Content

- Week in Review

- FTX Week 2 & Digital Currency Group (DCG)

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What were the major events in the crypto market during the week of 21st November 2022?

- How did the FTX's systemic problems impact the crypto market?

- What is the concept of "safe CEX" proposed by Ethereum co-founder Vitalik Buterin?

- What were the macroeconomic factors influencing the crypto market during the week?

- How did the crypto market respond to the technicals and order flow during the week?

21 Nov, 22

Weekly Crypto Market Wrap, 21st November 2022

- Week in Review

- FTX Week 2 & Digital Currency Group (DCG)

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What were the major events in the crypto market during the week of 21st November 2022?

- How did the FTX's systemic problems impact the crypto market?

- What is the concept of "safe CEX" proposed by Ethereum co-founder Vitalik Buterin?

- What were the macroeconomic factors influencing the crypto market during the week?

- How did the crypto market respond to the technicals and order flow during the week?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- US House lawmakers call on FTX executives and former CEO to testify on the collapse.

- Fallen exchange begins strategic review of all its global assets.

- “We got overconfident and careless,” founder SBF said in series of tweets, claiming FTX operated with $13 billion leveraged from clients’ funds.

- Nansen report concludes Alameda and FTX colluded from the start.

- “Never in my career have I seen such a complete failure of corporate controls” insolvency attorney for FTX, who also worked on Enron’s.

- Glassnode data shows exchange outflows hitting historic highs following FTX collapse, as industry personalities such as Binance’s CEO continue push towards self-custody.

- Decentralised exchanges (DEX) activity spikes as users leave centralised platforms – hardware wallet Trezor reports 300% surge in sales revenue since FTX debacle.

- Ethereum co-founder Vitalik Buterin publishes framework towards “safe CEX” concept.

- NY FED launches 12-week long CBDC pilot program with several major banks.

- El Salvador President Nayib Bukele announces investment plan of “one Bitcoin a day.”

- ECB’s President Lagarde says rates to rise more, may become economically restrictive.

- UK inflation at 41-year high – faces largest fall in living standards since records began.

- US Manufacturing Index drops much lower than expected; -19.4% compared to predicted -6.2% – Meanwhile, US Core Retail Sales rise higher than expected.

FTX Week 2 & Digital Currency Group (DCG)

- The depth of the FTX’s systemic problems were highlighted by the exchange’s new CEO, John J. Ray III, who wrote that he has “never… seen such a complete failure of corporate controls”. This is especially significant given that Ray was involved in the restructuring of Enron after its accounting scandal. Within Ray’s bankruptcy filing, the public discovered that Alameda Research was exempted from auto-liquidation on FTX; thus giving them an extreme advantage over other traders. Furthermore, FTX leant ex-CEO Sam Bankman-Fried over $1 billion USD for personal use.

- The aftershocks of FTX’s market-wide earthquake have begun with crypto lender BlockFi, initiating job cuts and considering whether it should file for Chapter 11 bankruptcy protection. Furthermore, Multicoin Capital, a cryptocurrency fund, lost more than half of its fund’s capital in FTX. Similarly, Galois Capital, another VC fund, has over $100 million USD stuck on FTX, representing about 50% of its capital.

- In response to the difficulty in verifying the solvency of centralised exchanges (CEX), Binance sought to establish a new industry standard called Proof of Reserves. Chainlink Labs announced its service which verifies the solvency of a CEX based on its reserves, however, many were efficient in pointing out that an exchange’s reserves fail to consider its liabilities. Consequently, many solutions were proposed that account for reserves and liabilities. Even the co-founder of Ethereum, Vitalik Buterin, contributed to the debate with Proof of Solvency; this concept uses zero-knowledge proofs to protect users of exchanges without CEXs needing to sacrifice their privacy.

- The wallet that drained an estimated $477 million USD from FTX after its bankruptcy announcement began trading with its additional liquidity last week. First, the wallet gradually accumulated ETH, becoming the 35th largest holder of the coin with over 220k ETH. Subsequently, the exploiter dumped thousands of ETH, swapping it for a wrapped version of BTC. This resulted in the value of ETH falling significantly as the hacker chose not to swap their ETH into BTC gradually.

- Furthermore, in the wake of FTX’s collapse, DCG’s lending firm, Genesis, suspended redemptions and withdrawals prompting widespread fear of insolvency. Following this, Genesis reportedly sought a loan of $1b to alleviate balance sheet and liquidity concerns. Notably, DCG is the parent company of Genesis and concerns have arisen for other DCG-owned companies which include CoinDesk, Circle, BitGo and Grayscale Investments.

- Importantly, Grayscale Investments manages the Grayscale Bitcoin Trust (GBTC) which owns approximately 3.5% of Bitcoin’s supply. The aforementioned concerns have led to speculation regarding the potential liquidation of GBTC and the impact that would have on the price of Bitcoin. Notably, GBTC’s discount to spot Bitcoin has widened to 45.2% since Genesis announced the suspension. Moreover, Grayscale stated that it will not show a Proof of Reserves due to “security concerns”.

Winners & Losers

Macro Environment

- All eyes were on commodities markets last week, the S&P GSCI Commodities benchmark dropping -4.90% over the week. Oil was particularly volatile, with an encircling “triple threat” arising from a stronger dollar, weaker China demand outlook, and looming European trade embargo on Russian crude and oil products beginning to take effect.

- It seems market participants may have overlooked the potential for another +0.75% rate hike in December’s meeting, in recent hawkish commentary from United States (US) Federal Reserve Bank of Boston CEO Susan Collins. Collins asserted that a “Seventy-five still is on the table,” citing little evidence of easing price pressures: US retail sales sporting a +1.3% increase month on month in October, and a necessary “softening” in the labour market: US unemployment currently sitting at relatively tight 3.7%. Despite the hawkish commentary, the dollar (DXY) traded flat – up just +0.23% WoW, consolidating around the 106.59 level. Markets are now pricing in a 55 basis point hike in December’s FOMC meeting, coinciding with reduced demand for USD-denominated commodities.

- Commodities traders, having been poised for easing COVID restrictions in China, and a subsequent bolstered resource demand from the transport sector were sorely disappointed, by the report of China’s first COVID-related death in 6 months – with new local active cases surpassing the 26,000 mark. Most major metals fell on fears of increased COVID restrictions – the Shanghai Futures exchange December Copper contract sinking to its lowest since November 4th – down -1.5%. A number of Chinese oil refineries have already requested a reduction in “December loading crude oil volumes.” WTI slumped to a weekly low of 77.567 on Friday, BRENT also tumbling downwards to 85.409 – WTI and BRENT closed the week less -9.86% and -8.75% respectively. Despite mounting downward demand-side price pressure, a fast-approaching European embargo on Russian Crude could see prices flip. The ban on Russian crude is set to come into play on December 5th, with a later ban on oil product imports arriving later on February 5th. The embargo is set to cut Russian oil output by 1.4 million barrels per day (bpd), seeing an estimated 1 million bpd supply side rift form in Europe. France has already doubled down on energy alternatives: Electricite de France and Credit Agricole having recently signed a €1 billion loan to finance the ongoing maintenance of France’s 56 nuclear reactors – currently accounting for over 70% of France’s electricity output.

- The United Kingdom (UK) released its annual headline inflation numbers for October, coming in at a menacing +11.1%. The figures present a 41-year high for UK inflation, far exceeding market expectations for a rise of +10.7%. The major contributors to the increase were unsurprising: the rising cost of household gas and electricity, swelling 128.9% and 65.7%, despite the UK Government’s energy price guarantee. The unyielding weight of rising Energy and Food prices on the headline print is reflected in the UK’s core inflationary reading, which controls for the prices of energy, food, and demerit goods – sitting unchanged at +6.5% (Annualised) for October.

- Heading into the weekend the Japanese Yen (USD/JPY) was back above ¥140, the UK Pound (GBP) also up at $1.19, and the EUR traded down at $1.0330 along with the AUD at $0.6680.

Technicals & Order Flow

Bitcoin

- Early in the week, Bitcoin’s action lifted and tested the 17,000 level. However, a lack of buying appetite above 17,000 caused action to remain confined below the forming topside resistance. Price consolidated around the 16,600 level before a late-week sell-off led to a re-test of the 16,200 support. Bitcoin closed -0.27% WoW and lingering ambiguity will likely see action remain range bound moving into this coming week’s FOMC minutes.

- Following on from last week’s optimistic CPI print, U.S. PPI data on Tuesday also showed that price increases were slowing. The notion of peaked inflation accompanied by the premise of an easing hawkish monetary stance bolstered sentiment. Equities and Bitcoin benefited.

- Come Wednesday, attitudes shifted after inflation data out of the UK missed expectations, acting to remind investors of persistent global macro uncertainties. Bitcoin reacted poorly, retracing lower and back to the 16,600 level. Hawkish undertones continued to foster on Friday following Fed Reserve Bank of Boston leader Susan Collin’s suggestion that the Fed isn’t ruling out another 75 bp hike in December’s FOMC meeting. Bitcoin edged lower into the week’s close.

- Historically, Bitcoin has behaved like a high beta asset. However, amid the recent turmoil and lingering insolvency concerns, we’ve seen Bitcoin’s relationship with equities and its negative relationship with the DXY breakdown.

- Providing sustenance to traders’ current views is Bitcoin’s 25-delta skew. This measure depicts the difference between a 25-delta put’s implied volatility and a 25-delta call’s implied volatility and has persisted at high levels following FTX’s capitulation. This behaviour outlines a strong preference for downside protection.

- Looking out to Bitcoin Option’s 25th Nov expiry, significant open interest below the 17,000 strike can be seen for puts. Some of this open interest can be attributed to traders hedging out downside exposure in recent weeks. Notably for calls, strikes with large levels of open interest are 20,000, 24,000 and 28,000, positions which will likely expire out of the money.

- The effects of FTX’s capitulation were felt last week. We’ve seen Bitcoin’s relationship with high beta assets breakdown and speculation regarding GBTC’s liquidation may see this trend continue in light of any positive macroeconomic releases. Derivatives data shows that traders are continuing to value downside protection into this month’s expiry. Moreover, as we persist into December, we’ll likely see Bitcoin’s action centred around the developing GBTC narrative as well as any newsflow that impacts December’s rate hike decision.

Ethereum

- Alongside Bitcoin, Ethereum initiated the action with a prompt move higher. However, Ether failed to make a clear break of the 1,270 – 1,300 resistance zone. Mid-week de-risking saw Ethereum shift lower where it eventually consolidated around the 1,200 level. Sunday hosted an influx of selling which acted to push Ethereum below 1,200 and toward the 1,100 resistance. Ethereum closed -6.52% WoW. While Ethereum may find bids below key support placed at 1,100, in the context of any further risk events, we may see further flows out of Ethereum and into relatively safer assets.

ETHBTC Daily Chart

- Last week, the ETH/BTC pair reflected the market’s current propensity toward risk-off. Off the back of heightened insolvency risk and macro uncertainty out of the UK, the ETH/BTC pair sold off, catapulting downward. Firm support at the 0.0664 level acted to halt its descent. A rebound in sentiment mid-week saw risk appetite somewhat return and the pair reverted higher. However, elevated action was short-lived, with the pair edging lower into the latter parts of the week. Given the market’s current sentiment and growing prospects of a 75bp hike in December’s FOMC, we may see further de-risking until insolvency risks are alleviated.

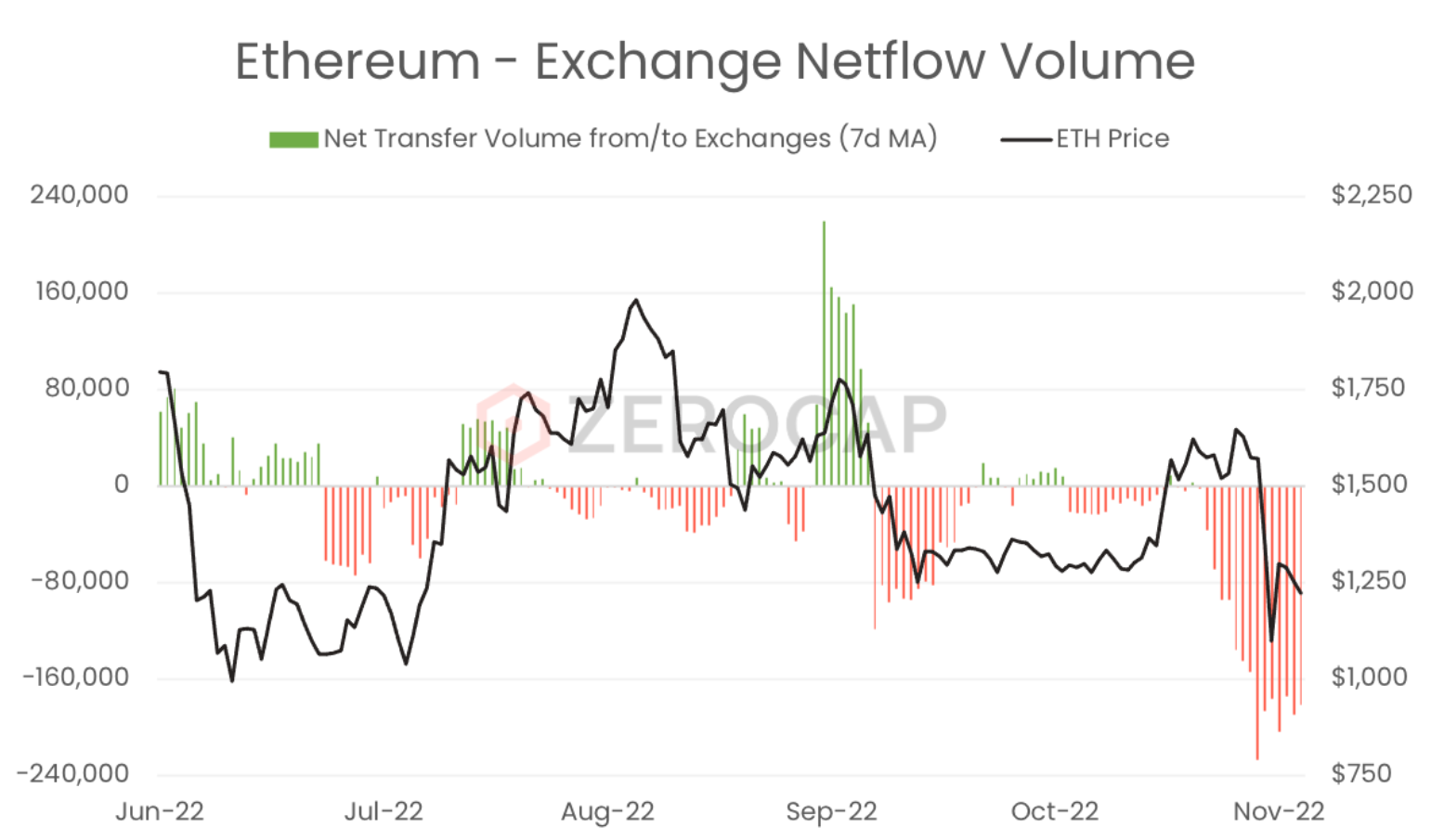

- Following the FTX events, most exchanges continued to experience severe outflows of major Ethereum-based cryptocurrencies, including ETH. These outflows have resulted in more tokens being held in web3 wallets and locked in smart contracts. In this context, exchange outflows fundamentally equate to on-chain inflows. Although portions of the tokens that have been moved off of exchanges are being held by investors, in response to market fear and uncertainty, significant amounts of ERC-20 tokens and ETH are being sold. This has contributed to the substantial selling pressure of these cryptocurrencies, evident from the high beta between token price and exchanges’ netflow volume.

- Observing Ethereum’s derivatives data and the most popular options strategies for last week, it can be seen that traders are formulating bullish trades focussed on the 30th December expiry that target the 1,400 strike. Contrastingly, we can see that shorter-dated expiries, such as this month’s, downside protection strategies are emphasised.

- The circulating supply of ETH dropped below its supply at the time of The Merge. One promise of The Merge was the introduction of deflationary tokenomics for Ethereum as ETH’s issuance rate was cut in line with the removal of miners’ rewards. Despite the fact that at certain points, ETH’s supply has been decreasing, it is currently 4.7k ETH lower than what it was when Ethereum shifted from Proof of Work to Proof of Stake. Without the impacts of The Merge, ETH’s supply would be almost 800k ETH higher than it currently is.

DeFi

- Amidst the FTX collapse and the mass exodus from other CEXs, volumes on DeFi platforms have sparked significantly as traders flock to decentralised platforms. On-chain data depicted that most DeFi protocols, ranging from decentralised exchanges (DEXs) to decentralised derivative exchanges, saw almost a 100% increase in users. dYdX and GMX, two dominant decentralised perpetual platforms, skyrocketed in trading volume, respectively reaching $3.5 billion USD and $1.2 billion USD over the past week.

- As traders moved to self-custodying their tokens and DeFi platforms, Uniswap, the most popular DEX on Ethereum, endured all-time highs with respect to the number of users of its web app. This meaningful increase in usage did not have a significant impact on the UNI token. Nonetheless, the demand for Uniswap was so substantial that the DEX’s web page went down for several hours due to a Cloudflare routing issue.

Innovation

- Circle, the issuer of USDC, has integrated Apple Pay as a means for businesses to accept crypto-based payments. This integration focuses on both crypto-natives and traditional companies. Businesses with a crypto-native audience will be able to offer more convenient and efficient transactions for the purchase of goods and services. Moreover, companies in the TradFi space can now take advantage of USDC transactions through Apple Pay as it shifts to enable retail payments with digital currencies.

- The Australian Stock Exchange (ASX) announced that it will cease attempting to use its distributed ledger technology (DLT) platform, Synfini, to replace its CHESS settlement and clearing system. After being announced in 2017, the CHESS replacement project was subject to a severe number of delays. The cancellation of this project results in a write-off of over $245 million AUD, however, it does not spell the end of Synfini entirely. Indeed, following its successful Proof of Concept with the Zerocap, the ASX will continue working on unique applications for its DLT – with a focus on tokenisation as an emerging opportunity.

- Matter Labs, the company behind zkSync, has raised $200 million USD to boost the adoption of the layer 2 network and expand its team. In its Series C funding round that was closed prior to the collapse of FTX, Matter Labs has raised capital, at an unknown valuation, from a multitude of reputable investors. The round was co-led by Blockchain Capital and Dragonfly, with participation from Variant, Lightspeed Venture Partners and a16z. Currently, zkSync 2.0 has been launched in its ‘baby alpha’ where only the Matter Labs team can make use of the zero-knowledge rollup platform.

Altcoins

- The proposal relating to Cosmos’ plans on revamping the tokenomics of ATOM and the wider Cosmos Hub was rejected as the layer 0’s community voted against the changes. The ATOM 2.0 whitepaper set out all of the changes that will be made to the project. With the community being asked to vote on the changes holistically, they rejected the ATOM 2.0 proposal given it was not split up into separate actionable proposals. Accordingly, though the improvement proposal has thus far been struck down, the AOM community is calling for the various clauses in the main proposal to be voted on independently,

- Solana’s ecosystem and token, SOL, have continued to endure fear and uncertainty as exchanges, including (temporarily) Binance and OKX suspended USDC and USDT deposits via the Solana blockchain. Further, Tether, the issuer of USDT, explained that it was moving 1 billion USDT off of Solana and onto Ethereum. The bridging of $1 billion USD of value from the Solana chain will likely have negative impacts on its DeFi ecosystem.

NFTs & Metaverse

- Marking its latest major venture in the crypto space since acquiring RTFKT, Nike has launched .SWOOSH, a web3 community platform. The platform will enable users to collect and create NFTs, earning royalties on secondary sales for their products. Nike’s web3 platform will facilitate the trading of digital apparel, sneakers, and accessories that can be redeemed for physical products. Moreover, .SWOOSH will come with NFT-based IDs that can be minted on Polygon. Currently, the platform is in beta, yet is expected to launch publicly in 2023.

- Meta and EU officials have reached a point of disagreement in relation to metaverse centralisation. With Meta proposing a single metaverse where it holds centralised power, EU representatives have argued that there should be a number of different metaverses, each controlled by the users as opposed to one company. Despite the EU stating that the metaverse is still in the early stages of legislative exploration, officials are contending that centralisation in the context of the metaverse will limit creativity. Nonetheless, Meta posited that it will hire 10k people in Europe to work on its metaverse.

What to Watch

- Australian Central Bank governor Lowe’s speech and New Zealand’s monetary policy statement, on Monday.

- Developments on FTX’s global assets review, and investigations around the world regarding the exchange’s bankruptcy.

- German and UK’s flash manufacturing PMI, on Wednesday.

- FED’s FOMC Meeting Minutes, also on Wednesday.

Insights

Crypto and Web3 innovation are recurring topics in the financial world, but where are such ecosystems truly heading? In this article, Innovation Lead Nathan Lenga brings the main innovations in cryptocurrencies and web 3.0 that are likely to reach their mainstream spheres in the near future.

Disclaimer

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What were the major events in the crypto market during the week of 21st November 2022?

The week was marked by significant events such as the FTX Week 2 and the issues surrounding the Digital Currency Group (DCG). The FTX exchange faced a systemic failure, leading to a strategic review of all its global assets. The DCG’s lending firm, Genesis, suspended redemptions and withdrawals, leading to widespread fear of insolvency.

How did the FTX’s systemic problems impact the crypto market?

The systemic problems of FTX led to a significant market-wide impact. Crypto lender BlockFi initiated job cuts and considered filing for Chapter 11 bankruptcy protection. Multicoin Capital, a cryptocurrency fund, lost more than half of its fund’s capital in FTX. Galois Capital also had over $100 million USD stuck on FTX, representing about 50% of its capital.

What is the concept of “safe CEX” proposed by Ethereum co-founder Vitalik Buterin?

In response to the difficulty in verifying the solvency of centralized exchanges (CEX), Vitalik Buterin proposed the concept of “safe CEX”. This concept uses zero-knowledge proofs to protect users of exchanges without CEXs needing to sacrifice their privacy.

What were the macroeconomic factors influencing the crypto market during the week?

Several macroeconomic factors influenced the crypto market during the week. These included the launch of a 12-week long CBDC pilot program by the NY FED with several major banks, the announcement of an investment plan of “one Bitcoin a day” by El Salvador President Nayib Bukele, and the UK inflation hitting a 41-year high.

How did the crypto market respond to the technicals and order flow during the week?

Bitcoin tested the 17,000 level but found a lack of buying appetite above this level, leading to a consolidation around the 16,600 level. Ethereum also failed to make a clear break of the 1,270 – 1,300 resistance zone. The ETH/BTC pair reflected the market’s current propensity toward risk-off. The derivatives data showed that traders continued to value downside protection into the month’s expiry.

Like this article? Share

Latest Insights

Bitcoin Mining in the US: Main Challenges

Bitcoin mining in the United States has recently faced a range of challenges, from regulatory hurdles to community and environmental concerns. As a significant hub

Bitcoin Halving: Market Reacts

The 2024 Bitcoin halving, a significant event for the cryptocurrency world, marked a notable shift in the market dynamics of Bitcoin. As the block reward

Weekly Crypto Market Wrap, 22nd April 2024

Download the PDF Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post