Content

- Key Cabinet and Government members of Joe Biden's Presidency

- Gary Gensler - US Securities and Exchange Commission Chair

- Janet Yellen - Secretary of the Treasury, former Head of Fed Reserve

- Lael Brainard - Fed Reserve Governor

- Plans that can affect cryptos

- The US$1.9 Trillion Covid Stimulus

- Federal framework to define cryptocurrencies

- Biden’s tax plan

- Looking ahead

20 Jan, 21

Joe Biden is President – What it means for crypto

- Key Cabinet and Government members of Joe Biden's Presidency

- Gary Gensler - US Securities and Exchange Commission Chair

- Janet Yellen - Secretary of the Treasury, former Head of Fed Reserve

- Lael Brainard - Fed Reserve Governor

- Plans that can affect cryptos

- The US$1.9 Trillion Covid Stimulus

- Federal framework to define cryptocurrencies

- Biden’s tax plan

- Looking ahead

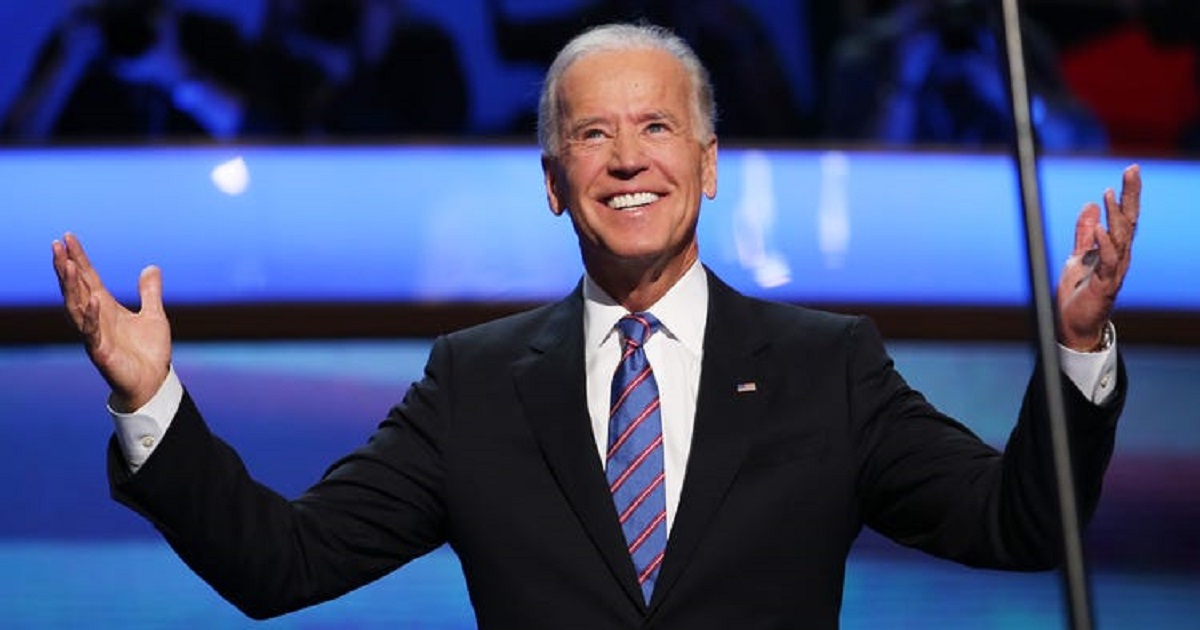

The 2020 presidential run was certainly one for the history books. Surrounded by the rising threat of a global pandemic, economic meltdown and election fraud accusations, the past year was a callous one to handle in the world of politics. Yet, regardless of political positions and the openly disputed authenticity of results, the next four years have begun; Joe Biden has been sworn in at the Capitol in Washington, becoming the 46th President of the United States.

With a new President and term ahead for the United States, it leaves crypto investors with plenty of questions and predictions about where this administration might lead digital assets. This article will cover what can be expected in crypto from Joe Biden’s government by examining critical politicians that have spoken about digital currencies. We’ll also look at key policies and frameworks expected from the administration that might lead to a direct or consequential impact into the cryptocurrency market. It’s worth noting that Joe Biden has never released an official statement on digital assets at the moment of this writing.

Key Cabinet and Government members of Joe Biden’s Presidency

From Joe Biden’s internal cabinet and those in office that will have a political impact over the next four years, many key political figures in this new government have strong opinions or proposals for digital assets. Below is a summary of the leading politicians that will likely impact the American framework for cryptocurrencies in the upcoming years.

Gary Gensler – US Securities and Exchange Commission Chair

Former CFTC President, Gensler was nominated for the US SEC position less than a week before Biden’s inauguration and is considered one of the most proactive politicians in the studies and debates around cryptocurrencies. He has administered Blockchain courses at MIT, with some of his lectures freely available online. Gensler has often praised the creation of bitcoin and the Blockchain network, stating that the anonymous creator(s) Satoshi Nakamoto has “solved the payments riddle, how to securely move value peer-2-peer on the internet while avoiding double-spending” and he remains “intrigued by Satoshi’s innovation’s potential to spur change.”

Gensler stated in an op-ed for crypto portal CoinDesk that digital assets are a catalyst for change regardless of how many different currencies rise and fall in the upcoming years, claiming that society is already living “in an age of digital money”. With expert knowledge of the Blockchain network and his bullish views on cryptocurrencies, it’s vital to keep a close eye on his actions as part of the US SEC.

However, Gensler may not have much of an impact on crypto, even likely to introduce some challenges for adoption. Bitcoin is federally classified as a virtual currency under the Office of the Comptroller of the Currency (OCC) and the Commodity Futures Trading Commission (CFTC), which does not relate directly to the SEC governance. He has often advocated for a national blueprint to monitor exchanges outside of states’ sovereignty and add more regulations to Wall Street, and the digital assets market. If those regulations come into effect, it can certainly enhance institutional adoption in the country, while simultaneously distancing bitcoin from its original frameworks of a decentralised currency that made the asset so appealing for initial adopters in its early stages.

Janet Yellen – Secretary of the Treasury, former Head of Fed Reserve

Nominated by Joe Biden in November, Yellen has held firm and somewhat convoluted positions regarding cryptocurrencies and blockchain in the past few years, particularly bitcoin. In December of 2017, the former Fed Reserve Chair stated in a Washington conference that bitcoin is “not a viable storage of value” and a “highly speculative asset”. She also stated nearly a year later that she is simply “not a fan” of digital assets because many are still being used for illegal transactions.

However, Yellen’s views on Blockchain are quite different and more optimistic. The treasury’s elected secretary sees the technology as a vital tool with “significant implications in which transactions are handled throughout the financial system”.

Lael Brainard – Fed Reserve Governor

Brainard was one of the top candidates for the role of Secretary of the Treasury, a seat now occupied by Janet Yellen. Despite not joining the administration, she still fulfils her role in the Fed Reserve Board as Governor and recently made a few important comments on the future of cryptocurrencies and their regulation in the United States.

During a speech for the Fed Reserve Board in August of 2020, Brainard looked forward to more technological innovation in the fintech sector and addressed the current developments coordinated by her and the Board’s Technology Lab. “[The Lab] has been building and testing a range of distributed ledger platforms to understand their potential opportunity and risk […] studying the implications of digital currencies on the payments ecosystem, monetary policy, financial stability, banking and finance, and consumer protection.”

Brainard has also mentioned the current race for Central Bank Digital Currencies (CBDCs), informing that the Fed Reserve has not yet taken a stance on national currencies and performs tests on CBDC frameworks and their applicability for the domestic banking system. “We are taking the time and effort to understand the significant implications of digital currencies and CBDCs around the globe.” Her digital currency research for the next four years will undoubtedly play an essential role for cryptocurrency acceptance during Biden’s administration.

Plans that can affect cryptos

Four years is a long time, and a lot is bound to happen throughout Biden’s term that will have a significant impact on digital assets, most of which remains unpredictable. Yet, there’s already a few key policies and decisions in the near-future that are bound to affect the crypto market.

The US$1.9 Trillion Covid Stimulus

A centrepiece for the president throughout his election campaign, Biden seeks to provide another covid stimulus package for the American people that could move investors and institutions further from the dollar and into other assets. According to Biden’s recent announcement, the stimulus plan will cost at least US$1.9 trillion, an amount in addition to the US$900 billion covid relief bill recently passed by Congress.

In 2021, more than US$9 trillion was created globally through quantitative easing (QE), with the Fed Reserve’s balance sheet now at US$7.3 trillion and growing at a rate of US$120 billion per month.

Janet Yellen’s role as Secretary of the Treasury is a strong indication of further easing. Yellen has defended QEmonetary policies since the 2008 Global Financial Crisis, during her time as head of the Federal Reserve and throughout Joe Biden’s campaign. Under more significant stimulus in the upcoming years, the dollar’s devaluation in relative terms is inevitable. Investors will seek other vehicles to earn yield and, with bitcoin’s history of performance during crises, and its ability to generate yield in credit markets, it forms a viable alternative asset class.

Federal framework to define cryptocurrencies

For the past year, the United States government has been slowly but surely shifting towards development that seeks to create a federal cryptocurrency framework, baselining digital assets under the same definition across all states. As of this writing, the country defines cryptocurrencies as legitimate and taxable assets, but without a national consensus to precisely determine what they are.

In September of 2020, the CFTC released the Digital Commodity Exchange Act of 2020, with the goal to put all cryptocurrencies and digital assets under an exclusive framework valid for the entire nation. If the bill passes cryptocurrency exchanges will be allowed to operate freely in all American states, instead of having to pursue individual registration for each jurisdiction. Such a development will greatly encourage crypto providers to expand while simplifying investments in digital assets for all Americans and institutions.

The bill is a promising policy to expect, but not an easy one to accomplish. A previously similar bill, named Blockchain Record and Transactions Act, went through Congress twice in 2017 and 2018 but failed to gain any traction.

Biden’s tax plan

One of the fundamental points of Joe Biden’s campaign is to increase taxes on American households making more than US$400K per year. While there hasn’t been an official approval on how the new taxation will roll out, the plan is aimed at the “top 1% of the country”, according to Joe Biden. However, senior analyst at CAP Seth Hanlon states that the tax increase will also affect a large portion of middle-class families depending on their living region and number of occupants in the household.

If approved, the new taxing framework could have high net-worth Americans paying up to 62% in taxes in high-earning areas such as California and New York. The plan will likely present a similar outcome to the US$1.9T stimulus, with investors and entrepreneurs seeking alternative sources of income and tax effective structures that move away from the dollar and traditional US markets.

Looking ahead

The impact of the Biden administration and the overall US government on the crypto market during this presidential term is still uncertain. Still, it is safe to predict that much will change in the upcoming years for digital currencies. Whether through presidential plans that push investments away from the dollar, or federal crypto frameworks facilitating access to digital assets, there’s plenty to keep an eye on.. One thing is sure; urgent discussions on cryptocurrencies are in the Presidential Cabinet and Congress, with strongly-opinionated members driving what the next four years will represent for cryptocurrencies.

If you would like to learn more or are ready to purchase digital assets, contact us at:

Like this article? Share

Latest Insights

Ethereum Smart Contracts: How They Changed Crypto

Ethereum, launched in 2015, revolutionized the digital world by introducing “smart contracts,” self-executing contracts with the terms of the agreement directly written into code. This

Main Crypto Events in the World

The world of cryptocurrencies is dynamic and ever-evolving, with numerous conferences and events held globally to foster innovation, collaboration, and networking among crypto enthusiasts. Here’s

What is Ethena Finance?

Ethena Finance (ENA/USDe) is emerging as a notable player in the cryptocurrency and decentralized finance (DeFi) sectors. Powered by its proprietary stablecoin, USDe, Ethena aims

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post