol, a massive milestone for the Dapp and Ethereum as a global settlement layer.

- DyDx performs superbly well for a DeFi perpetual swap exchange with lower liquidity than its centralised counterparts.

- Sushiswap’s developer runs through how their money market solution has been performing since launch, with a $10 million in total locked value already. The protocol has also pushed a beautiful UI update.

- Pancakeswap (Binance Smart Chain’s Uniswap) sees huge user growth and traction, as their token continues to appreciate despite the current market. However, BSC is starting to struggle with demand for usage on the network, as users report issues.

- Decentralised perpetual swap protocols are starting to process the same volumes as popular DeFi exchanges.

- Thorchain continues to implement fixes for bugs. The network has since processed $73m in volume since its inception two weeks ago. Liquidity providers who were able to join the network before the cap was reached are earning double-digit APYs on their Bitcoin, ETH and other assets through trading fees alone.

- NBA Topshots’ developer, Dapper Labs, is having another funding round with a $7.5 billion valuation.

What to Watch

- Was BTC’s meteoric rise to $64k purely driven by speculation supported by leverage due to the attention driven from the Coinbase IPO? Or will investors bid up Bitcoin on persistent uncertainties in monetary and economic policy?

- ETH continues to hold strong in anticipation for EIP1559. Will the protocol successfully upgrade its network and make ETH a deflationary currency?

Insights

Decentralised peer-to-peer: Why bitcoin’s base feature is still the most important one – A brief coverage of what P2P is, its crucial qualities for cryptocurrencies and why peer-to-peer assets will continue to grow in adoption.

FAQs

What were the major events in the crypto market for the week of 26th April 2021?

The week saw significant events such as Biden’s proposal for higher tax rates affecting the crypto market, the People’s Bank of China calling Bitcoin an investment alternative, new Bitcoin and Ethereum ETFs appearing on the Toronto Stock Exchange, Venmo allowing crypto transactions, and Coinbase announcing support for USDT. Other notable events include Paxos receiving a federal trust charter, BitGo expanding its insurance coverage, and a Turkish crypto exchange boss going missing with customers’ funds.

How did Bitcoin and Ethereum perform during the week?

Bitcoin faced a severe drop due to proposed tax increases in the US and other factors, consolidating around the US$55,000 mark before plummeting below US$50,000. Ethereum, on the other hand, hit a new all-time high at US$2,645, decoupling further from Bitcoin’s correlation. Overall, BTC recorded a 12.86% loss, and ETH had a 3.52% gain.

What are the insights into DeFi and Innovation for the week?

DeFi and Innovation saw significant developments, including MakerDao allowing tokenized real-estate as collateral, DyDx performing well as a DeFi perpetual swap exchange, Sushiswap’s developer updating on their money market solution, Pancakeswap seeing huge user growth, and Thorchain processing $73m in volume since its inception two weeks ago. Decentralized perpetual swap protocols also started to process volumes similar to popular DeFi exchanges.

What are the key technical aspects and order flow for Bitcoin and Ethereum?

Bitcoin broke below the ascending trendline from December 2020, with a close above 53,000 seen as bullish. Inflows to exchanges rose in line with the sell-off. Ethereum held its ground, showing strong indications that DeFi platforms are a contender against broader market sentiment. The key level for ETH was at 2,550, and ETH continued its trending outflow from exchanges.

What should investors watch for in the coming weeks?

Investors should watch whether BTC’s rise to $64k was driven by speculation or if uncertainties in monetary and economic policy will bid up Bitcoin. They should also monitor ETH’s anticipation for EIP1559 and whether the protocol will successfully upgrade its network. The overall market sentiment and its impact on prices will also be crucial in the coming weeks.

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal opinions about the cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are between 18 Apr. 2021 0:00 UTC to 25 Apr. 2021 23:59 UTC from TradingView. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content herein above.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | CRBQX | U.S. 10Y |

Like this article? Share

Latest Insights

What is the Base Blockchain? The Coinbase Layer 2

The Base blockchain, introduced by Coinbase, represents a significant development in the realm of cryptocurrency and blockchain technology. It is a layer-2 solution built on

Bitcoin Mining in the US: Main Challenges

Bitcoin mining in the United States has recently faced a range of challenges, from regulatory hurdles to community and environmental concerns. As a significant hub

Bitcoin Halving: Market Reacts

The 2024 Bitcoin halving, a significant event for the cryptocurrency world, marked a notable shift in the market dynamics of Bitcoin. As the block reward

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post