10 Oct, 22

Weekly Crypto Market Wrap, 10th October 2022

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Binance halts BNB chain after alleged $566 million exploit, back online a day later.

- FTX partners with Visa to roll out crypto debit cards in 40 countries.

- MakerDAO (MKR) moves forward with a $500 million investment plan in US treasuries and bonds – Maker is part of Zerocap’s Innovation Index with nine other leading projects.

- Celsius co-founders cashed out millions of dollars in assets right before it froze client withdrawals – company exposes thousands of customers’ information in court docs.

- SWIFT states “ground-breaking” research a success in showing implementation of CBDCs and tokenised assets for current financial structures.

- SEC charges Kim Kardashian $1.26 million for unlawfully promoting crypto token.

- South Korean police executes first arrest on executive involved in Terra (LUNA) collapse – SK ministry orders co-founder Do Kwon to surrender his passport.

- Web3 gaming still a long way from mainstream adoption; Coda Labs research.

- McDonald’s now accepting Bitcoin and Tether payments in Swiss town.

- Twitter’s lawsuit against Elon Musk halted, initial $44B deal to close by 28th October.

- OPEC+ agrees to cut crude oil production by 2 million barrels per day.

- US employment rate shows strong labour force as unemployment drops to 3.5%.

Winners & Losers

Macro Environment

- The United Nations (UN) Trade and Development conference report was released on Monday, highlighting the detrimental effects that the hawkish United States (US) Federal Reserve (FED)’s hikes have had on both developed and emerging economies. According to the report, the FED risks burdening developing economies with its persistent and rapid rate increases, alongside a stagnant global economy. The report estimated: that for every 100 basis point (bps) increase in the FED funds target rate, economic output for neighbouring rich countries falls by approximately 50bps, developing countries hit harder with output contracting by 80bps – both over a three-year period.

- The United Kingdom (UK)’s Monetary flippening the week prior continued to weigh down on global bond markets, resulting in a continued sell-off of long-term UK Gilts. UK 10-year bond yields at the time of writing, up past 4.25%. US treasuries felt similar momentum on Wednesday, further catalysed by strong service sector data released throughout the week. September’s ISM services PMI came out stronger than expected at 56.6, beating market estimates of 56. The ISM data reported a slowdown in business activity, down 59.1 from 60.9, and a reduction in new orders (also decreasing to 60.6 from 61.8). Despite this, significant improvements in employment (53 vs the projected 50.2), supply chain efficiency and resource availability bolstered the better-than-expected reading. As a result, 2 and 10-year treasury yields were up, closing the week with a 9bps and 8bps gain for 2 and 10-year yields, sitting at 4.314% and 3.885% respectively. The 2 and 10-year yield curve inversion consolidates at around 42bps.

- The Reserve Bank of Australia (RBA) unexpectedly raised the cash rate target 25 basis points to 2.60% on Tuesday, missing market expectations of a 50bps hike (as seen in the 4 prior meetings). The RBA also opted to increase the interest rate on exchange settlement balances by 25bps to 2.5%, maintaining a consistent lower bound for the interest rate corridor. RBA commentary around the meeting reinforced estimates that consumer price index (CPI) inflation is expected to break above 4% in 2023, and ideally drop back down to the target band of 3% in 2023. Thus in order to maintain its primary goal of price stability, the RBA asserted its commitment to continue hiking interest rates – subject to incoming economic data.

- Wednesday saw another prominent ratings firm – Fitch Ratings unveil its revised outlook for the UK – Long term foreign currency (LTFC) issuer default rating down to -AA. The revision shifted the UK’s Issuer Default rating to negative from stable & affirmed. This move mimicked its rival rating agency “Standard & Poor,” who cut the outlook on UK sovereign debt from stable to negative the week prior, resulting in a revised AA credit rating. Fitch expressed its growing concerns around the lack of independent budget forecasts, and the clashing monetary policy stance as of late having negatively impacted overall market confidence and credibility – “a key, long-standing ratings strength.”

- Week-end saw the DXY rocket above 112, the USD/JPY pair convincingly back above the ¥145 level, the pound dipping back below $1.10 USD, and AUD weaker below $0.64 USD. Despite stocks retracing across the board: the Nasdaq and DJIA both down 400 and 700 respectively – Oil saw strong, sustained growth. The weekly gains in Oil came shortly after the OPEC Plus coalition announced its daily production cut of 2 million barrels. WTI and Brent now above $97 and $91 respectively.

Technicals & Order Flow

Bitcoin

- Entering the week, Bitcoin ascended within a tight range. While the 19,650 level temporarily acted as resistance, bids pushed prices higher. Bull’s challenged topside resistance above the 20,250 level and following little success, bullish momentum tapered. As sentiment turned, price reverted lower and consolidated around 19,500 into week close. We are trading in tight daily ranges, against a backdrop of risk which is encouraging for the asset. Bitcoin returned 2.02% WoW.

- The BoE’s re-initiated QE ignited hopes of a less hawkish Fed. This week began with a weak US ISM data print and markets responded positively, pricing in less steep forthcoming hikes to battle a slowing economy. Falling Job Openings out of the US on Tuesday re-affirmed the move to Bitcoin’s weekly highs.

- However, attitudes began to flip midweek after ADP data came in above expectations, challenging the notion of whether less severe hikes are justified. Friday arrived with strong Unemployment data (NFPs) out of the U.S. which made it clear that markets were on course for another 75bps hike. Risk assets and Bitcoin sold-off shortly after.

- Open interest, in terms of BTC, in Bitcoin’s perpetual futures contracts reached an all-time-high this week. On Tuesday Bitcoin moved to above 20,000, open interest (BTC) increased by 12.23%. While this may be indicative of traders opening long positions, the increase can also be attributed to traders opening short positions Notably, as price moved lower in the later parts of the week, open interest (BTC) remained relatively constant which is suggestive of the latter. We may see this metric decrease as traders realise PnL on short positions into this week’s inflation print out of the U.S.

- Historically, a crossover of Bitcoin’s Hash Rate 30-day moving average through the 60-day moving average has been followed by price appreciation. Hash rate is a factor that grants insights into the health of Bitcoin’s network and the cross-over of these two moving averages is typically indicative of the end of a bearish cyclical trend. Notably, participants are yet to witness notable price appreciation despite the cross-over.

- Bitcoin’s URPD is a metric that depicts the on-chain volume at which coins have changed hands. The URPD metric grants insights into levels of support. As shown, a significant amount of volume has been transacted at current levels which suggests that current pricing will serve as long-term support. This re-affirms that current levels pertain to a cyclical bottom, a narrative suggested by numerous other on-chain metrics.

- We’ve been touching on how the macro environment is a major determinant of current price behaviour. Last week, this notion continued to prove true. In tandem with sentiment out of the U.S. equity markets, Bitcoin’s weekly highs and lows moved alongside economic prints out of the U.S. and changes in rate hike expectations. Some traders took this into consideration, forming short positions in the perpetual futures markets, pushing BTC open interest higher. On-chain metrics depict the significance of current levels. Moreover, this week’s FOMC minutes and inflation data out of the U.S. will likely pertain to heightened volatility and act to determine directionality in the short term.

Ethereum

- Continuing its range-bound behaviour, Ether saw a strong start to the week. Price bounced off lows around 1,260 and rallied as much as 9.6% by Wednesday’s close, reaching prior resistance at the 1,375 level. However, bears firmly rejected action from this level, forming its relevance as continued short-term resistance. Following late-week selling, Ethereum consolidated around the 1,350 level, closing above 1,300 and +3.65% WoW.

- Following and alongside Bitcoin, participants de-risked in anticipation of Friday’s U.S. NFP release. Subsequent to the news release, prices aggressively sold off as the figure indicated a stronger-than-expected labour market – a potential catalyst for further rate hikes.

ETHBTC Daily Chart

- Much of the strength from this week’s move was driven by BTC. Nonetheless, we did see an uptick in ETH’s relative strength following Wednesday. This behaviour is likely due to BTC buyer exhaustion following the asset’s inflows during the days prior. As discussed last week, the ETH/BTC pair has established support in the 0.064-0.067 range. A break above this level would likely see a retest of the trend breakdown around 0.0705 hinting at relief for ETH bulls.

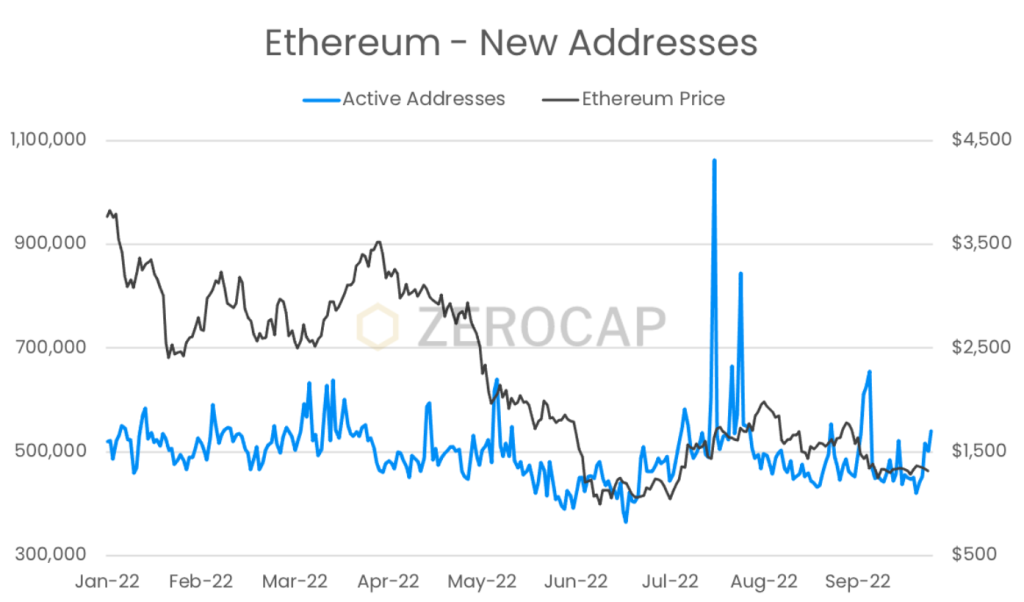

- The number of active Ethereum addresses saw an uptick this week to levels not seen since mid-September, a result of multiple drivers. As price consolidates, on-chain flows increase due to a number of reasons with the major input being the trading of alts and NFTs.

- Since Ethereum’s Merge on September 15th – Ethereum’s 25d skew has edged higher. Notably, this week, coinciding with Tuesday’s move above 1,330, we saw skew diminish as traders shifted into calls. Nonetheless, as the week progressed and as the prospect of further aggressive hikes became more likely, downside protection was favoured and skew increased accordingly.

- A new token standard, ERC-3525, has been approved, creating a token type for web3 gaming and finance applications. This token standard builds on the ERC-20 standard (tokens) and ERC-721 standard (NFTs), yet innovates in the sense that users can create semi-fungible tokens with the same contract. Using the same contract ensures that the key features of tokens are the same, however, small differences can still exist. The purpose of ERC-3525 tokens is to assist in the financialisation of NFTs as the standard facilitates the creation, allocation and management of tokens. Hence, these smart contracts allow for the development of on-chain insurance policies, bonds and vesting plans. Moreover, the semi-fungible nature of this standard lends itself to metaverse applications as players can efficiently swap and trade NFTs with the same underlying properties.

DeFi

- Following the fear and uncertainty around the possibility of Circle blacklisting the USDC backing MakerDAO’s DAI stablecoin, the entity has voted to invest $500 million in short-term US government bonds. This endeavour to diversify its treasury would see MakerDAO purchase $400 million in US Treasury bonds and $100 million in investment-grade corporate bonds. Overseeing the OTC conversion of the $500 million worth of DAI into USD is DeFI asset advisor Monetalis. Many in the community are pointing out the irony behind MakerDAO’s purchase in the context of limiting direct exposure to the US government. Initially seeking to safeguard DAI from US regulation and authorities, the token is drifting towards being backed by bonds issued by this exact entity,

- The DeFi market saw new loans across a number of metrics in September. Indeed, the monthly volume on decentralised exchanges (DEX), in September was found to be $55.7 billion. This value is the lowest it has been in 12 months and down 74% from its peak in November 2021. Similarly, the DEX to centralised exchange volume ratio is reaching yearly lows; only 10.75% of the total crypto trading volume was done via DEXs. As CEX volume outperforms that of DEXs, it appears that the crypto community is shifting away from utilising decentralised options for trading. Bolstering this is the 85% decrease in revenue for DeFi protocols in September from its peak in November of 2021.

Innovation

- Dominant liquid staking provider for Ethereum, Lido Finance, has extended its ETH offerings onto layer 2 networks in an effort to improve accessibility to Ethereum staking via reduced gas fees. Lido has bridged its staked ETH token, stETH, onto Arbitrum and Optimism – networks which utilise optimistic rollups and hence are compatible with Ethereum’s virtual machine. Having already obtained market control of liquid staking on the Ethereum mainnet with 30% of the total ETH staked through Lido, the protocol is now seeking to obtain another first mover advantage. Lido is targeting the most popular layer 2 networks to build out its staking offerings and target more investors.

- Mastercard has announced its new product for banks – Crypto Secure – a crypto-native software which detects and prevents fraud on platforms within its network. Crypto Secure will function by visually assessing risks through AI and real-time data from blockchains. To facilitate the effectiveness of the software, Mastercard will be leveraging its recent acquisition of CipherTrace, an on-chain blockchain security startup. Moreover, Mastercard will provide a user dashboard to visualise the risks, enabling individuals to determine the actions steps to subsequently be taken in the case of fraudulent activity.

- Hamilton Lane revealed its plans to use distributed ledger technology to make its credit-market funds more accessible to individual investors. This is being achieved through Hamilton Lane’s partnership with Securitize – a digital asset security firm and the market leader in the tokenisation sector. Through the use of Securitize, Hamilton Lane will be tokenising three of its funds; its equities, private-credit and secondary transactions funds. Notably, this announcement follows KKR’s disclosure of its focus on tokenising its Health Care Strategic Growth Fund in collaboration with Securitize.

Altcoins

- Binance’s blockchain, Binance Smart Chain (BSC), faced a $566 million attack as its native bridge was exploited for 2 million BNB tokens. Unlike other blockchains that exist on a diverse set of validators, BSC is more centralised, hence had the capacity to halt the entire chain. This prevented the hacker from getting the full amount of tokens off BSC; an estimated $100 million worth of crypto of $566 million was lost. The chain’s block production was paused for several hours before resuming after a node upgrade. The exploit ironically occurred weeks after the announcement of Binance’s AvengerDAO, an entity created to safeguard the blockchain from scams, malicious actors and exploits.

- NEAR Protocol has partnered with Google Cloud to accelerate the development of web3 startups on the blockchain. Google Cloud will offer its services in providing technical support for projects that have received grants from the NEAR Foundation. Moreover, the subsidiary of Google will provide infrastructure support for NEAR’s Remote Procedure Call (RPC) client. This has the potential to attract many more developers to the ecosystem, expediting adoption of the NEAR blockchain.

NFTs & Metaverse

- Yuga Labs has formed the Bored Ape Yacht Club (BAYC) community council, replete with 7 councillors, to represent the NFT collection’s community when conversing with the firm. The council will primarily engage with the community, gathering feedback and input, before relaying it to Yuga Labs. The BAYC community council will additionally be tasked with assisting Yuga Labs with community driven initiatives, such as commercial projects, meetups and charity work. Furthermore, the company explained that depending on the success of the BAYC entity, it would look to launch councils for its other projects – CryptoPunks, Otherside and Meebit.

- Japan is continuing in its push to invest in and adopt metaverse and NFTs. Since becoming the country’s prime minister, Fumio Kashida has made web3 development one of the pillars of his revitalisation of the Japanese economy. In a recent speech, Kashida elucidated that the government will concentrate on web3 services that are powered by metaverse infrastructure. Indeed, the prime minister made mention of how NFTs could be used to protect Japan’s intellectual property in the gaming, animation and technology industries. Moreover, usage of NFTs within the country has already begun; the Japanese government has already utilised NFTs to award mayors with certificates to authenticate the impact of their policies.

- Uncertainty around the number of unique interactions with the Decentraland metaverse has arisen due to DappRadar reporting the virtual world had 38 active users in 24 hours. Many have questioned how a metaverse valued over $1.3 billion (by its native token’s market capitalisation), can have such minimal usage. However, DappRadar’s metric is determined by the number of interactions with Decentraland’s smart contracts; hence, interactions are only counted as they relate to sales and purchases with in-game tokens. In reality, the number of unique visitors is a more accurate indicator for usage than the number of smart contract interactions. Over the past 3 months, the daily average visitors to Decentraland’s metaverse is around 8.5k.

What to Watch

- Potential legal repercussions following Binance’s BNB Chain halt – will regulators address the matter?

- Bank of England Governor Bailey speaks, on Tuesday – speech comes two weeks after the bank stated that the UK may already be in a recession.

- UK’s monthly GDP report, on Wednesday.

- FED’s FOMC meeting minutes, on Wednesday – detailed records may provide more insights on future rate hikes.

- US CPI report, on Thursday.

- US Retail Sales report, on Friday.

Insights

- How do DeFi Protocols Make Money? Revenue examples with leading projects: Innovation Analyst Nathan Lenga covers how DeFi protocols generate revenue with examples from leading projects in the ecosystem – and whether they profit from current frameworks.

Disclaimer

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799.

Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client), or your local equivalent.

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Like this article? Share

Latest Insights

Ethereum Smart Contracts: How They Changed Crypto

Ethereum, launched in 2015, revolutionized the digital world by introducing “smart contracts,” self-executing contracts with the terms of the agreement directly written into code. This

Main Crypto Events in the World

The world of cryptocurrencies is dynamic and ever-evolving, with numerous conferences and events held globally to foster innovation, collaboration, and networking among crypto enthusiasts. Here’s

What is Ethena Finance?

Ethena Finance (ENA/USDe) is emerging as a notable player in the cryptocurrency and decentralized finance (DeFi) sectors. Powered by its proprietary stablecoin, USDe, Ethena aims

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post